Nearly every one of the muni industry’s worst-performing products since 2016 have at least one attribute in common: shedding interest rate risk.

The 20 muni funds with the lowest three-year returns all reported gains over the period, Morningstar Direct data show, but their average return was lower than the Bloomberg Barclays U.S. Aggregate Bond Index's 2.99% gain — as measured by the SPDR Portfolio Aggregate Bond ETF (SPAB) — over the same period.

“The municipal bond funds with the lowest three-year returns, which were still positive returns, were all short-term bond funds, to be expected,” says Greg McBride, senior financial analyst at Bankrate. "This is a particularly relevant consideration at today’s low interest rates where bond investors tempted to chase yield in longer maturities are taking on significant interest rate risk,” he adds.

Muni funds with the worst returns carry lower fees than both the average top-performing muni product as well as the average fund. With an average net expense ratio of 0.36%, these funds are less than half of the 0.81% investors paid for the average top-performing muni product and almost 10 basis points less than the 0.48% investors paid on average for fund investing last year, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs.

Beth Foos, senior analyst at Morningstar, says because of the lower risk, advisors should expect lower expense ratios. “When you’re comparing these funds to the whole universe it’s important to factor in their interest rate risk,” Foos says. “Here we see the lower expense ratios in funds that are primarily investing along that curve. These have low expense ratios because that’s how they were designed.”

For comparison, the industry’s largest muni fund, the $70.6 billion Vanguard Intermediate-Term Tax-Exempt Fund Admiral Shares (VWIUX), has an expense ratio of 0.09%, a three-year gain of 3.25% and 1-year gain of 8.97%, data show. The industry’s largest fund, the Vanguard Total Stock Market Fund (VTSAX), has $827.1 billion in AUM, a 0.04% expense ratio and 13.73% gain over the last three years.

For advisors looking for ways to justify the use of these muni products with their clients, Foos says they must remember the fund's investment objective. “It’s important when you’re talking about muni funds that you remember not every muni is trying to achieve the same thing,” Foos says, adding that “most of them focus on a particular part of the muni curve and have parameters around the amount of interest rate risk investors are willing to take.”

