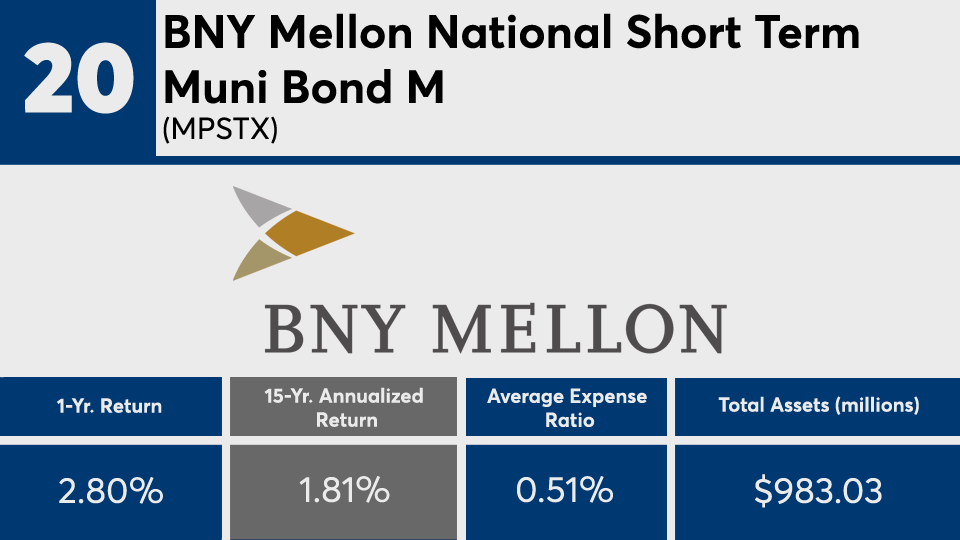

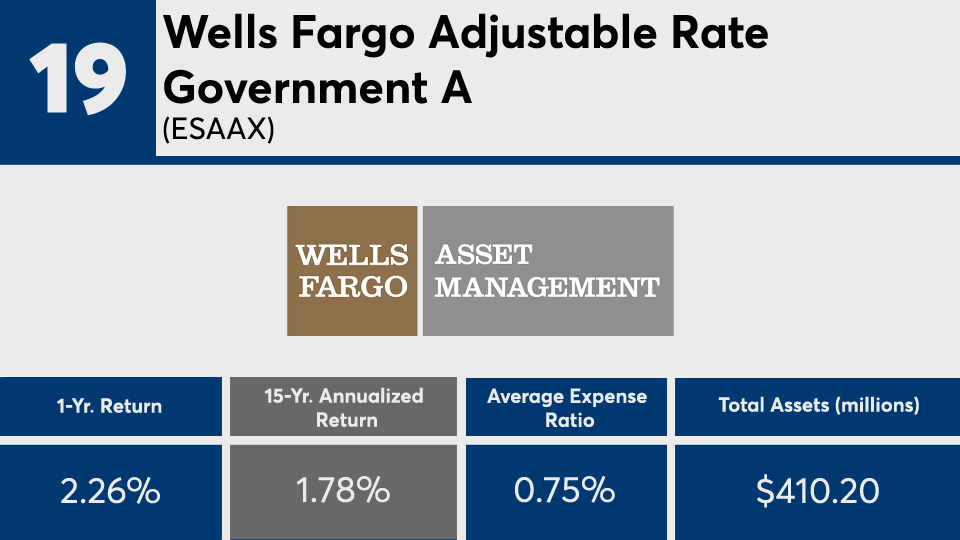

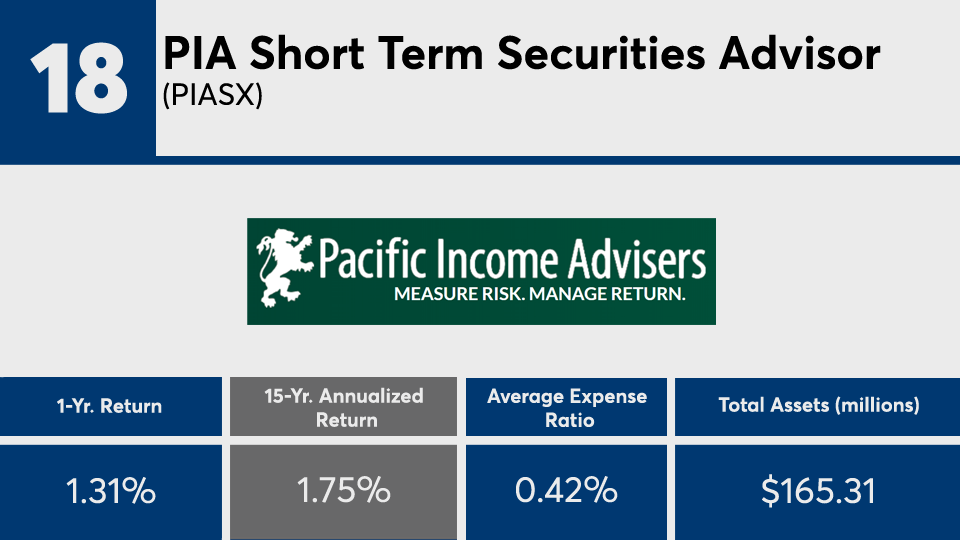

