How have the best-performing target-date funds of the decade fared amid recent coronavirus-driven volatility? For clients approaching retirement, one lesson in the space remains a constant: past performance is not indicative of the future returns.

The 20 top-performing target-date funds with target dates of 2030 and 2035, and at least $500 million in assets under management, posted an average 10-year gain of roughly 9%, Morningstar Direct data show. But so far this year, the 20 target-date funds posted a near 1.5% loss.

For comparison, index trackers like the SPDR S&P 500 ETF Trust (SPY) and the SPDR Dow Jones Industrial Average ETF Tracker (DIA) posted 10-year gains of 13.92% and 13.17%, respectively. The SPY and DIA have posted year-to-date losses of 0.31% and 4.31%, respectively.

“Looking at the performance differential, it's primarily made up of asset allocation differences,” says Marc Pfeffer, CIO of CLS Investments, adding that the target-date funds with the best 10-year returns have “less international and more growth, versus domestic and value, and those have been both in favor over the last decade, year in and year out. As I often tell people, asset allocation leaders — in terms of what works and what doesn’t work — changes.”

The leaders — from firms like Capital Group, T. Rowe Price and Vanguard — carried an average net expense ratio of 0.58%. That’s more than 20 basis points higher than the average expense ratio among target-date mutual funds in 2019, according to ICI’s latest fee report. It’s also 10 basis points higher than the

For comparison, the Vanguard Target Retirement 2030 Investor (VTHRX) has a 14 basis point expense ratio, 10-year gain of 9.17% and YTD loss of 0.74%, data show.

“I think the expense ratio matters here, but you should also be more importantly looking at their investment styles,” Pfeffer says. “Every client's risk tolerance is different and every advisor should be customizing and knowing what that is — they have to explain the details.”

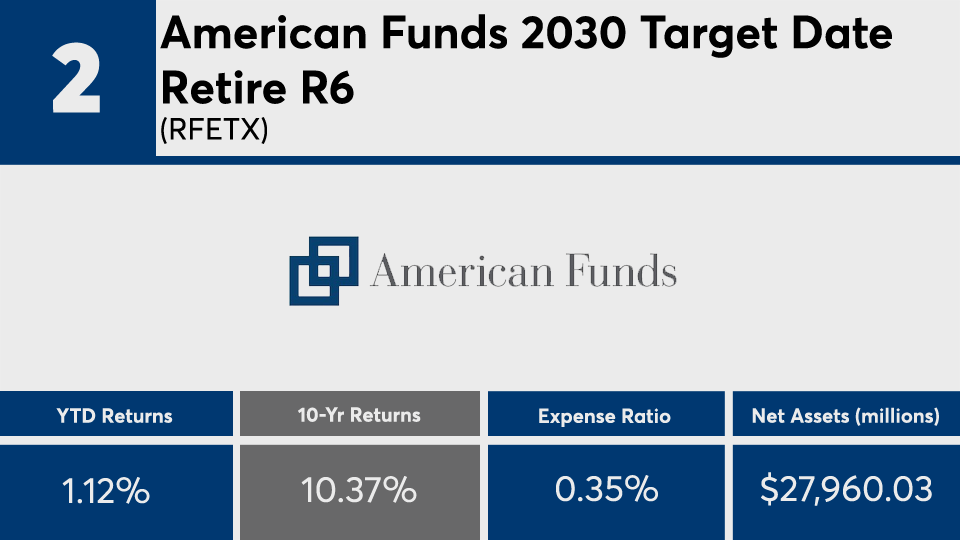

Scroll through to see the 20 target-date 2030-35 category funds with the best 10-year returns through June 10. Funds with less than $500 million in AUM and with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios, as well as year-to-date and one-, three-, five- and 10-year returns and net flows are listed for each. Flow data as of June 1. The data show each fund's primary share class. All data is from Morningstar Direct.