The record size of registered investment advisory firms has solved some problems but created new ones for financial advisors operating in a highly competitive industry.

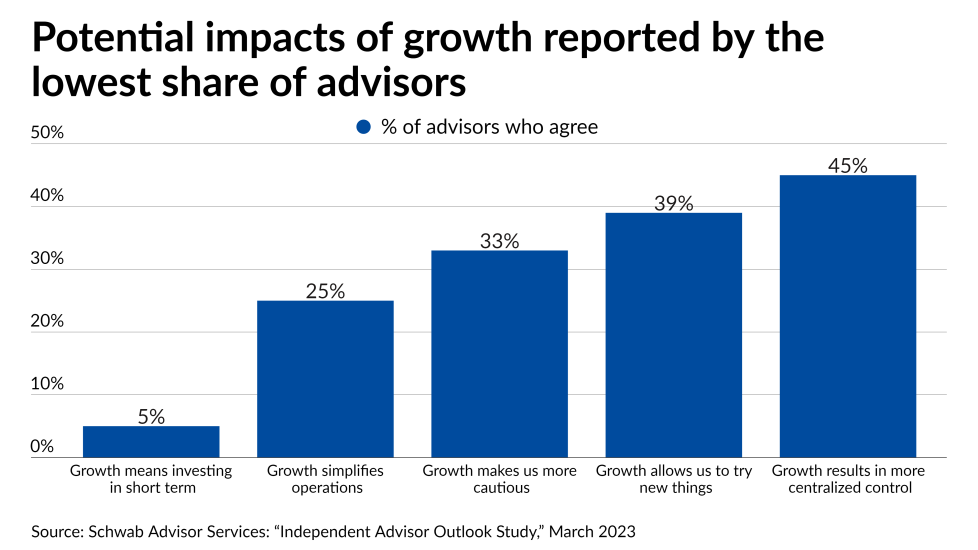

Growth makes maintaining a company's culture and the momentum of its expansion more difficult, according to the latest annual Charles Schwab "

Those findings from the early December survey of 862 independent advisors who use Schwab Advisor Services as their custodian sounded similar to the experiences of RIAs working with Phoenix-based consulting and transaction advisory firm

"Growth is not the top challenge; talent tends to be the top challenge across sizes," Kawal said in an interview. "If you think about what's driving the M&A market right now, talent is a huge motivator. Talent acquisition is a huge motivator for a lot of these big buyers. It's a part of their talent acquisition strategy."

One often overlooked effect of those deals and the accelerating growth that comes with them relates to the metrics RIAs use to evaluate success, according to Furey. The big firms can exercise "an unfair advantage" over smaller advisory practices when it comes to "building and installing accountability systems" for career progressions and strategic results, he said.

"The smaller firms, they just don't have the know-how, nor do they have the infrastructure to do that," Furey said. "I think accountability is something that few firms talk about … Most firms now — probably over 90% — of registered investment advisors in the United States have absolutely no accountability system to anything."

Another issue yet to be addressed in the expanding industry revolves around untapped technology tools for data, according to Schwab's study. Only 43% of advisors in the survey said that their firms are using analytics software, with lower numbers reporting that their RIAs are tapping into "warehousing capabilities for proprietary data," (37%); "custom data feeds," (28%); and "data analytics experts," (21%).

"Advisors have an incredible opportunity to grow their business through digital prospecting efforts," Eric Clarke, the CEO of advisor software firm

"Historically, firms have used marketing tactics like direct mail, seminars, dinners, and radio and TV ads — all of which are very expensive and often time consuming," he added. "But today, firms can invest a reasonable amount of money in digital marketing tools to reach their target audiences efficiently and effectively. It allows them to work smarter, not harder."

Not every technology service leads to better results, according to one of the other experts, Nandita Das, an advisor who's also the director of the financial planning and wealth management program and the Financial Literacy Institute at

"Automation can't happen independent of the advisor," Das said. "I'm wary of completely automated solutions that suggest investments based on how users answer a few generic questions. These tools don't know who the investor is, and they don't have a feel for the investor's individual needs or values. Remember that personal finance is also behavioral, and technology can't capture that on its own."

To see the main takeaways from Schwab's latest research relating to the mixed nature of the record growth of RIAs in recent years, scroll down the slideshow. For a deep dive into the record count and assets under management at RIAs,

Note: All of the below findings and remarks from expert panelists come from Schwab's "