Bigger doesn’t always mean better.

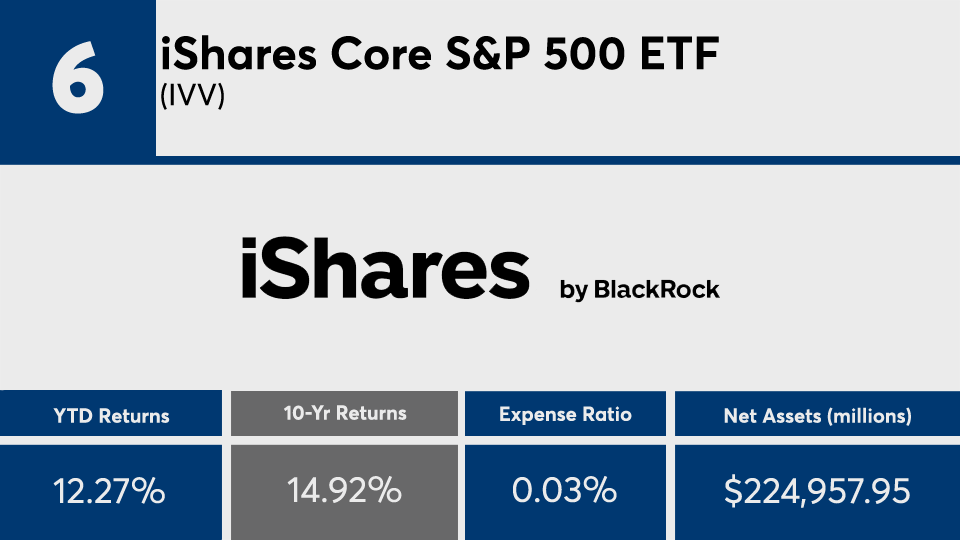

With an average 10-year gain of roughly 12% — and more than $3 trillion in AUM — the industry’s 20 biggest mutual funds and ETFs were outpaced by the broader fund industry, Morningstar Direct data show. Index trackers such as the SPDR S&P 500 ETF Trust (SPY) and the SPDR Dow Jones Industrial Average ETF Trust (DIA), meanwhile, posted gains of 14.87% and 13.60%, respectively, according to Morningstar Direct data.

In bonds, the iShares Core US Aggregate Bond ETF (AGG) generated a gain of 3.65%.

Despite some impressive short-term returns, the year-to-date average among the industry’s biggest hitters also underwhelmed. While the funds managed an average return of 12% this year, more than half underperformed SPY’s 12.31% gain, over the same period. DIA and AGG, meanwhile, posted gains of 3.68 and 7.21%, respectively.

Steve Skancke, chief economic advisor at wealth manager at Keel Point, says it’s no surprise which funds ended up at the top.

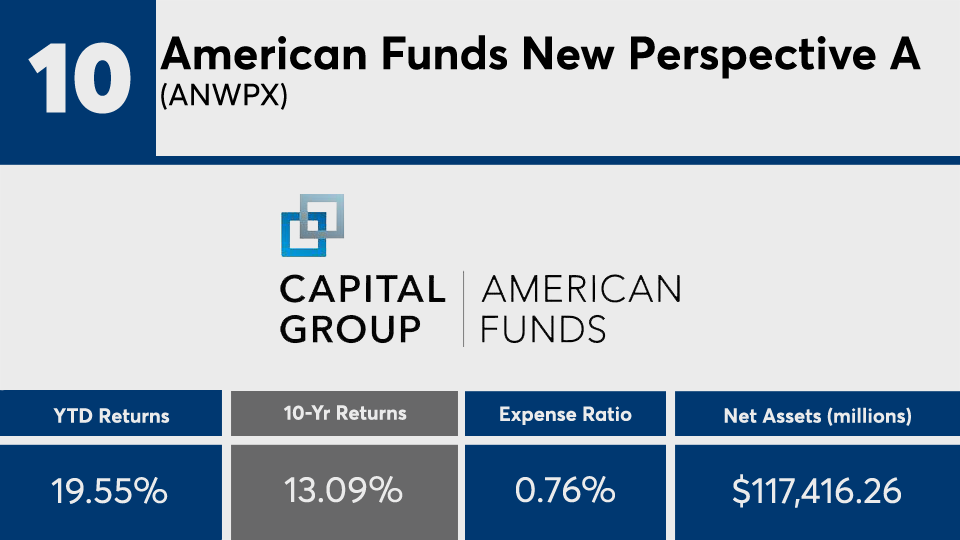

“When we look at the tech sector over the past 12 months, it is up approximately 56% versus 22.5% for the broader S&P 500,” Skancke says. “Over the past 10 years ... tech is up 537% compared to the S&P being up 312%, and international developed market non-US stocks being up 117%. So being more focused on technology and communication services has provided a larger overall return for the funds who were more concentrated in this space.”

