Corporate credit took it on the nose at the end of the first quarter as

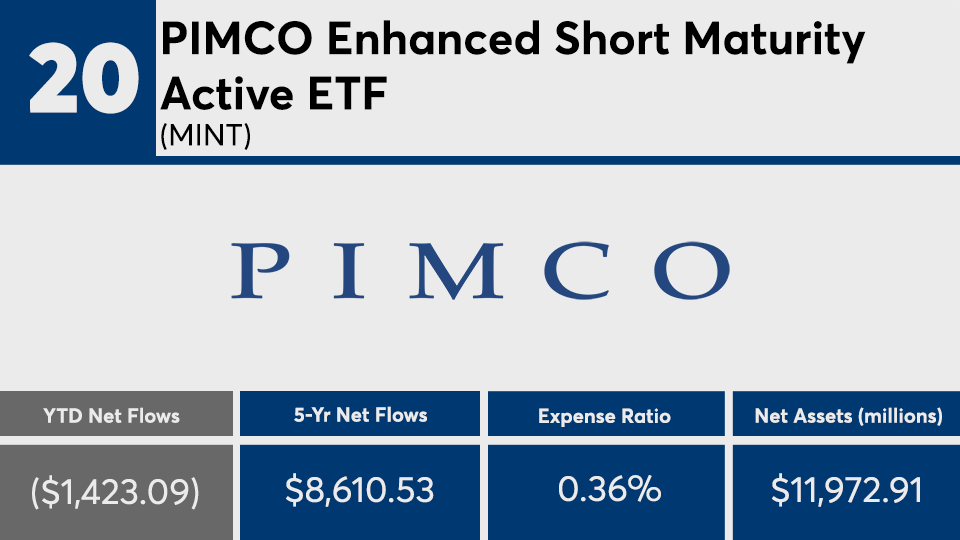

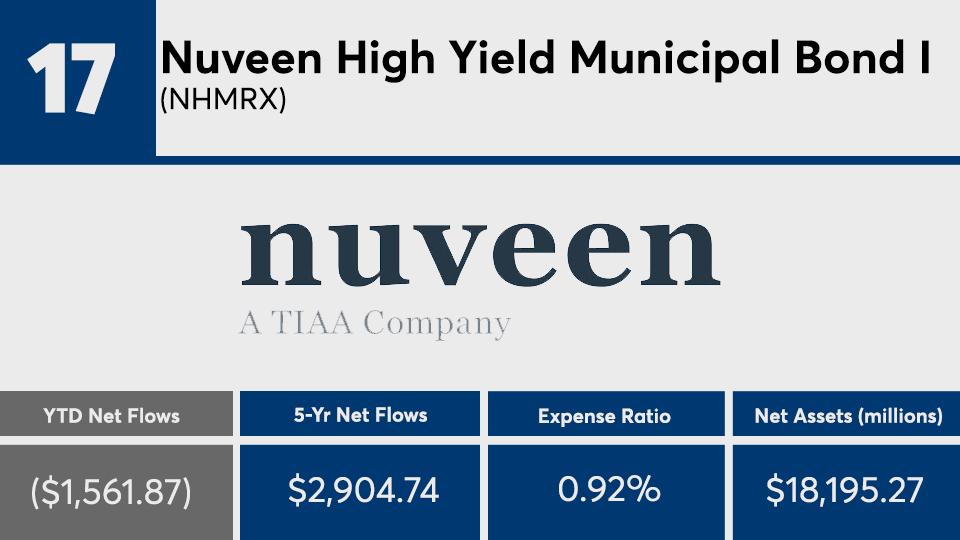

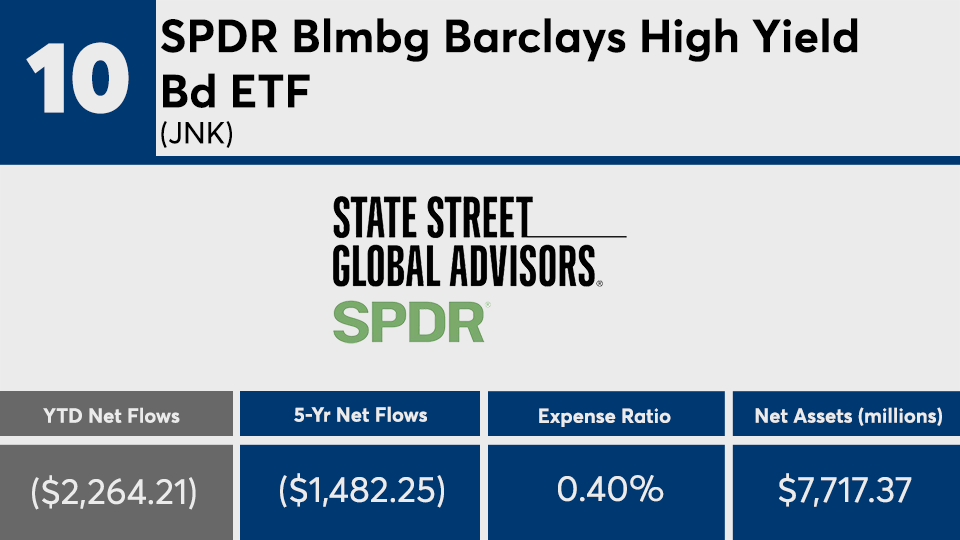

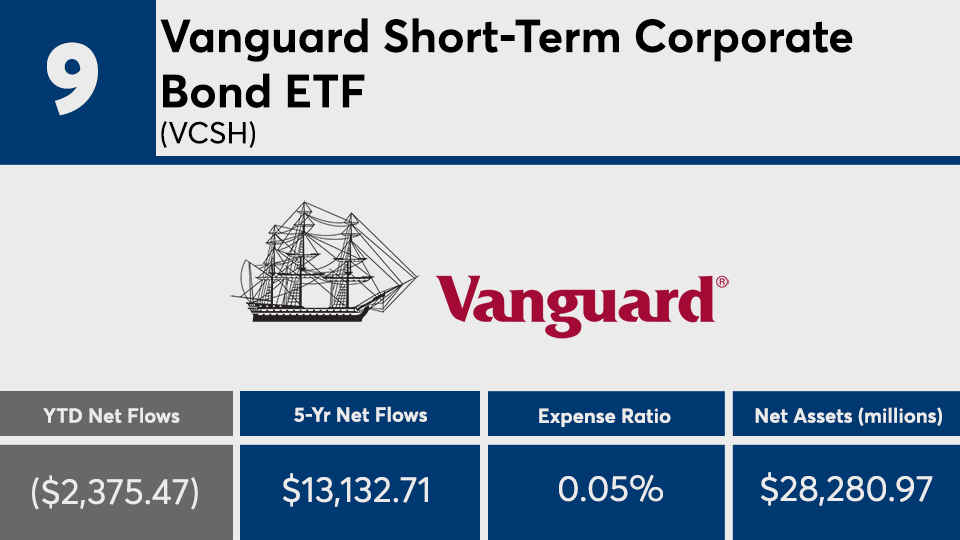

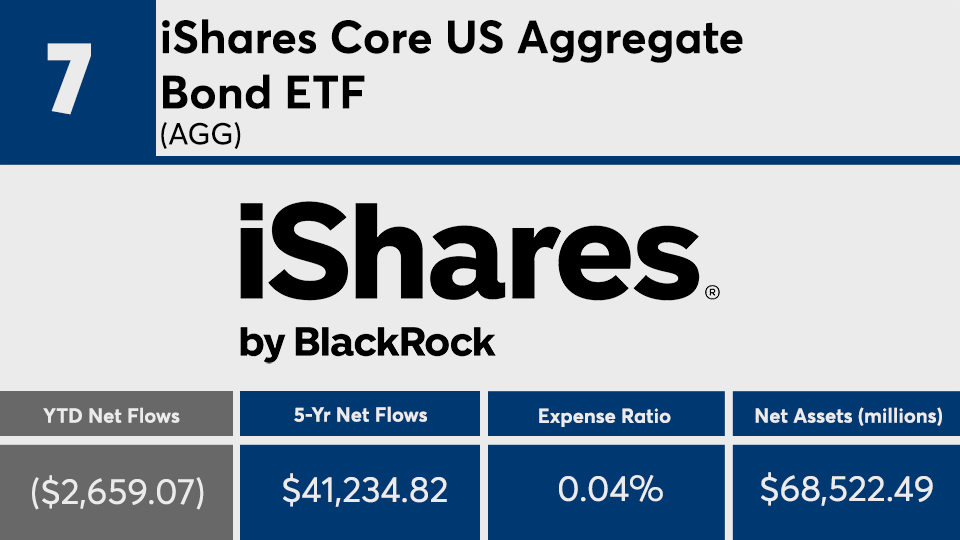

The 20 bond funds with the biggest net outflows so far this year, and at least $500 million in assets under management, have lost a combined $62.7 billion, Morningstar Direct data show. While some have posted double digit gains, these funds have recorded an average loss of 0.07%, well below the Bloomberg Barclays US Aggregate Bond Index’s 3.62% year-to-date return, as measured by the iShares Core US Aggregate Bond ETF (AGG). The funds have a combined $602.6 billion in AUM.