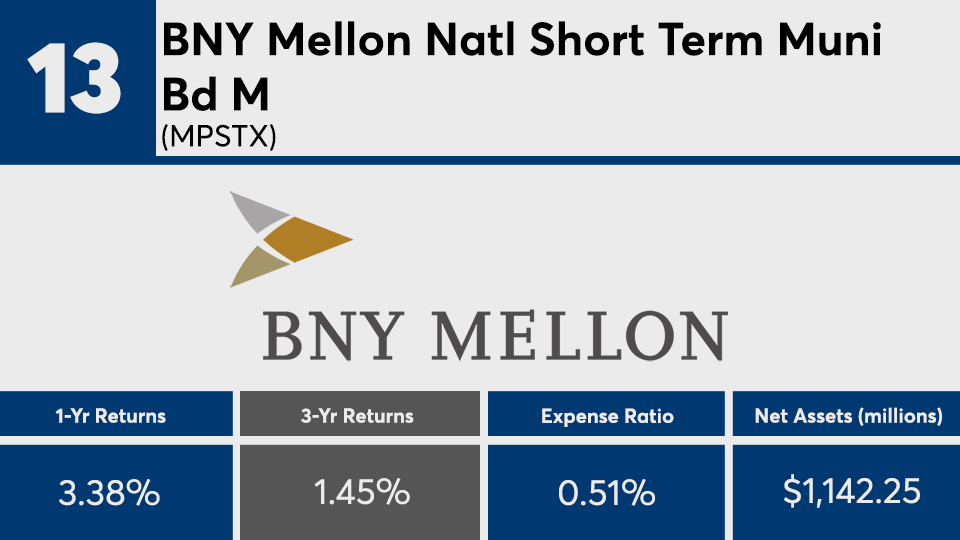

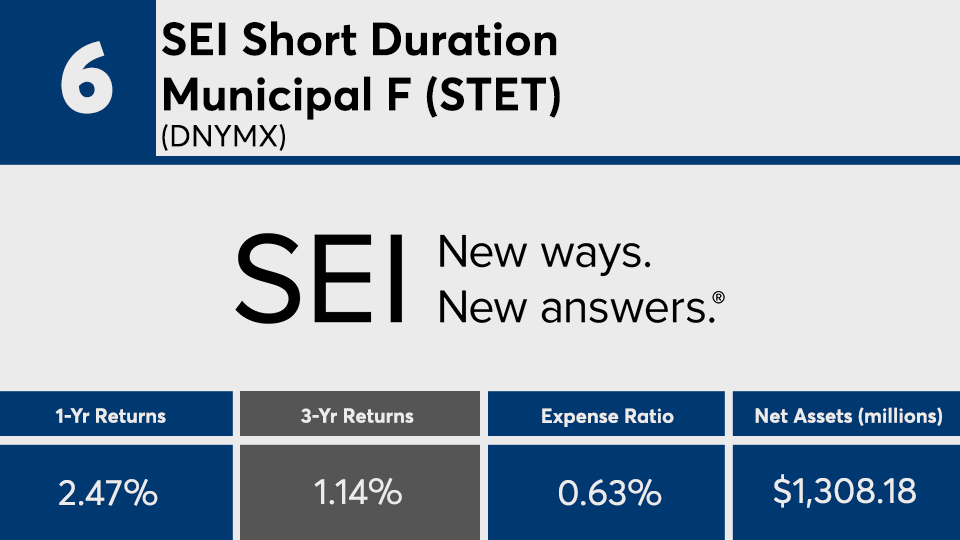

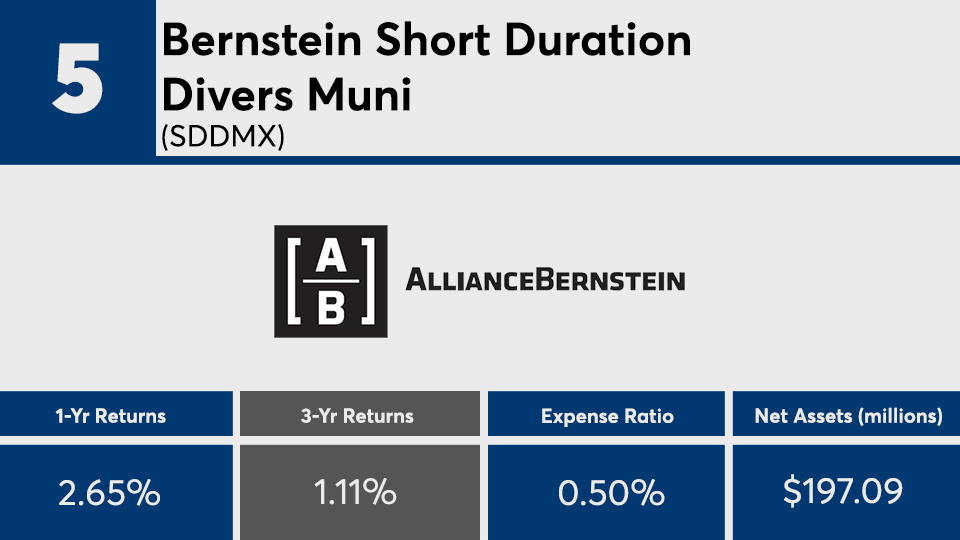

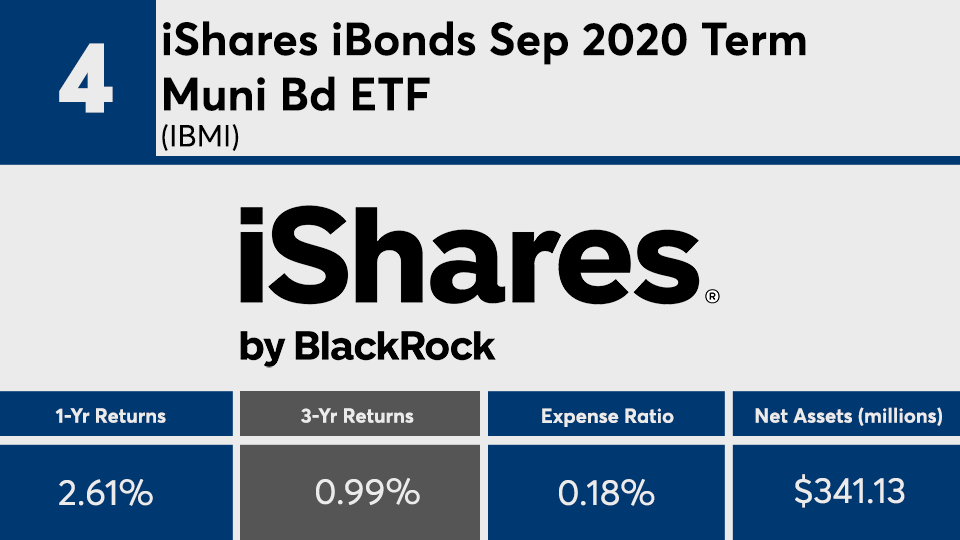

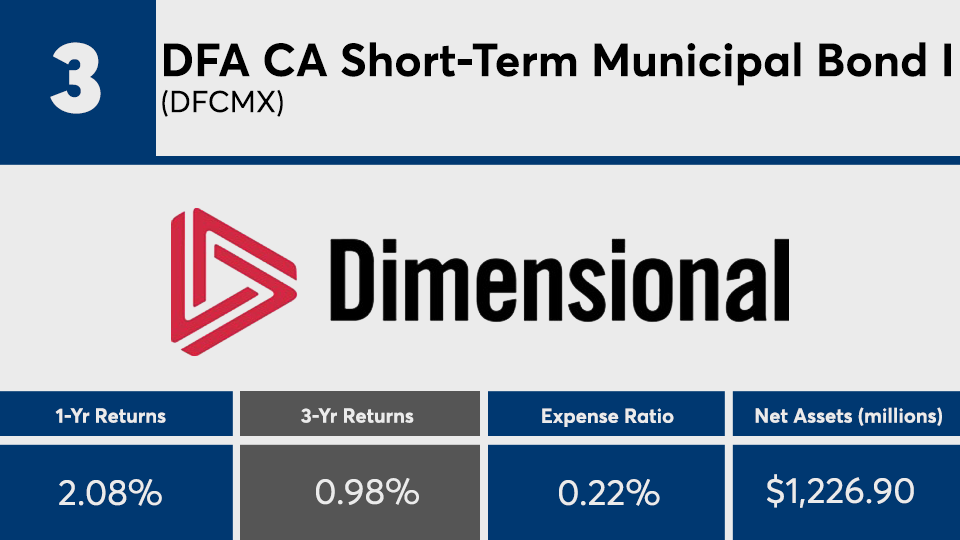

Scroll through to see the 20 worst-performing muni funds (with at least $100 million in assets under management) ranked by 10-year annualized returns through Oct. 9. Funds with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each, as well as one-year daily returns, are also listed. The data shows each fund's primary share class. All data from Morningstar Direct.