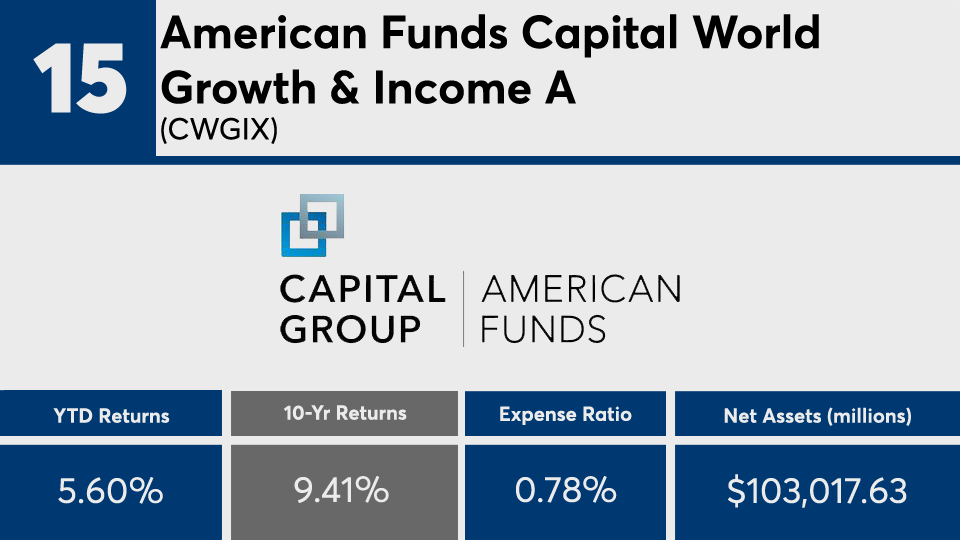

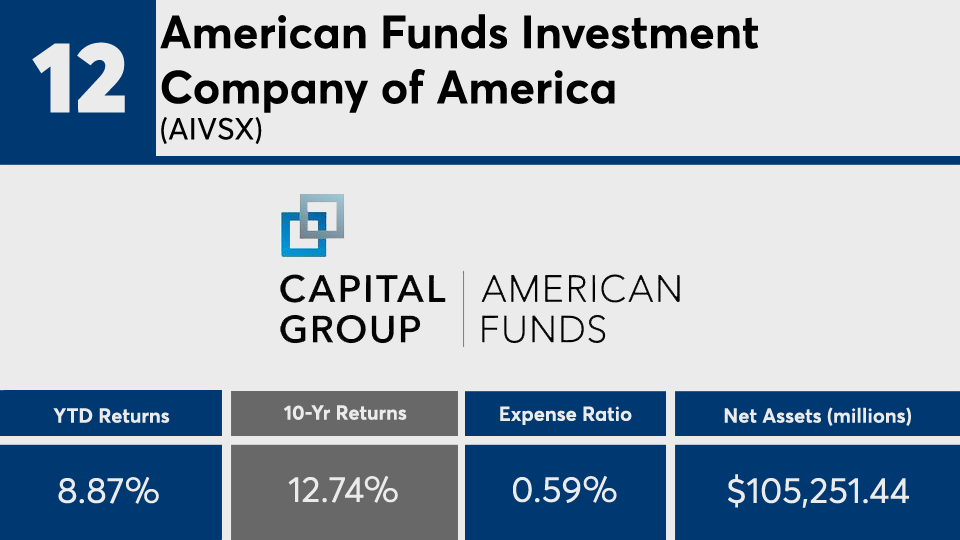

Although more than half of the 20 biggest funds are costlier than the broader industry, their average expense ratio is on par. With an average net fee of 42 basis points, these funds were only slightly less than the 0.45% investors paid on average for fund investing overall last year, according to

“Fees over 50 basis points in all but one fund did not keep American Funds from holding 10 of the 20 biggest funds,” Skancke notes, adding that the firm’s flagship Growth Fund of America, which has an 85-basis-point expense ratio, outpaced more than one S&P 500 ETF, “with somewhat similar allocations.”

Scroll through to see the 20 largest mutual funds and ETFs ranked by their 10-year returns through Sept. 3. Funds with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios, as well as YTD, one-, three-, five- and 10-year returns are listed for each. The data show each fund's primary share class. All data is from Morningstar Direct.