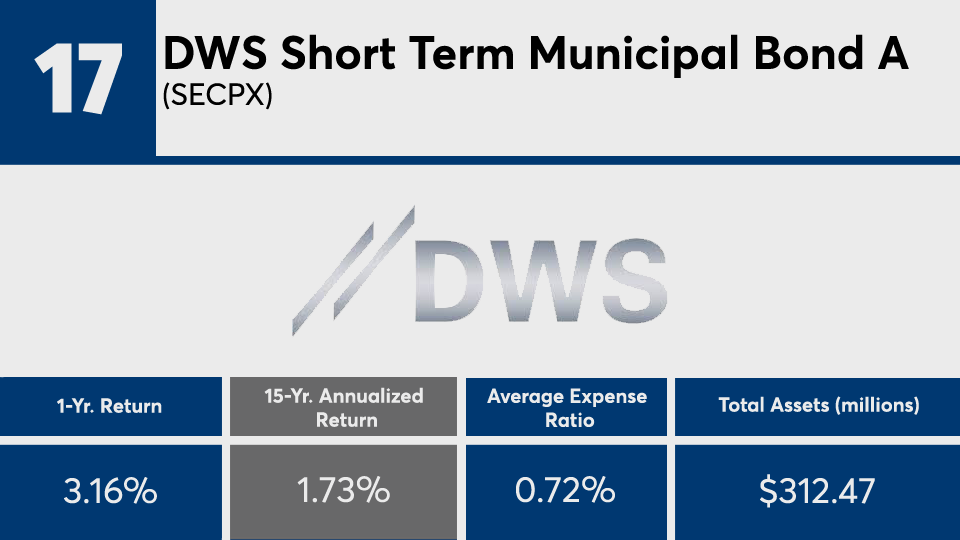

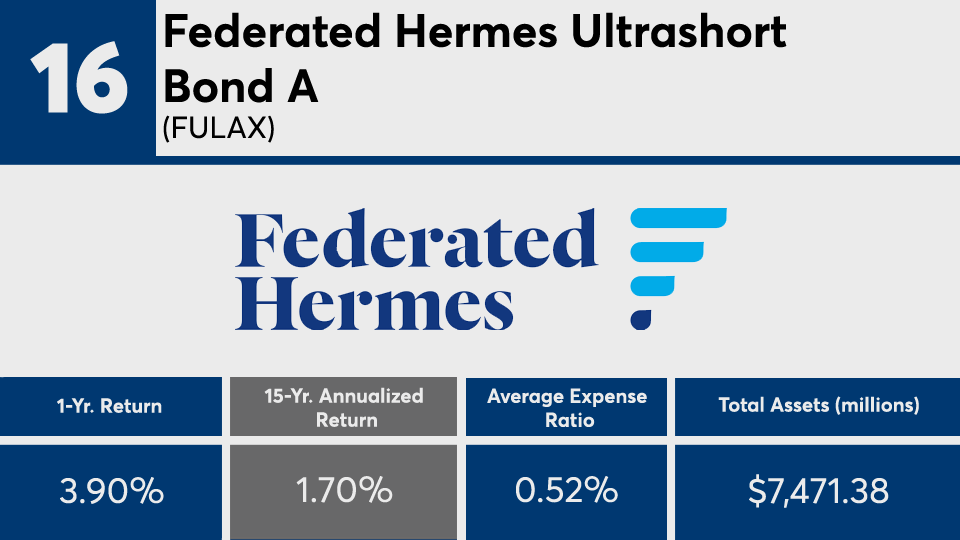

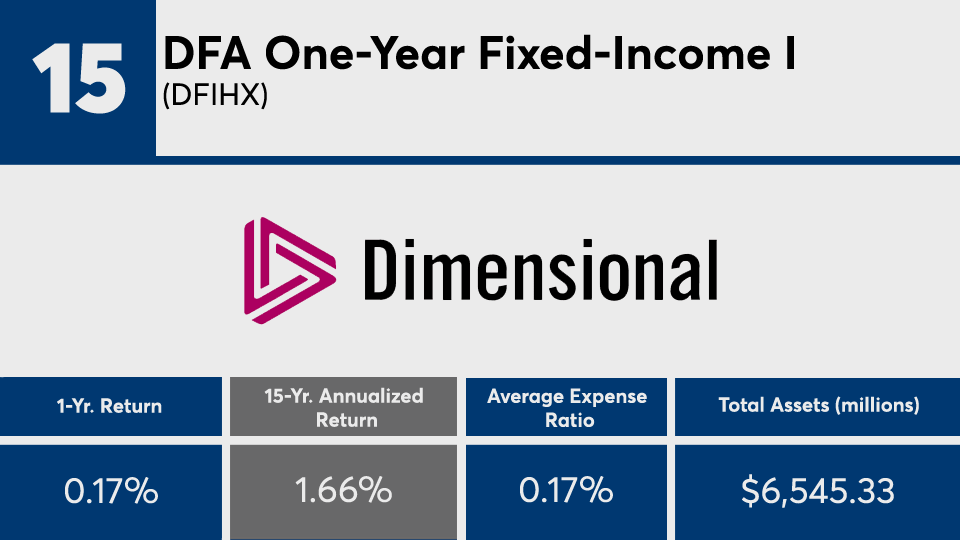

