Many of the 20 bond funds with biggest losses of 2020 were off to a great start — that is until COVID-19 reshaped financial markets.

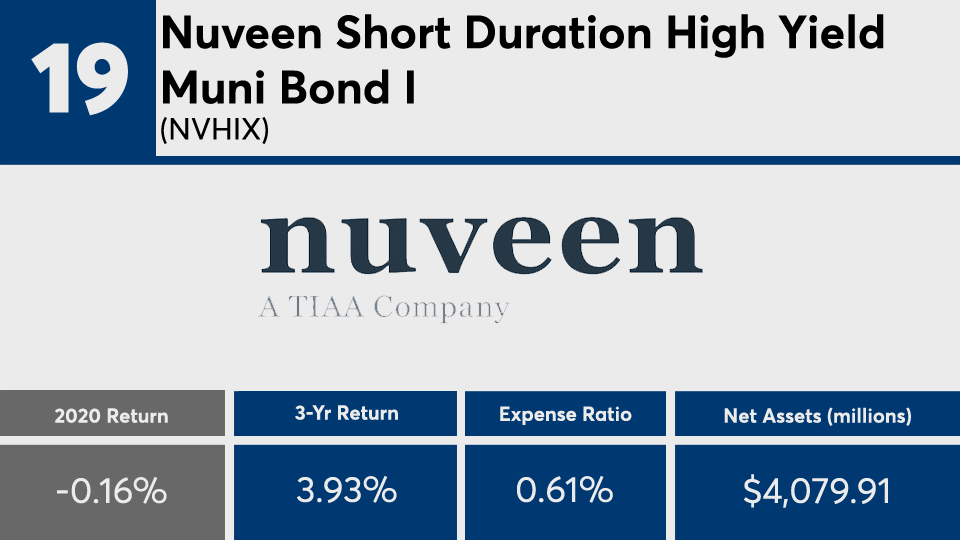

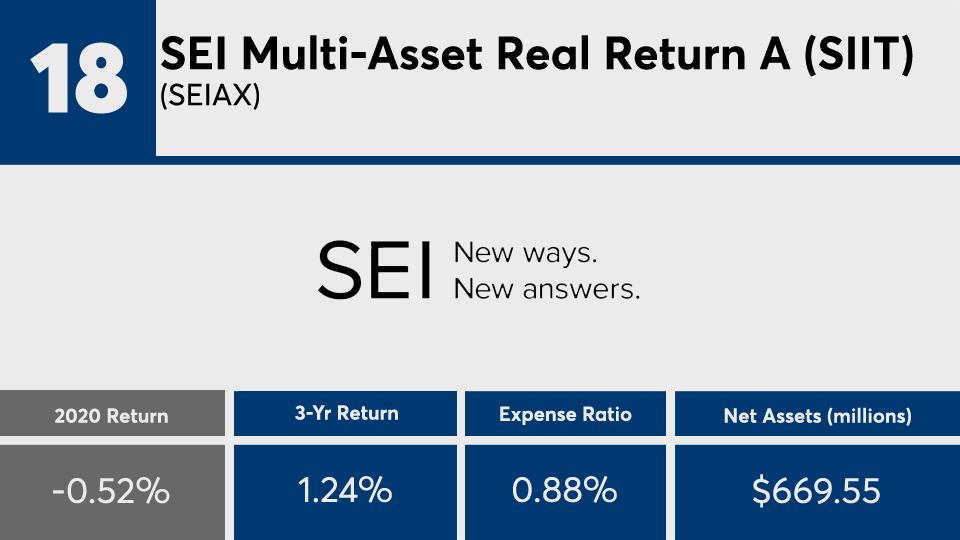

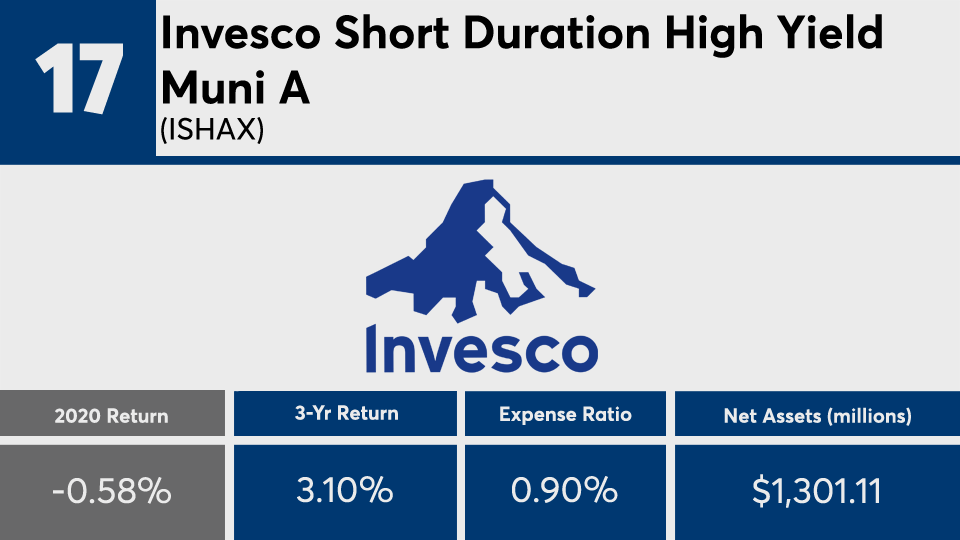

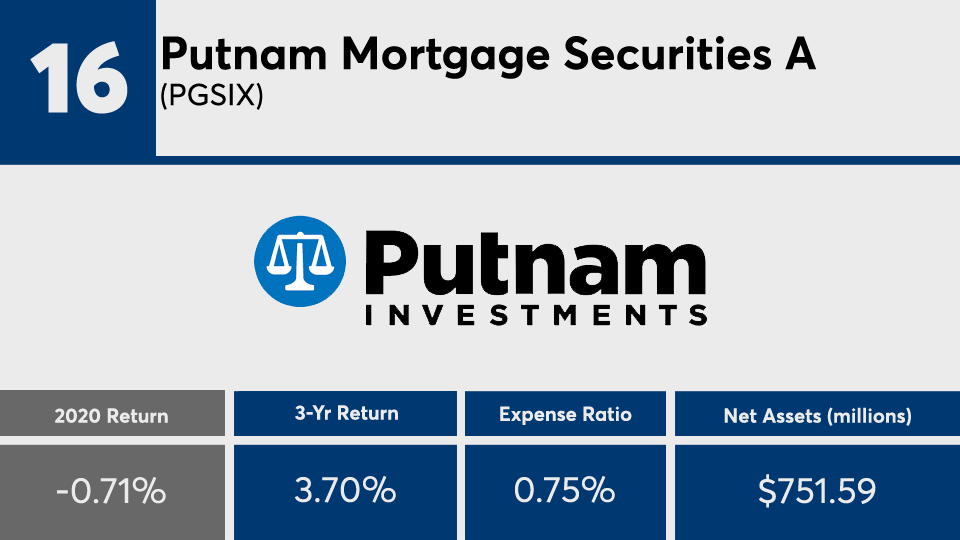

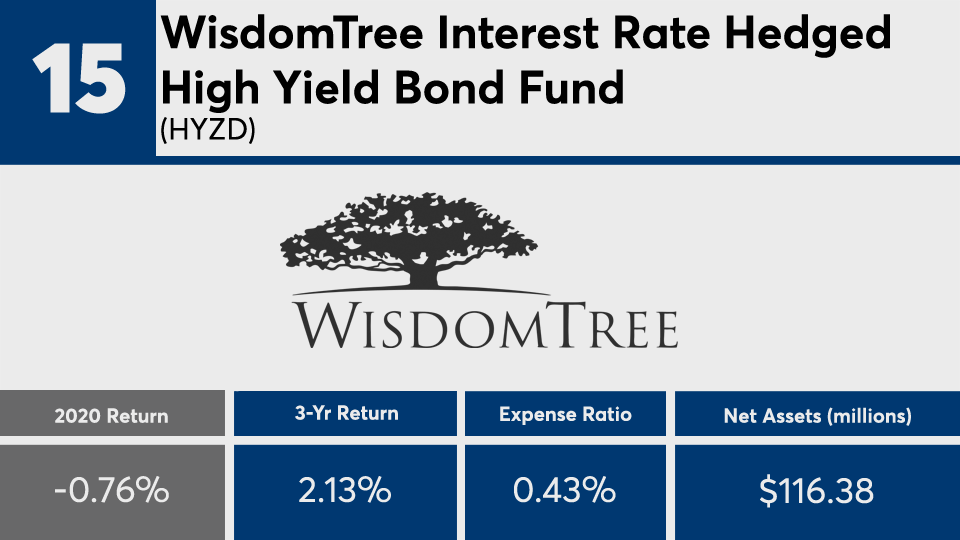

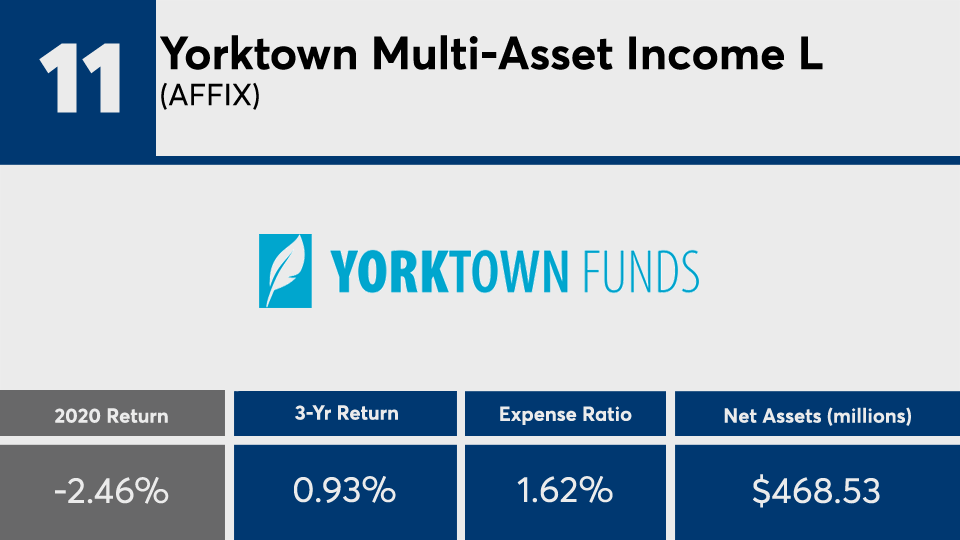

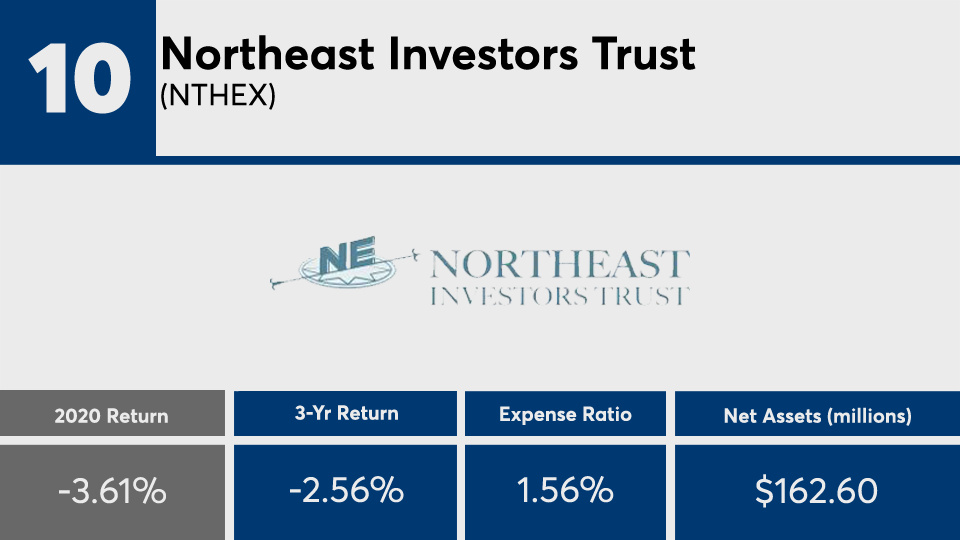

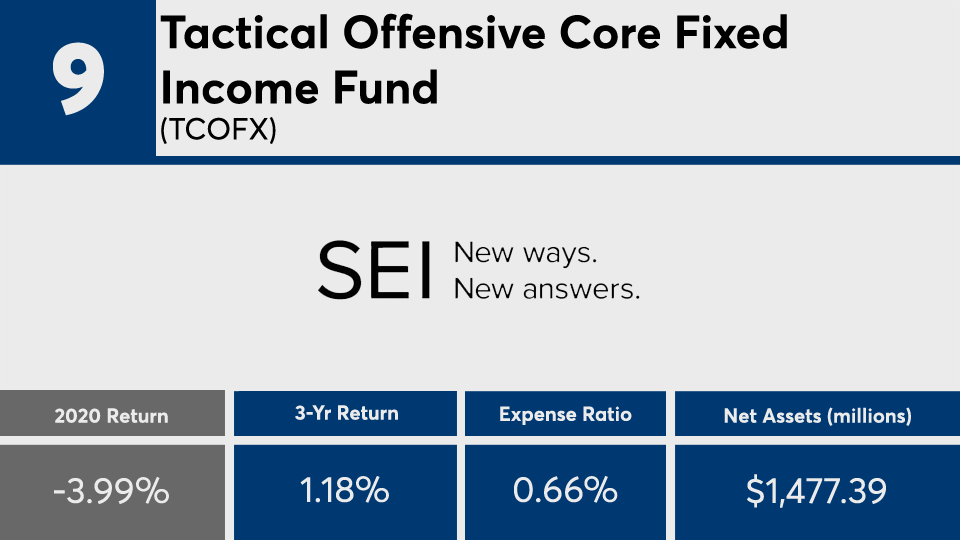

