The 20 bond funds with the biggest gains of 2020 benefited from the Fed’s aggressive response to COVID-19.

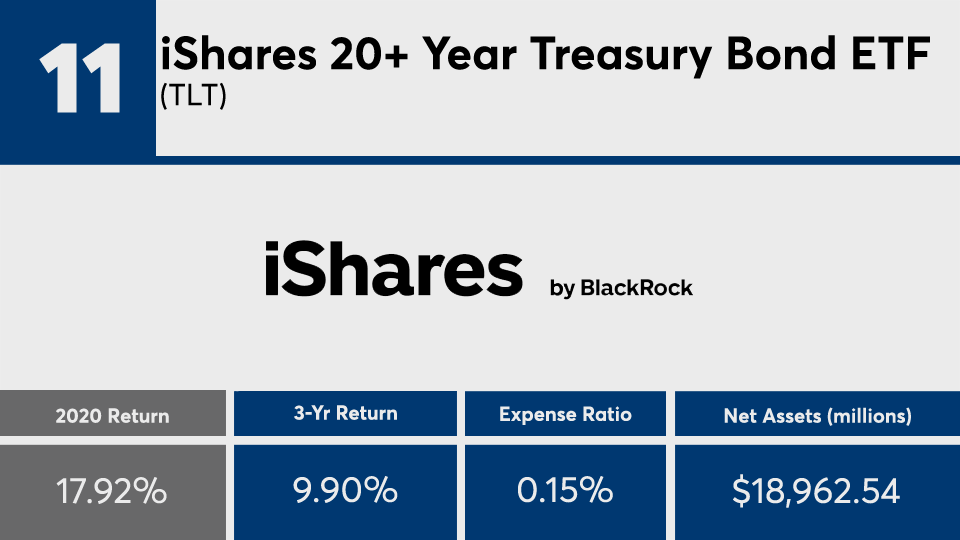

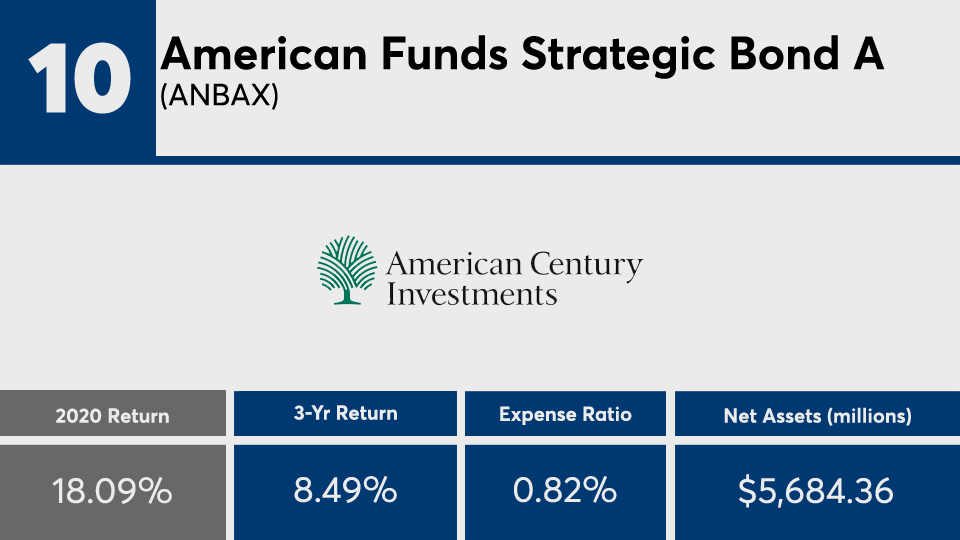

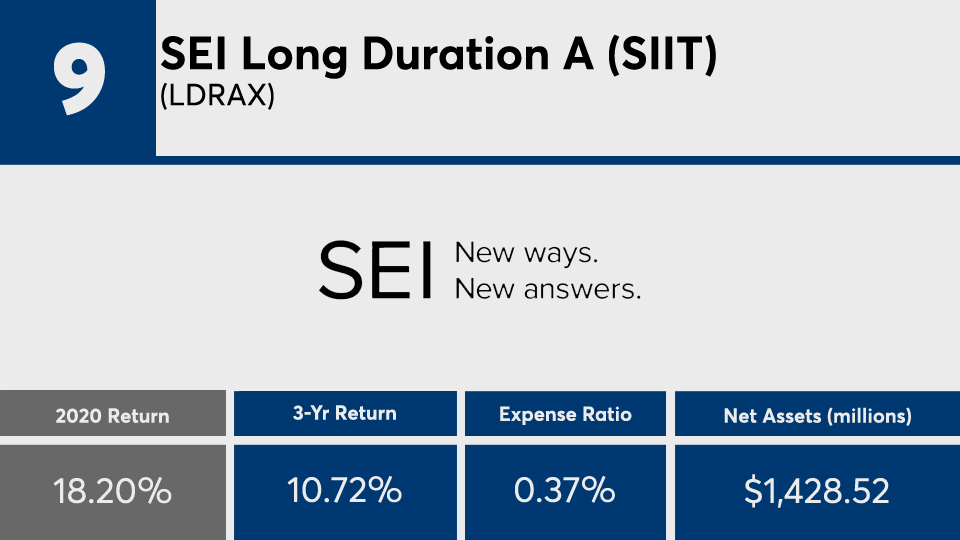

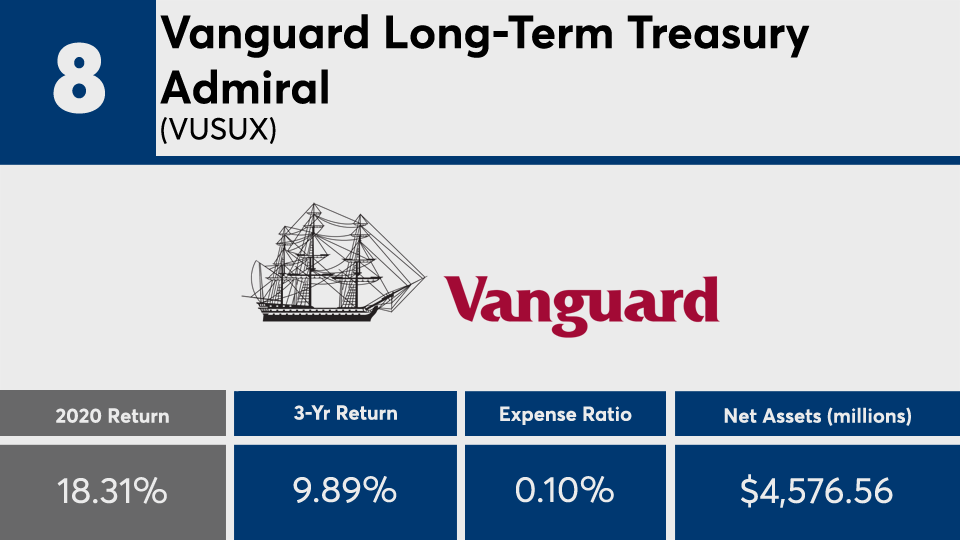

With an average annual return of more than 19%, the year’s fixed-income leaders more than doubled their industry peers and outpaced stock-index trackers over the period, Morningstar Direct data show.

For comparison, the iShares Core U.S. Aggregate Bond ETF (AGG) generated a 7.42% return in 2020, data show. The fund also notched a three-year annualized gain of 5.27%. In stocks, index trackers such as the SPDR S&P 500 ETF Trust (SPY) and the SPDR Dow Jones Industrial Average ETF Trust (DIA) had returns last year of 18.4% and 9.62%, respectively, data show. SPY and DIA had three-year annualized gains of 14.07% and 9.73%.

“The Fed served as a backstop to the corporate credit market, and from the March low through year-end, investment-grade credit gained 22% and high-yield credit gained 34%,” says Amy Magnotta, senior vice president and co-head of discretionary portfolios at Brinker Capital Investments. “Active fixed income managers that were able to take advantage of that dislocation were rewarded.”

