Where can a $400,000 producer earn the most?

It’s a seemingly straightforward question that lacks a straightforward answer. Simply put: It depends. There are a number of factors in play including how companies try to incentivize staff to pursue strategic goals. Some offer rewards to advisors for ensuring clients have a financial plan while others penalize brokers for failing to connect clients with consumer bank products.

A majority of core components remain the same as last year — a sign of how reluctant firms are to significantly alter comp plans except at the margins.

“The large companies over the past 20 years have been evolutionary rather than revolutionary. Unless there is a sea change in management, most of the changes will be minor year to year,” says Andy Tasnady, a compensation consultant.

To help advisors make sense of it all, Financial Planning presents this annual analysis of core compensation components at wirehouses, national and regional broker-dealers.

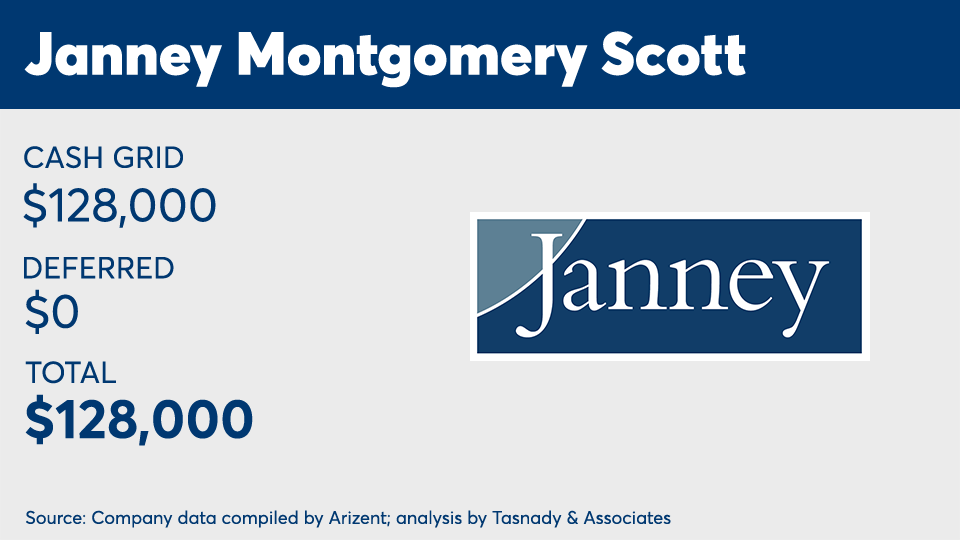

Scroll through to see how core comp plans compare.

This is the first of four parts of our annual survey. To see last year’s analysis,

Data was collected by Arizent and analysis conducted by Tasnady & Associates.

A note about this year’s analysis: A number of special policies are not included here because they do not affect 100% of the advisor population evenly and therefore are more haphazard to compare. Individual results can vary dramatically, based on the mix of business and policies at each firm. For example, pay can rise from special bonuses and fall from penalties such as discount sharing, small client limits and ticket charges.

Assumptions for basic pay (prior to special policies/contingent bonuses):

- 25% in individual stocks; 25% in individual bonds; 25% in mutual funds; 25% in fee-based (wrap accounts, managed accounts, etc.)

- Year-end basic bonuses are shown in deferred totals.

- Length of service is assumed to be 10 years.

- Assumes no impacts from bonuses based on growth, asset-based bonuses or other behavior-based awards.

- Excludes voluntary deferral matches, 401(k) matches or profit-sharing contributions, unless otherwise noted.

- Does not include: T&E expense allowance, discount sharing or ticket charge expense assumptions, small household or small ticket policy assumptions, or value of any options awards.