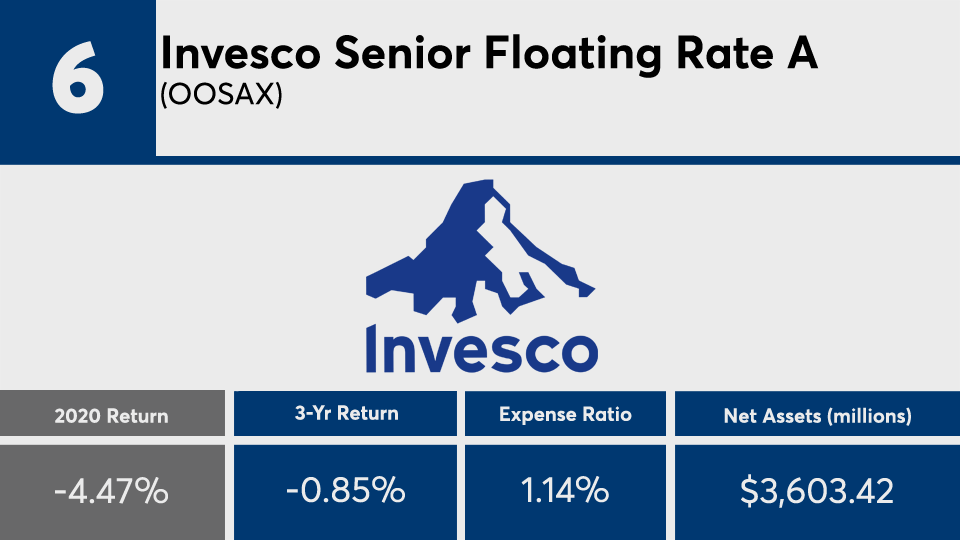

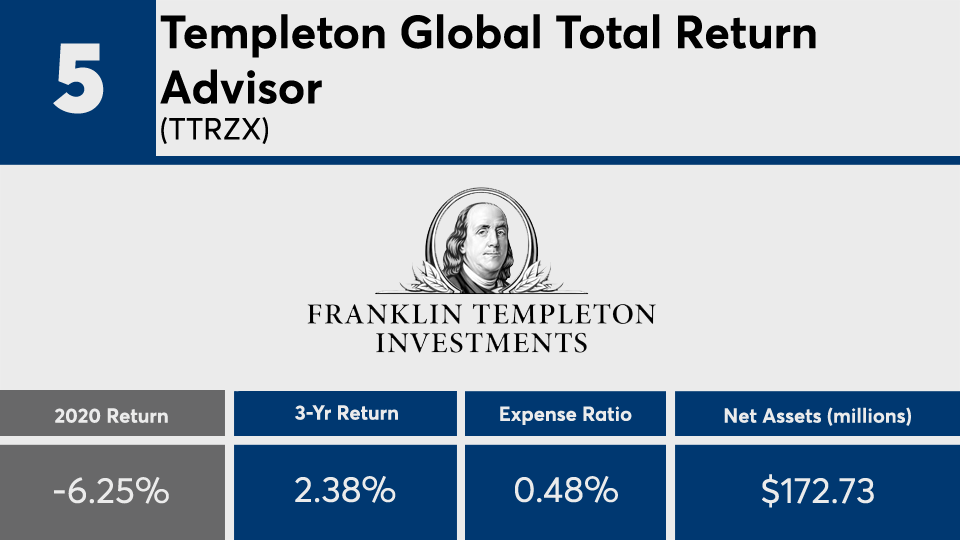

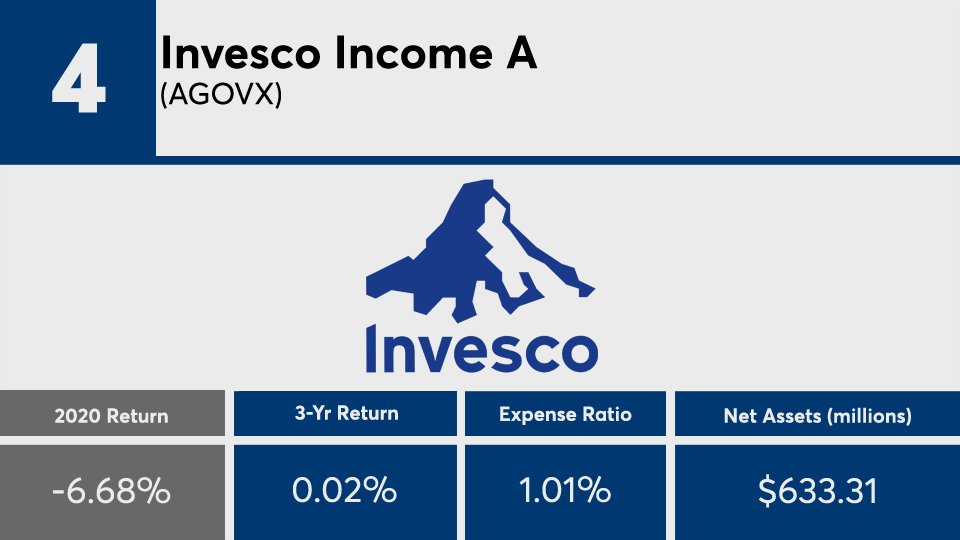

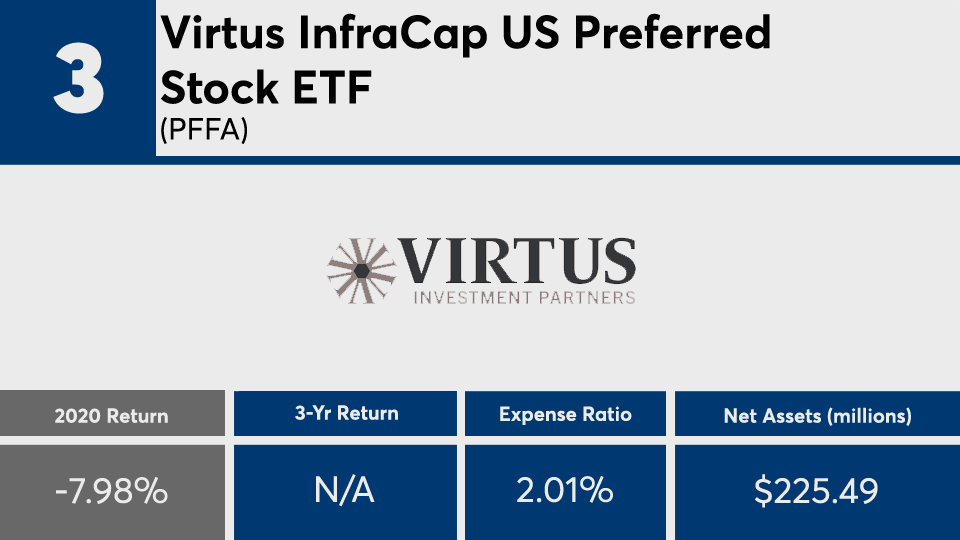

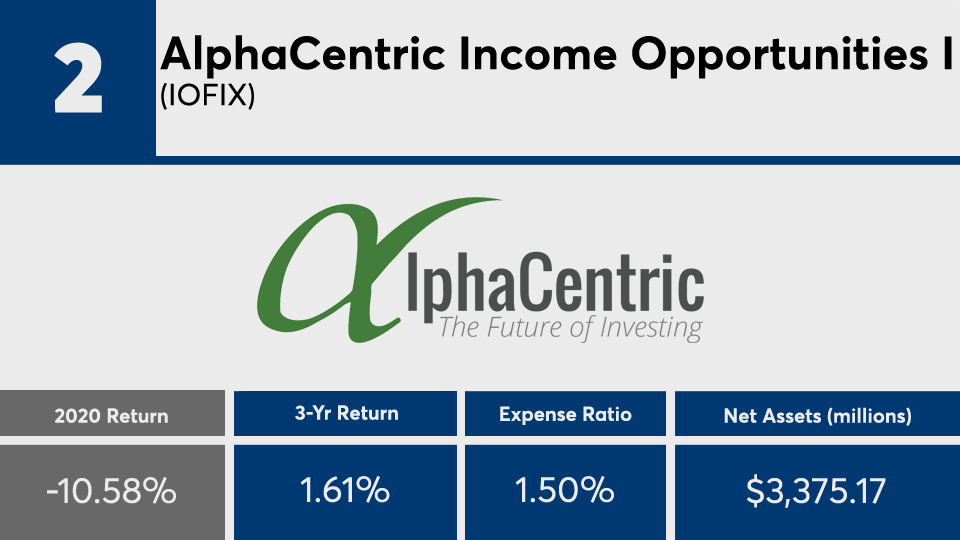

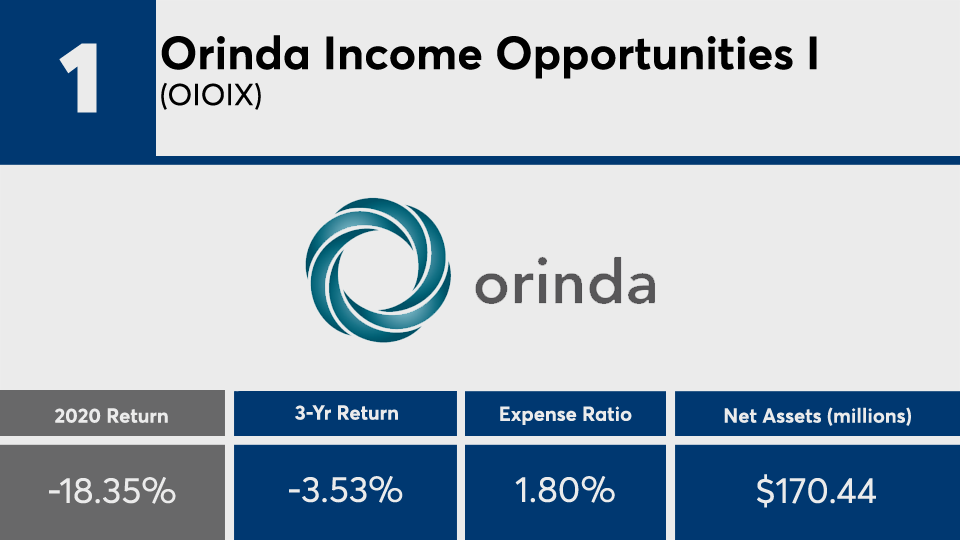

With an average loss of more than 4%, fixed-income funds that ended the year with the worst returns fell well below their peers, Morningstar Direct data show. With a minimum AUM threshold of $100 million, the funds here were home to a combined $44.7 billion.