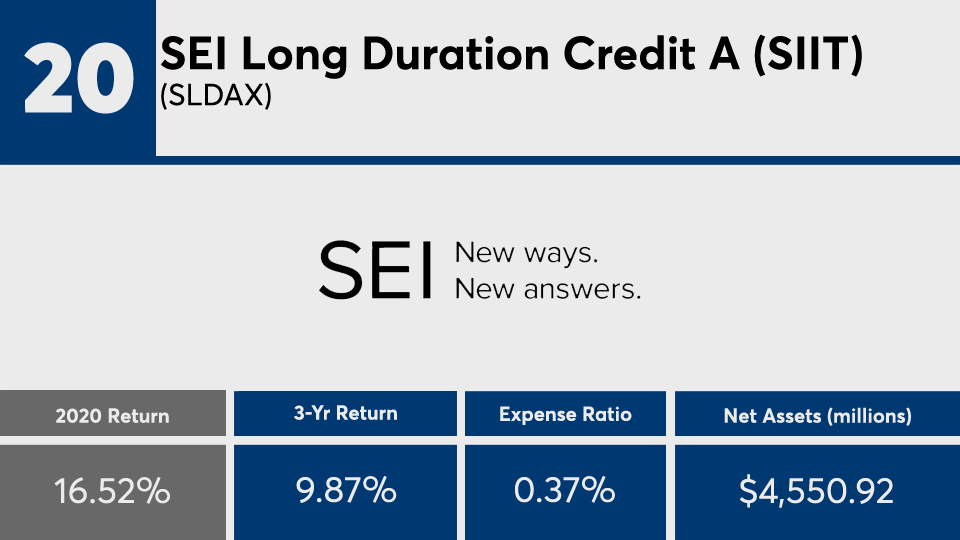

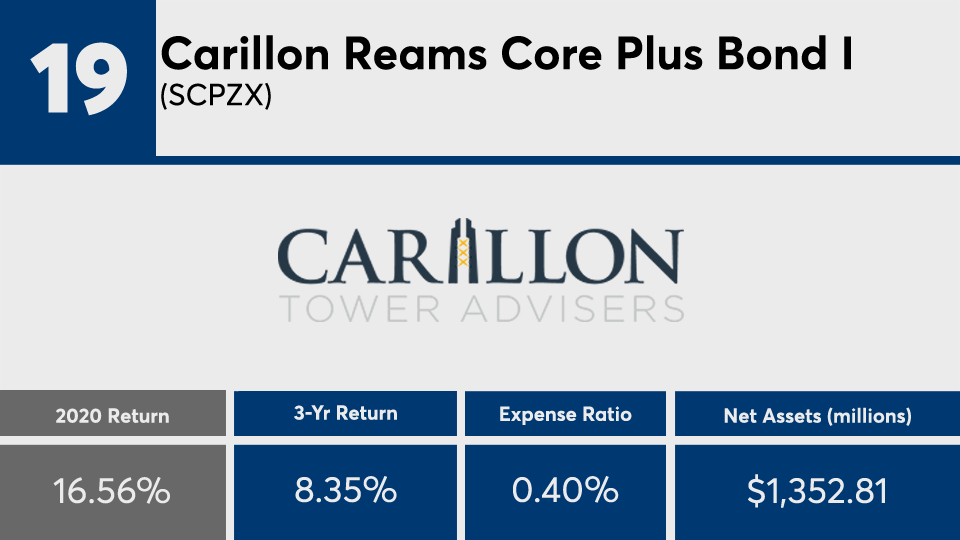

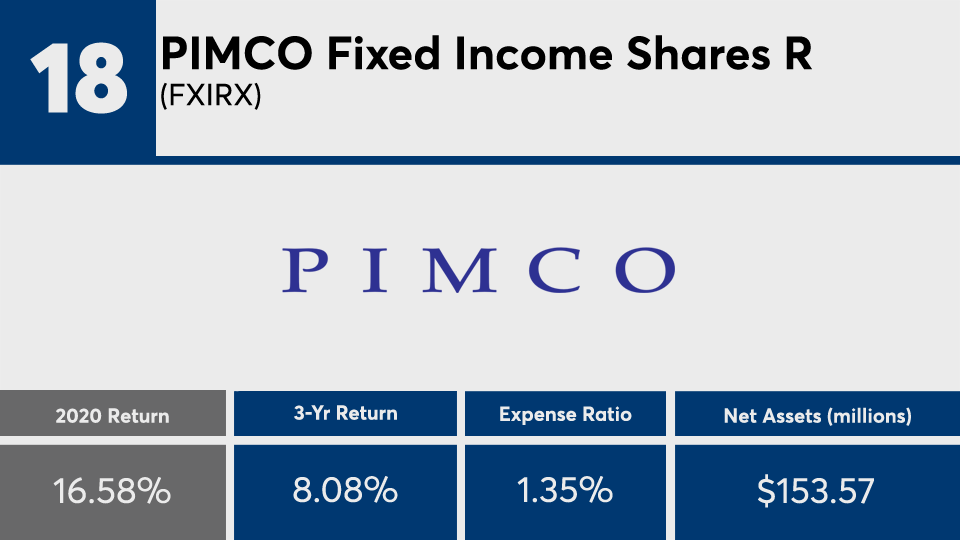

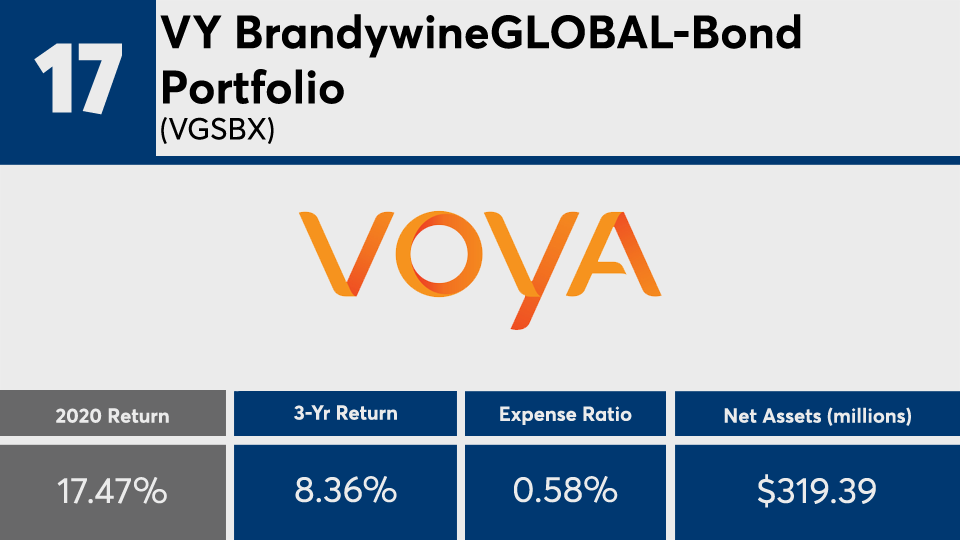

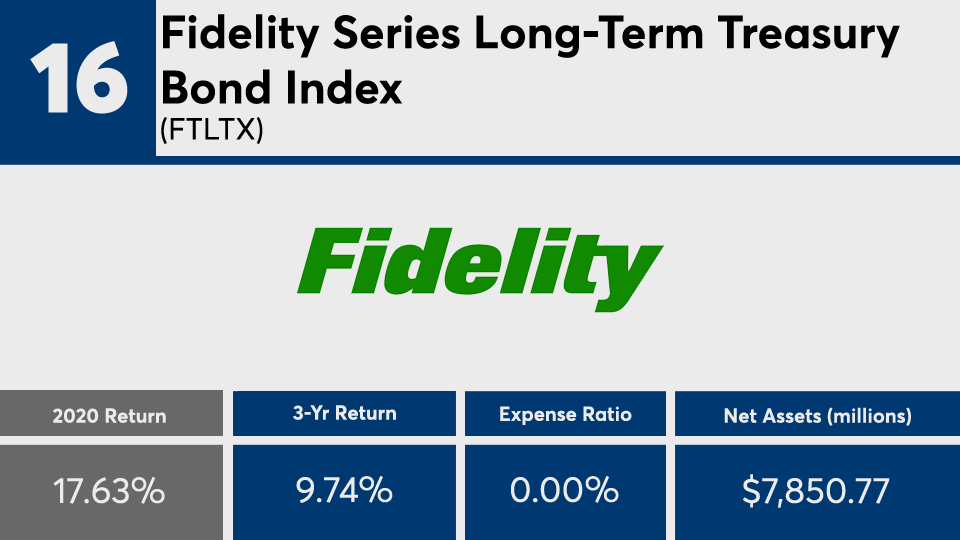

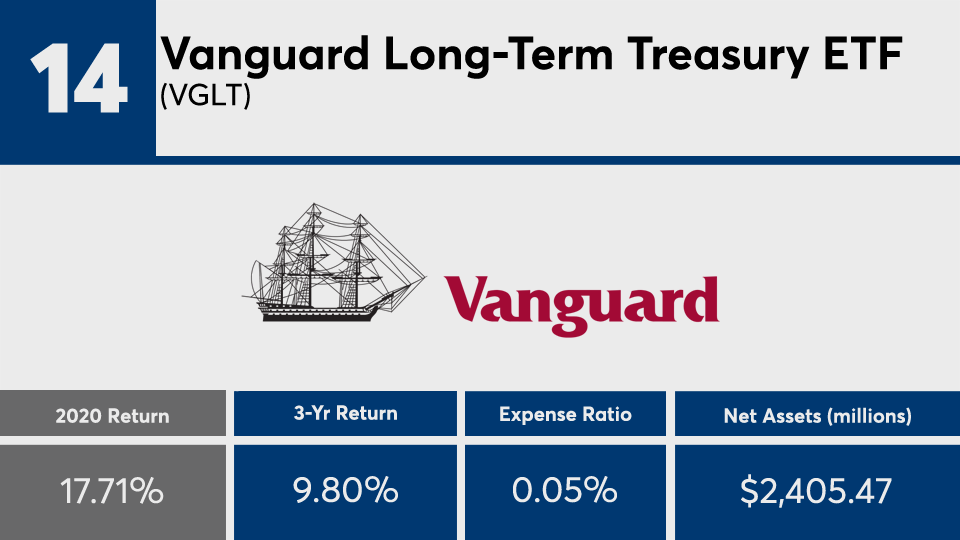