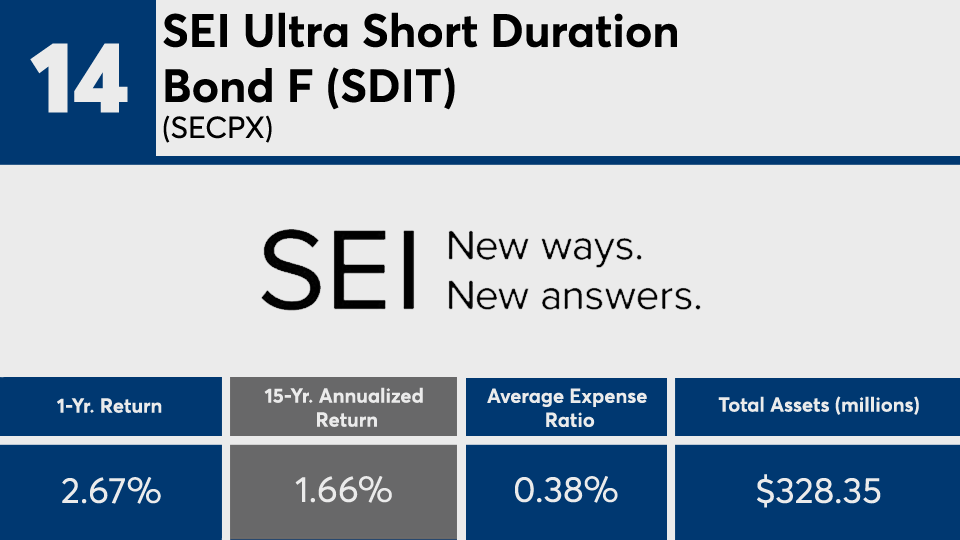

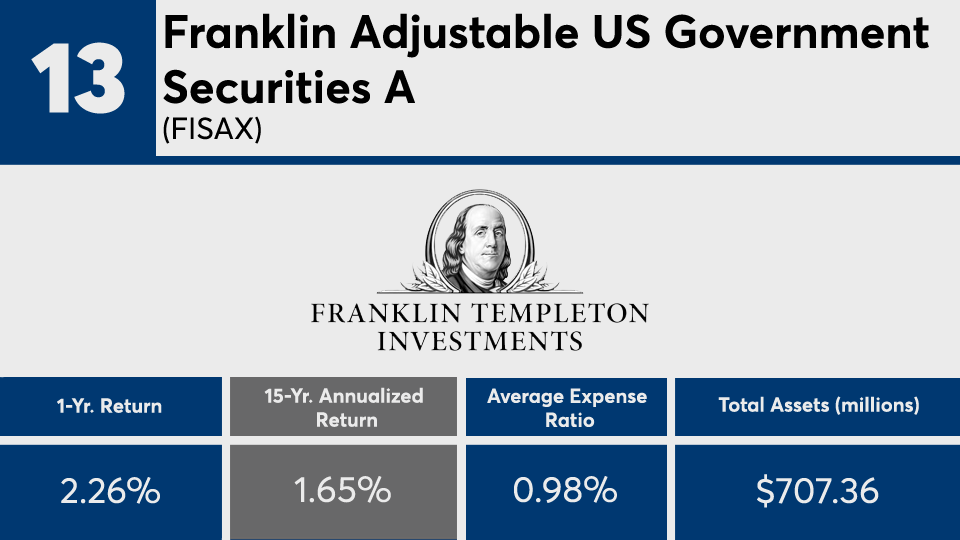

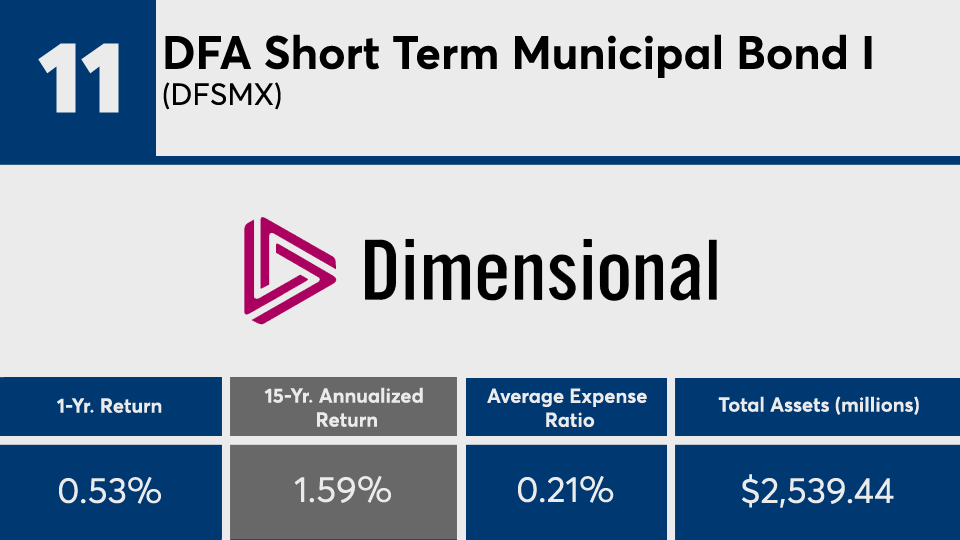