“Long-term Treasurys won in 2020 due to their significant gains during the first quarter. However, they now face the prospect of higher yields during an economic recovery, and potential losses along with that,” says Toews Asset Management CEO Phil Toews. “Investment-grade bonds are also vulnerable to rising yields, even before the Fed begins to be less accommodative.”

Pitted against broader markets, the iShares Core U.S. Aggregate Bond ETF (AGG) recorded a 7.42% return in 2020, data show. In stocks, index trackers such as the SPDR S&P 500 ETF Trust (SPY) and the SPDR Dow Jones Industrial Average ETF Trust (DIA) had returns of 18.4% and 9.62%, respectively, over the same period, data show.

Bond funds with the biggest losses had an average expense ratio of more than twice the rest of the fund industry. With an average fee of nearly 100 basis points, these products were well above the 0.45% investors paid for fund investing in 2019, according to

For advisors, Toews says the lesson from the bottom is to consider the bigger picture.

“Just-on-time-methods of communicating with investors about underperformance don’t work,” Toews says. “Instead, our behavioral investing institute teaches advisors to proactively train investors to understand and execute counter-intuitive decisions. When an asset class trails, it may be more likely to move higher.”

Scroll through to see the 20 bond funds with the biggest losses of 2020. Funds with less than $100 million in AUM were excluded, as were funds with investment minimums above $100,000, leveraged and institutional funds. Assets and expense ratios, as well as three-, five- and 10-year returns through Jan. 11 are also listed for each. Minimum initial investments and loads are also listed when applicable. The data show each fund's primary share class. All data is from Morningstar Direct.