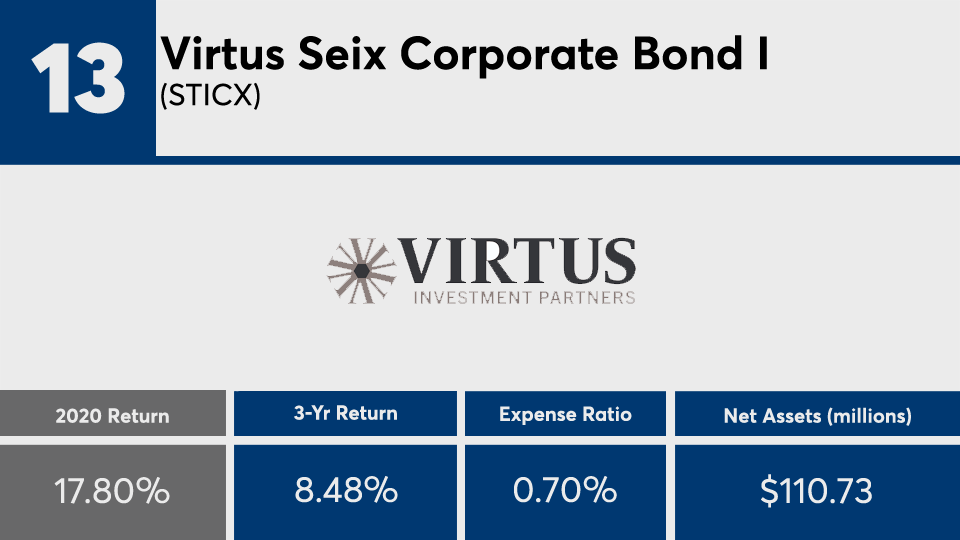

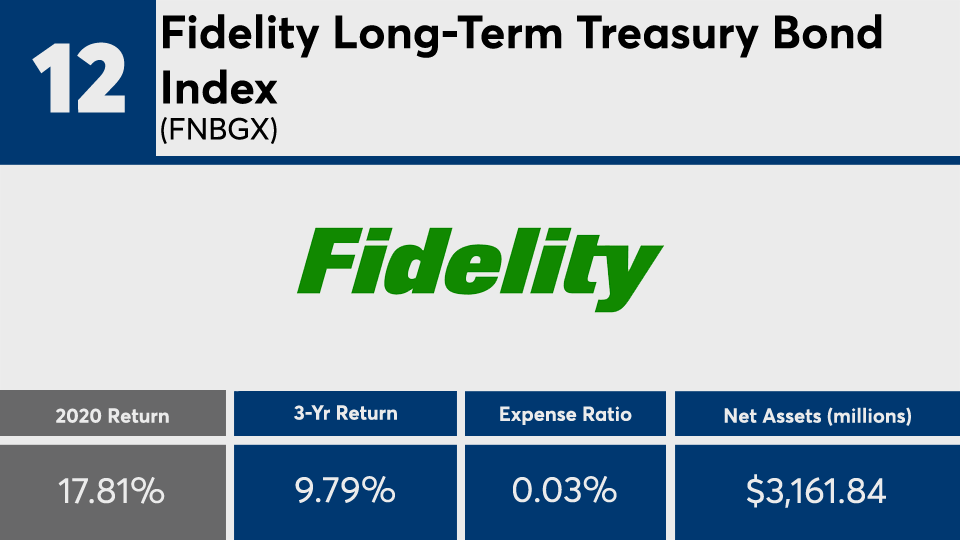

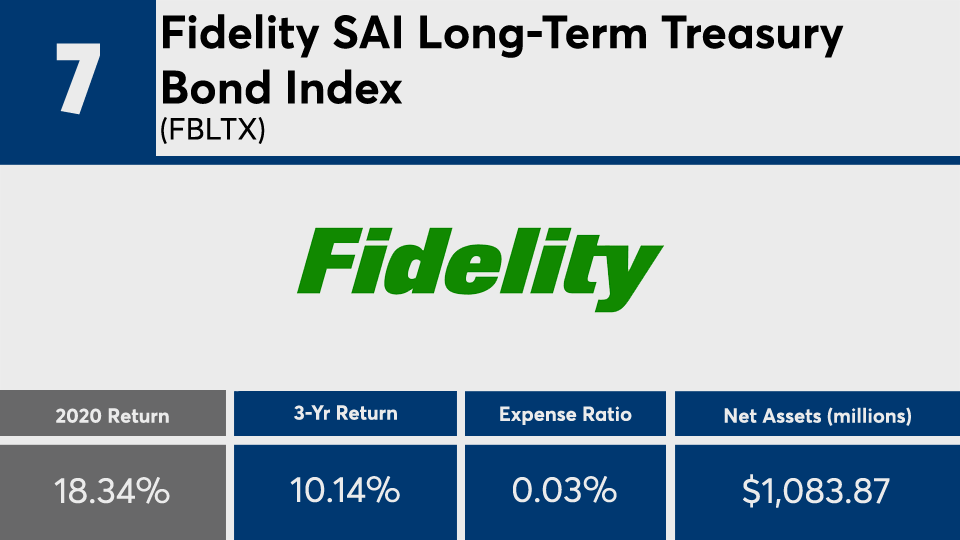

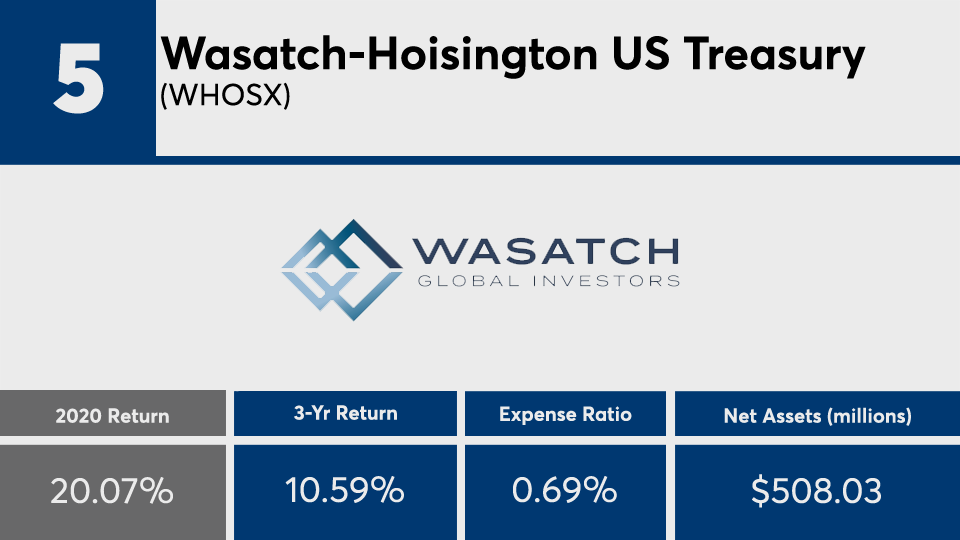

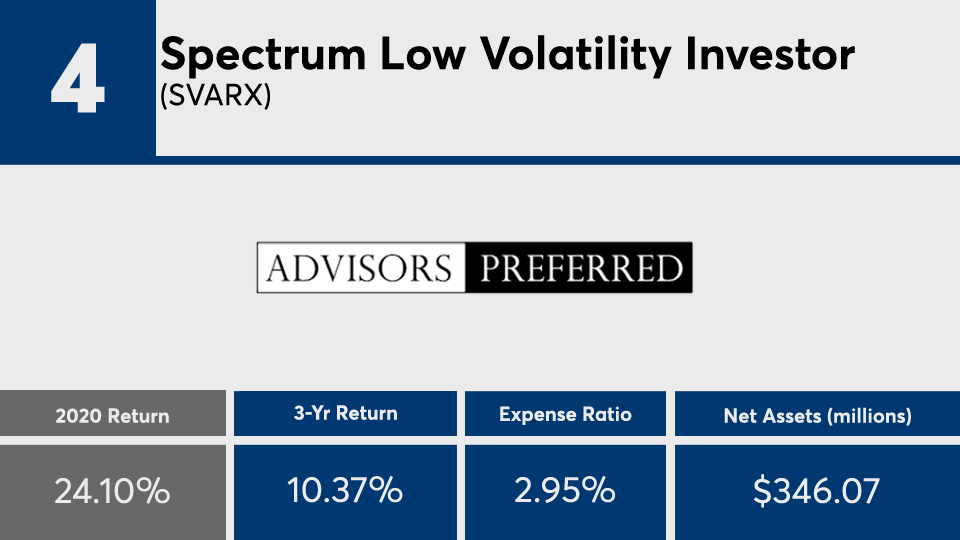

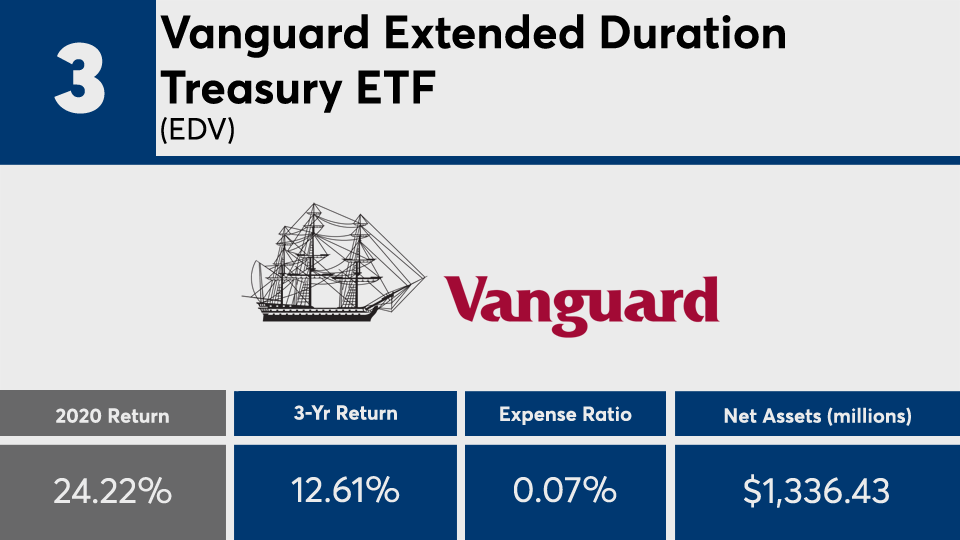

Fees among the leaders were all over the map, data show. Though some of these funds carried expense ratios well over 100 basis points, the group had an average of 0.45%, on par with what investors paid for fund investing last year, according to

“The majority of the long-duration Treasury strategies are ETFs or index funds with low fees,” Magnotta says. “However, the core plus and credit strategies on the list are actively managed and command a higher fee, and there is a more tactically managed fund on the list with even higher fees.”

For advisors with clients closely watching their portfolios, Magnotta says assessing the bond fund industry’s performance in 2020 may open the door to reassessing their long-term strategies.