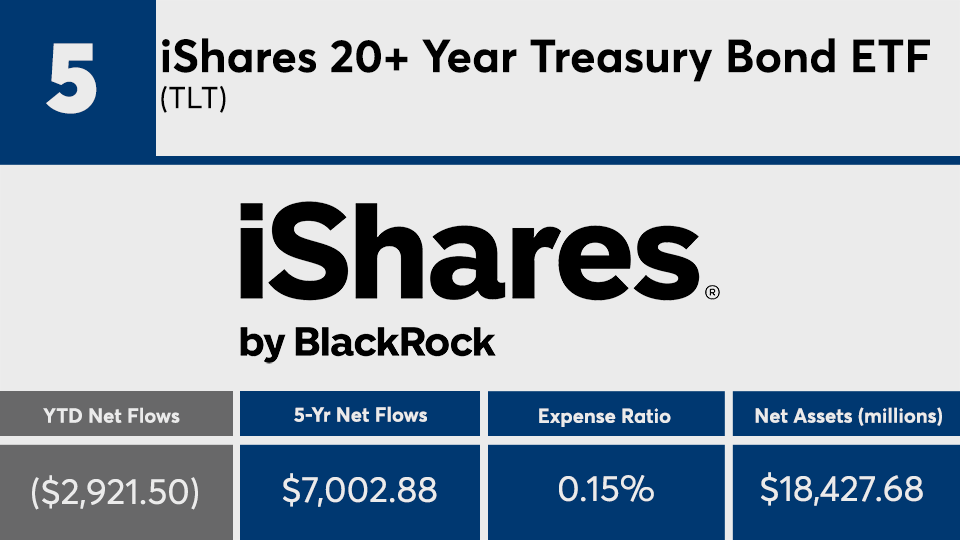

“It makes sense to see names like JNK, HYG and BKLN on this list experiencing outflows as investors ran from credit into the safety of Treasury mutual funds and ETFs in 2020, and in particular in March 2020," says Marc Pfeffer, CIO at CLS Investments. “Sometimes asset flows can be misinterpreted by investors in terms of what they should be doing. I find it surprising to see a Fidelity Treasury bond fund lose half of its assets when assets seem to be going in a major way into Treasurys, certainly into the ETF space. So, sometimes numbers have to be taken with a grain of salt.”

The industry’s largest bond fund, the $259.3 billion Vanguard Total Bond Market Index Admiral (VBTLX), recorded a net inflow of $2.8 billion and YTD return of 3.51%, data show. Over the longer term, the fund has generated a 10-year gain of 3.87%. In equities, the largest overall fund, the $736.7 billion Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX), has a 0.14% expense ratio and has seen a net inflow of $30.5 billion with a YTD loss of 18.89% and 10-year gain of 10.26%, data show.

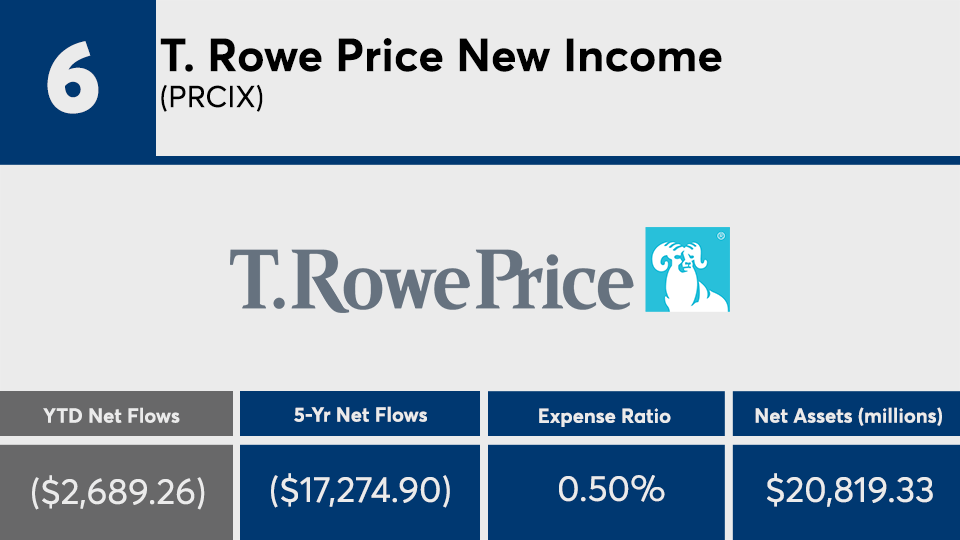

Though fees here are significantly higher than the 0.14% average from bond funds with the biggest net inflows, they were still lower than the rest of the industry. At an average of 28 basis points, these funds are far cheaper than the 0.48% investors paid on average for fund investing last year, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs.

“While it’s nice to have the information of fund flows, each individual investor needs to look at their own personal situation and risk tolerance, and make sure that it lines up with what their comfort level is,” Pfeffer says. “This market environment is a very good one for investors to do a self-awareness check to make sure that they are comfortable with the risk tolerance that they have on their investments and to make sure that they are lining up properly with how they believe they should be invested, and to not allow for an emotional toll.”

Scroll through to see the 20 fixed-income mutual funds and ETFs with the largest YTD share class outflows through April 1. Funds with less than $500 million in AUM and investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets, expense ratios and five-year net share class flows are listed for each, as well as year-to-date, one-, three-, five- and 10-year returns. The data show each fund's primary share class. All data from Morningstar Direct.