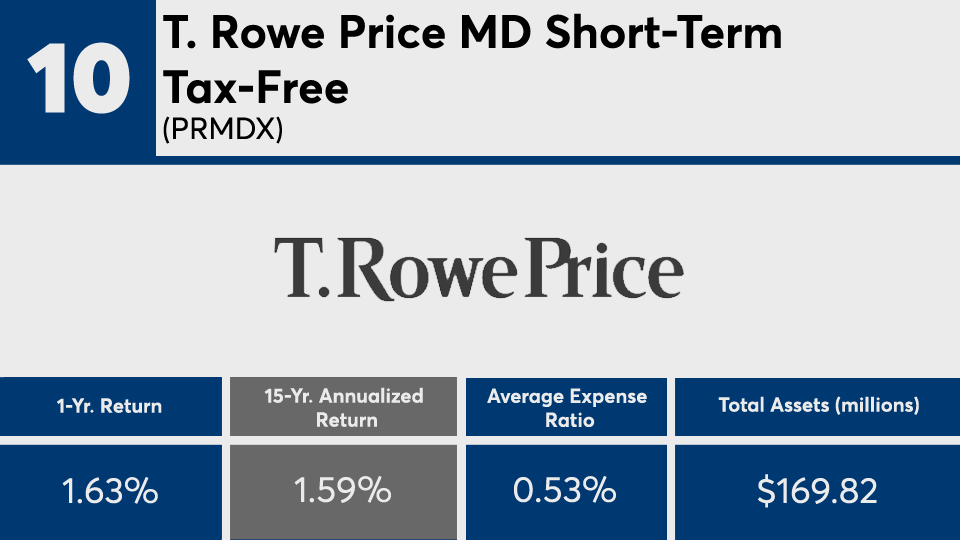

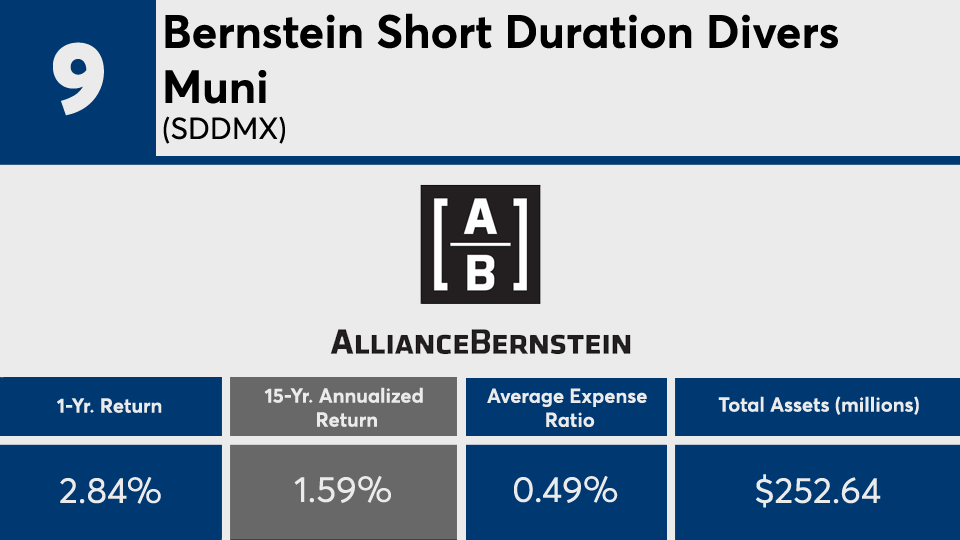

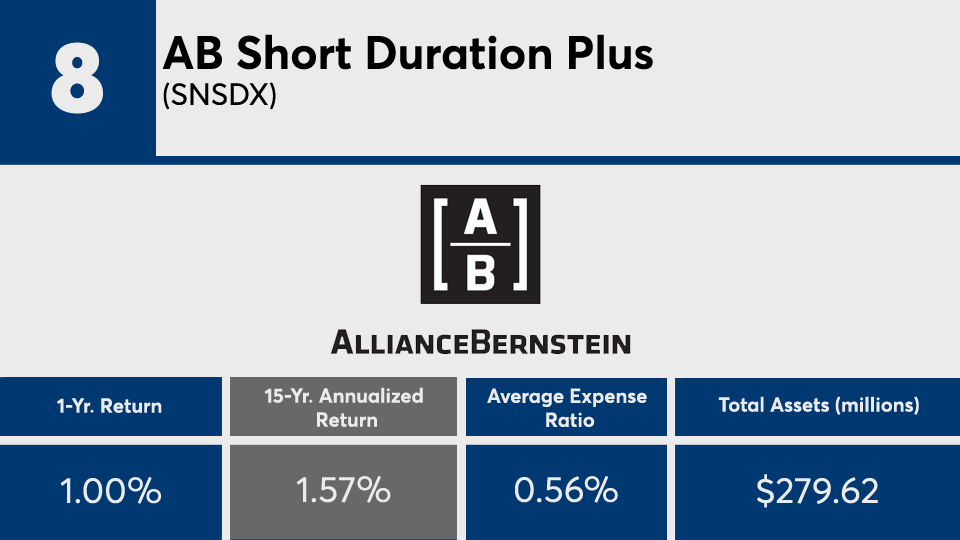

All of the fixed-income industry’s worst long-term performers recorded gains over all time horizons, with only one in the red so far in 2021.