“With yields so low on investment-grade fixed income, investors may be tempted to move further out the credit spectrum into higher yielding fixed income in order to meet their income needs,” she says. “Given this backdrop, it is important for financial advisors to talk to their clients about how their fixed-income allocation is positioned for the current market environment, and to set realistic expectations for fixed-income returns going forward.”

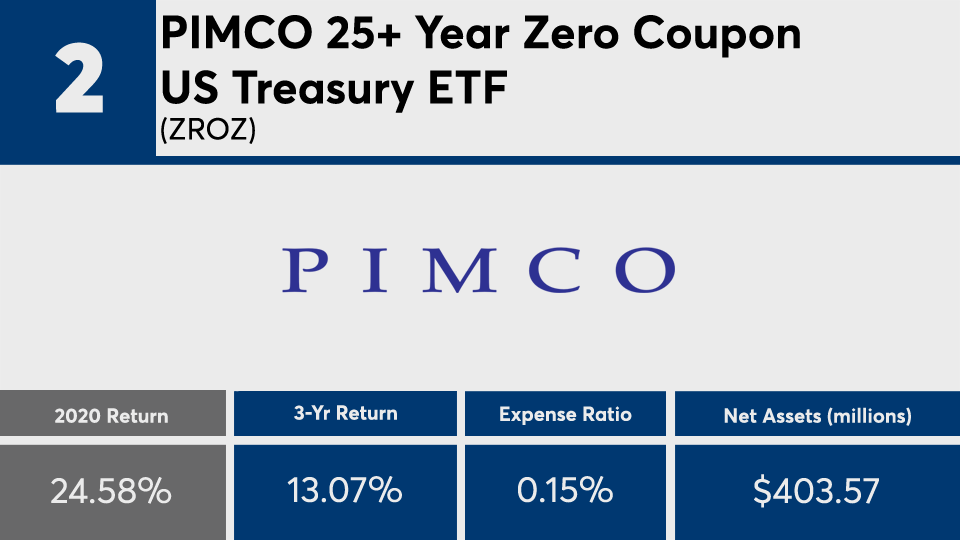

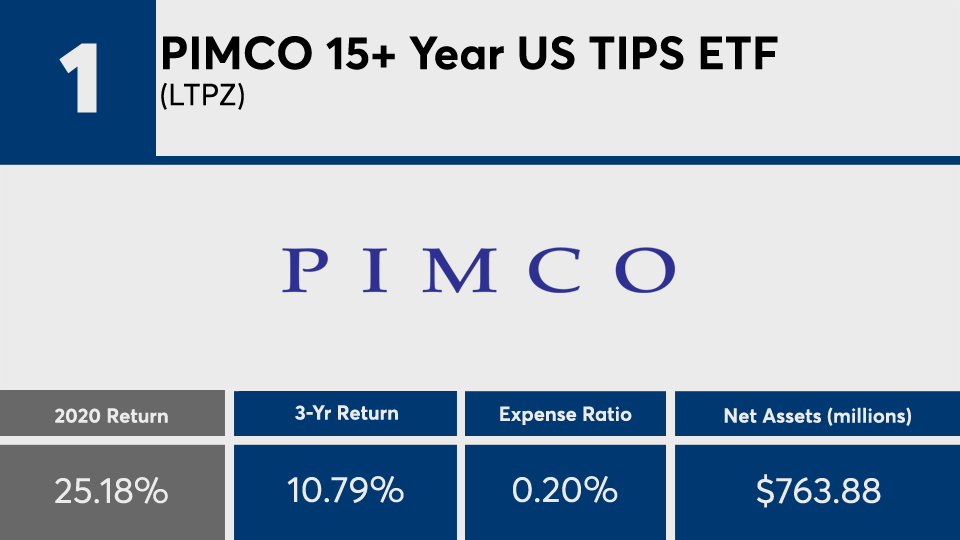

Scroll through to see the 20 bond funds with the biggest gains in 2020. Funds with less than $100 million in AUM were excluded, as were funds with investment minimums above $100,000, leveraged and institutional funds. Assets and expense ratios, as well as one-, three-, five- and 10-year returns through Jan. 4 are also listed for each. Minimum initial investments and loads are also listed when applicable. The data show each fund's primary share class. All data is from Morningstar Direct.