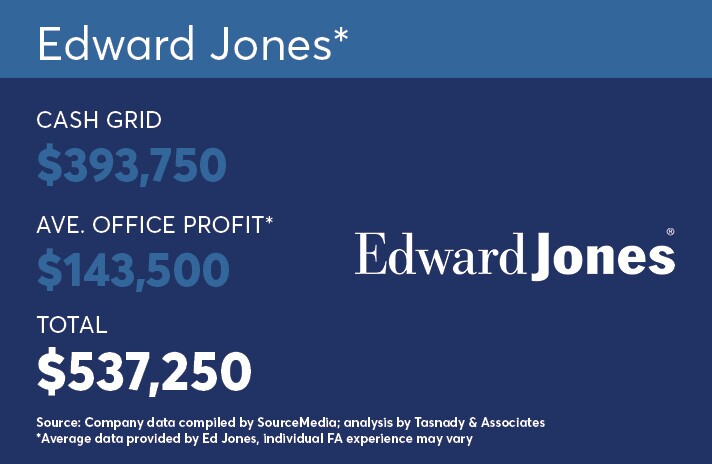

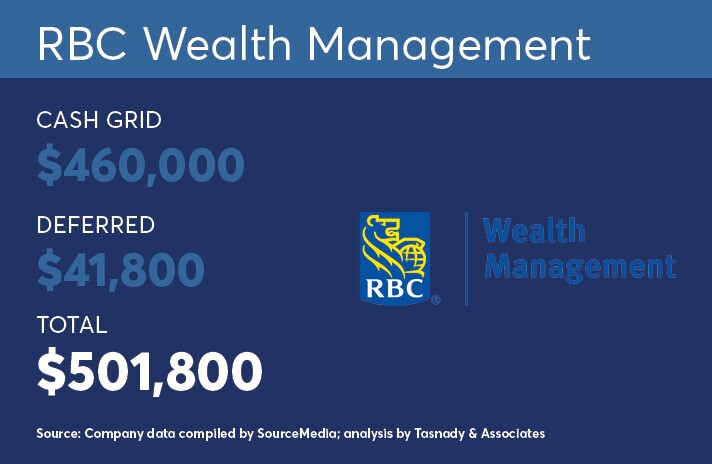

On Wall Street unveils the next component in its annual multipart analysis of starting payouts for advisors at wirehouse, regional and national brokerage firms. This analysis examines four production levels: $400,000, $600,000, $1 million and $2 million.

Scroll through to compare and contrast compensation plans at the $1 million level.

To see last year's compensation analysis,

Data was collected by SourceMedia and analysis conducted by Tasnady & Associates.

A number of special policies are not included here since they do not affect 100% of the population evenly and therefore are more haphazard to compare. Individual results can vary dramatically based on the mix of business and policies at each firm. For example, pay can rise from special bonuses and fall from penalties such as discount sharing, small client limits and ticket charges.

Assumptions for basic pay (prior to special policies/contingent bonuses):

- 25% in individual stocks; 25% in individual bonds; 25% in mutual funds; 25% in fee-based (wrap accounts, managed accounts, etc.)

- Year-end basic bonuses are shown in deferred totals.

- Length of service is assumed to be 10 years.

- Assumes no bonuses from growth, nor asset-based bonuses or other behavior-based awards.

Excludes voluntary deferral matches, 401(k) matches or profit-sharing contributions, unless otherwise noted.

Does not include: T&E expense allowance, discount sharing or ticket charge expense assumptions, small household or small ticket policy assumptions, or value of any options awards.