The 20 worst-performing bond funds of the past 15 years, with at least $100 million in assets under management, notched an average gain of nearly 1.5%, Morningstar Direct data show. Over the past 12 months, the same funds — all actively managed like those in last week’s

With Treasury yields hovering around 1% over the better part of the decade, Amy Magnotta, co-head of discretionary portfolios at Brinker Capital Investments, says it’s no surprise that the industry's shortest-duration bond funds had a large presence.

“All of the funds on the list with the worst 15-year returns are short-term bond funds, both taxable and municipal,” Magnotta says, adding, “The yield on the one-year Treasury bill has averaged just 1.16% over the last 15 years, and it spent most of the time period below 1%, which is not an attractive starting point for returns of shorter maturity securities.”

For comparison, the iShares Core U.S. Aggregate Bond ETF (

In stocks, the SPDR S&P 500 ETF Trust (

Fees among bond funds in this ranking were higher than the industry average. With an overall net expense ratio of 0.58%, funds here were only slightly pricier than the 0.45% investors paid for fund investing in 2019, according to

When discussing bond fund performance over any time horizon with clients, Magnotta says it’s key to also have a conversation about their role in a diversified portfolio.

“While bond funds can experience drawdowns when interest rates rise, as we saw in the first quarter of 2021, the drawdown is not at the level of magnitude associated with equity market drawdowns,” she says. “Short-duration fixed income strategies, like the funds on the list, can also serve as a diversifier within a client’s fixed income allocation and can be an attractive option in a rising interest rate environment.”

