For some of the industry’s biggest actively managed funds, neither market volatility sparked by the coronavirus pandemic nor the upcoming presidential election have deterred outsized gains.

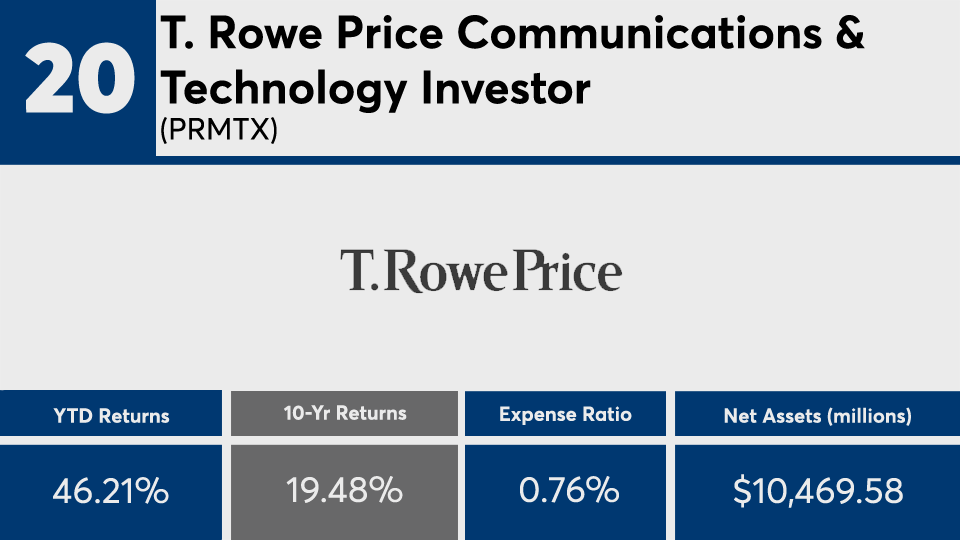

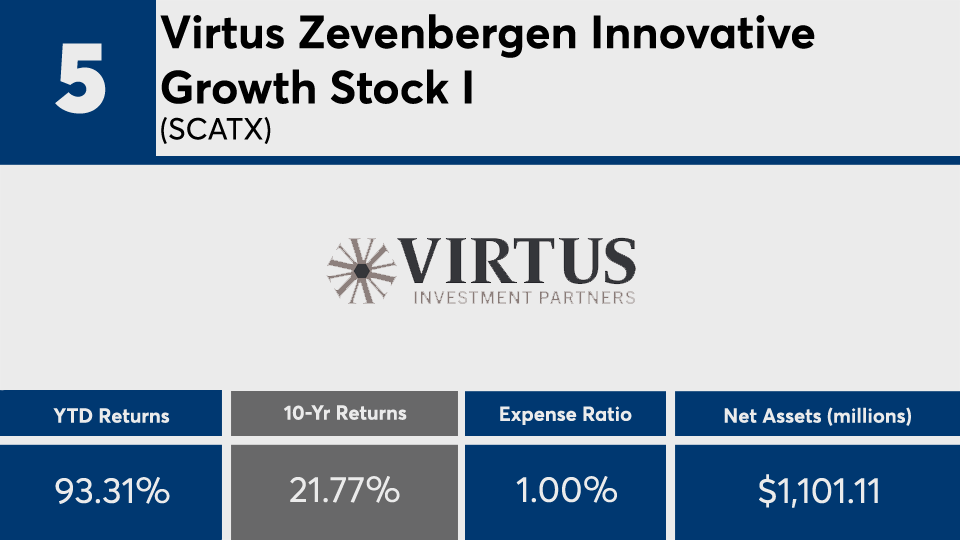

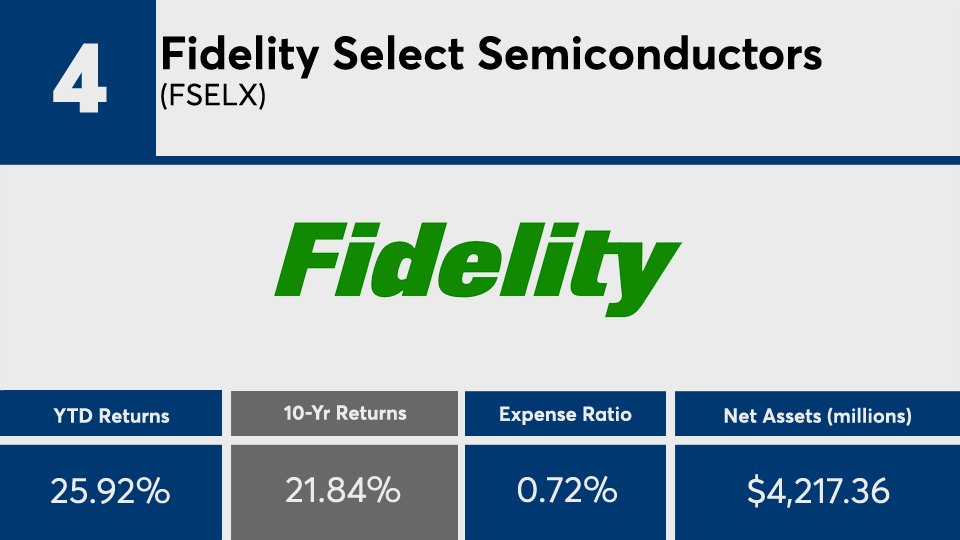

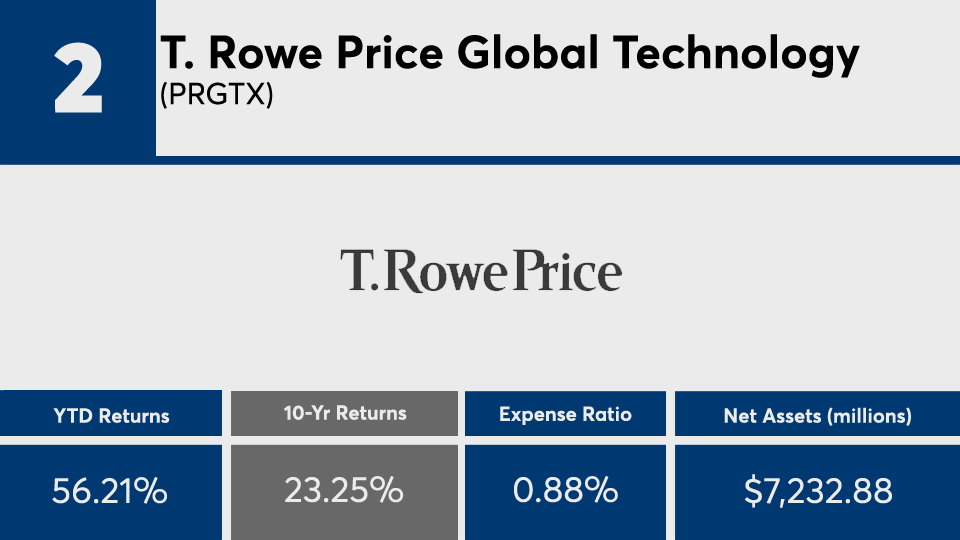

The 20 top-performing active products with at least $1 billion in assets under management have generated an average 10-year annualized return of more than 20%, Morningstar Direct data show. Year-to-date, the same funds have an average gain of more than 45%.

By comparison, the SPDR S&P 500 ETF Trust (SPY) and the SPDR Dow Jones Industrial Average ETF Trust (DIA) posted 10-year returns of 13.69% and 12.52%, respectively. This year, the index trackers have generated returns of 9.47% and 1.64%.

In bonds, the AGG has generated gains of 6.75% and 3.55% over the YTD and 10-year periods.

It should be no surprise that some of the top-performers’ strategies are the antithesis of what led last week’s ranking of

“Many of these funds are in growth, and growth stocks have so substantially outperformed value stocks — some of the differences are almost staggering,” Brenner says. “These are tracking the industries that are supporting the economy and will continue in the post-pandemic world.”

As expected, fees associated with the decade’s top-performing actively managed funds, most of which are in technology and growth sectors, are high. At 90 basis points, the funds on this list are twice that of the 0.45% investors paid on average for fund investing last year, according to

For advisors speaking with clients, Brenner says that while it is important to discuss long-term returns, it is also vital to discuss how the short-term success of a fund can impact their annualized gains.

“If you try to imagine 10 years from now what segment of the economy, or sector, is going to be the one that will have the best economic and financial performance, we can sit here and look at the current topsy, turvy market and say, ‘It has got to be technology.’ Though you don't have to go back too far to a time when there was broad market consensus that it would have been the energy sector,” Brenner says. “I don't think you have to be completely agnostic about sector judgements, although I would have some degree of confidence that technology is probably going to do better than energy over the next 10 years. But it would be different to have such confidence to have all of my money in technology and none in energy.”

Scroll through to see the 20 actively managed funds with more than $1 billion in AUM and the best returns through Oct. 16. Funds with less than $100 million in AUM were excluded, as were leveraged and institutional funds. Assets and expense ratios, as well as YTD, one-, three- and five- returns are also listed for each. The data show each fund's primary share class. All data is from Morningstar Direct.