This year’s largest recruiting moves boast some impressive stats: 17 teams and solo advisors overseeing $75 billion in assets.

The overall number of billion-dollar moves is down

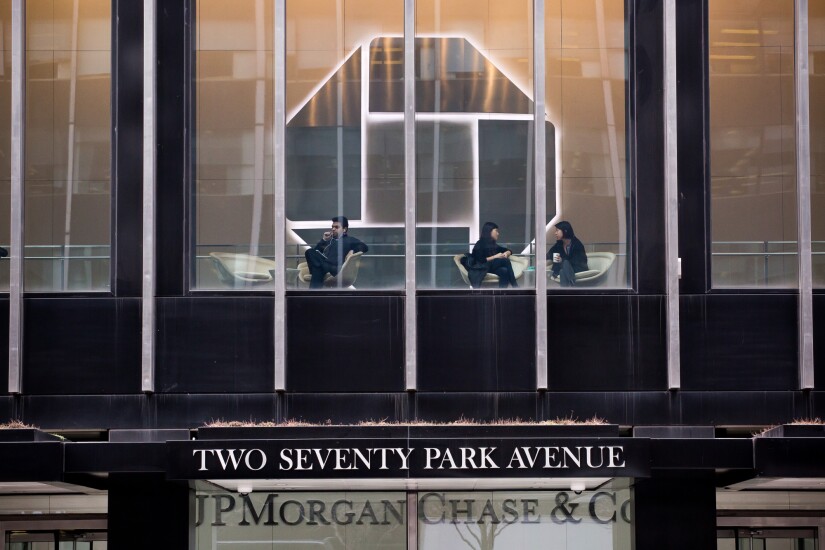

The firms that are ending the year as the new homes of these elite brokers include a diverse cast: regional BDs, wirehouses, boutiques and RIAs. Some names are familiar, such as Raymond James and J.P. Morgan Securities, while a few may surprise. And, continuing a trend of past years, several billion-dollar wirehouse teams launched their own RIAs.

This list only includes moves and asset figures that have been confirmed. All moves are either within the employee channel or breakaway brokers.

Scroll through to see where these elite advisors landed.