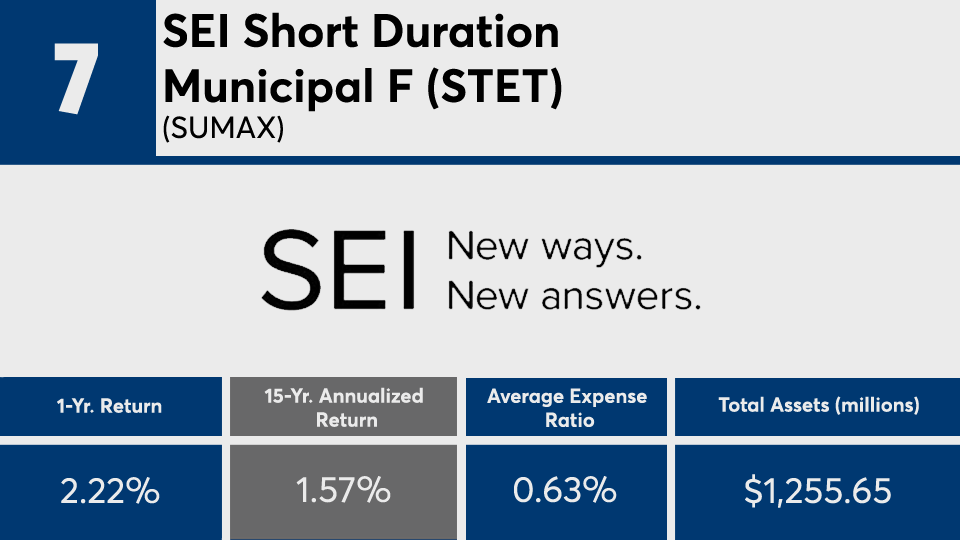

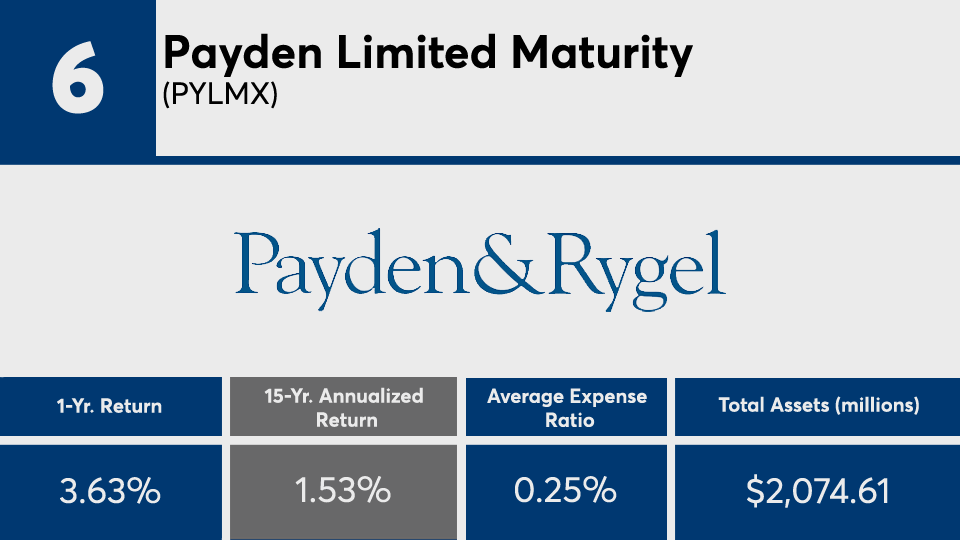

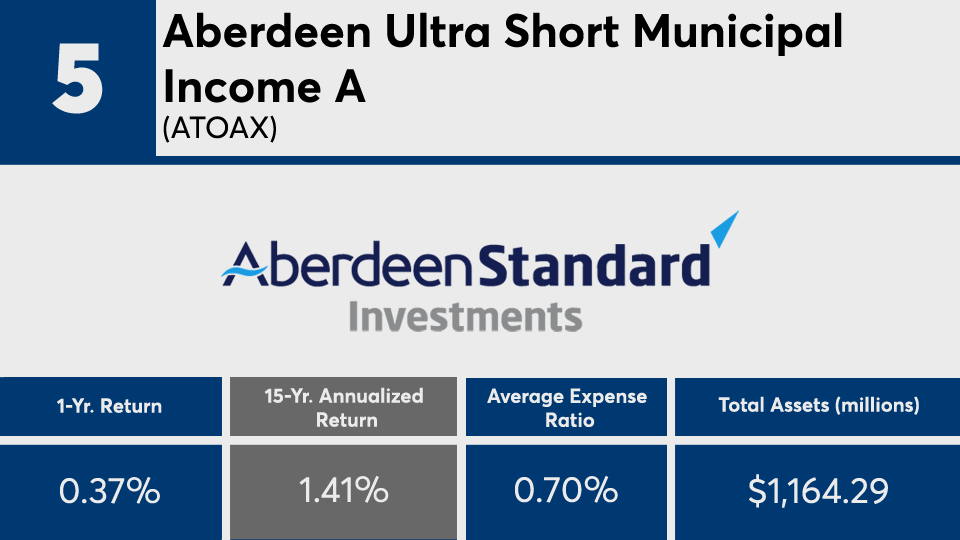

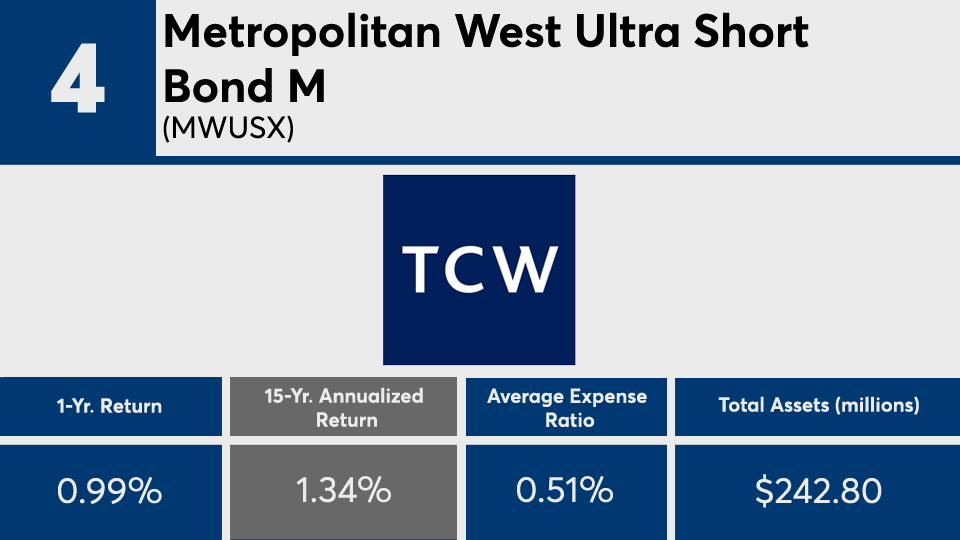

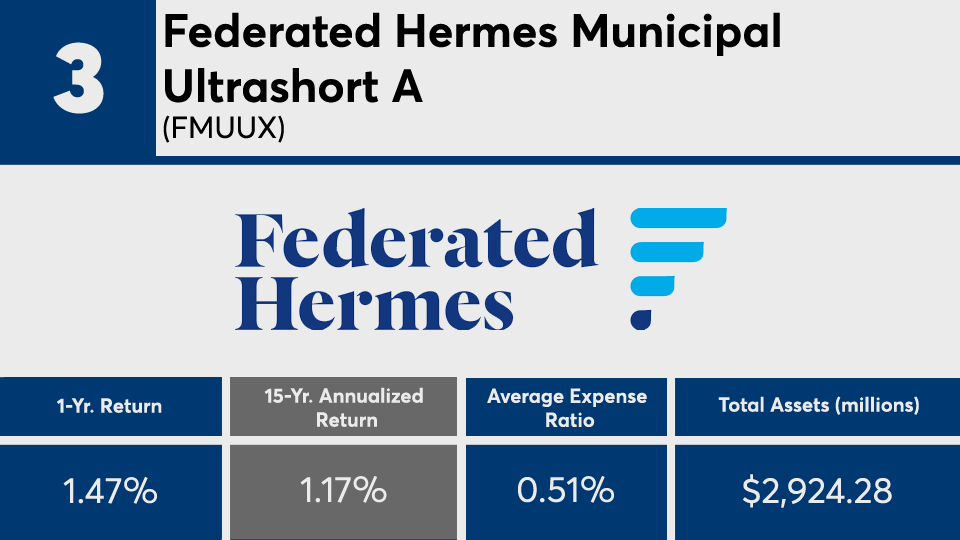

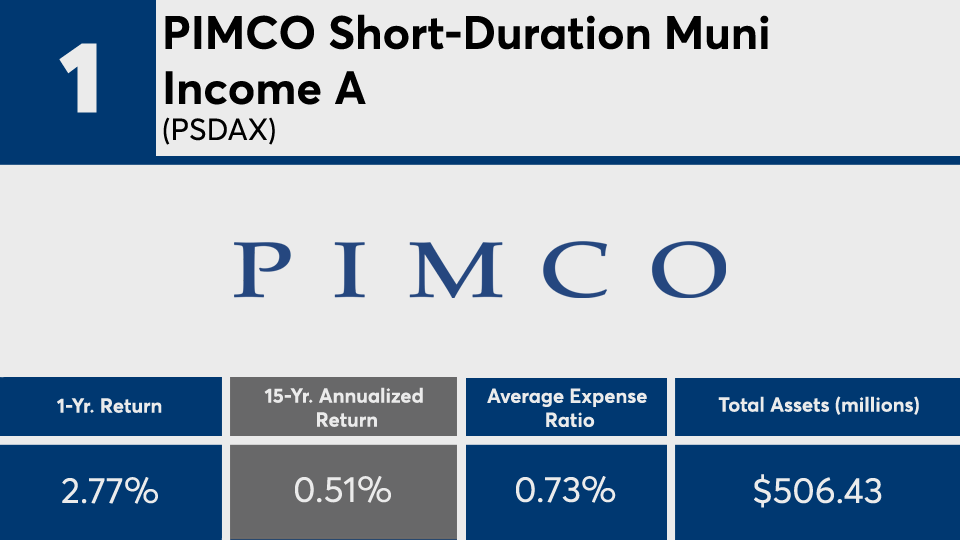

Scroll through to see the 20 bond funds with more than $100 million in AUM and the worst 15-year returns through April 15. Assets and average expense ratios, as well as year-to-date, one-, three-, five and 10-year returns are also listed for each, as are YTD-, one-, three-, five-, 10- and 15-year net share class flows through April 1. The data show each fund's primary share class. All data is from Morningstar Direct.