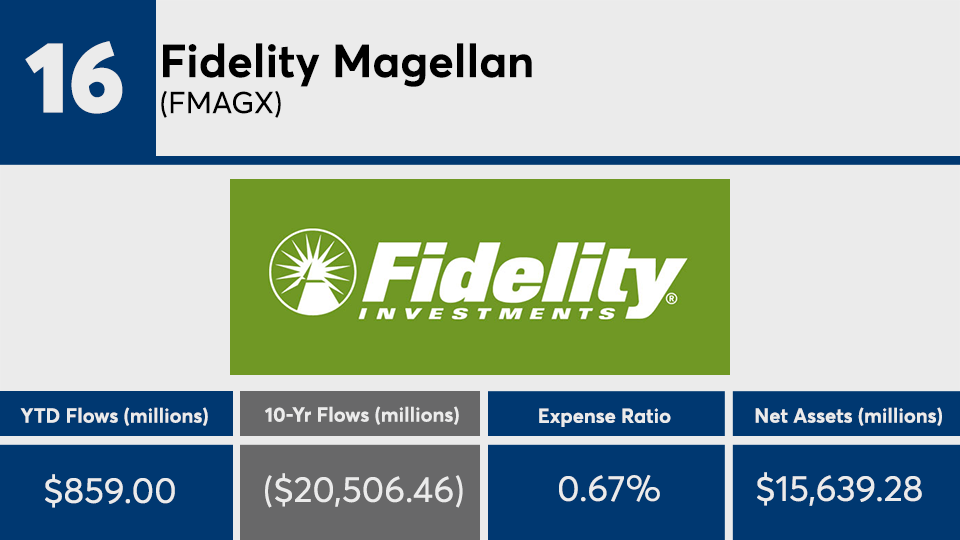

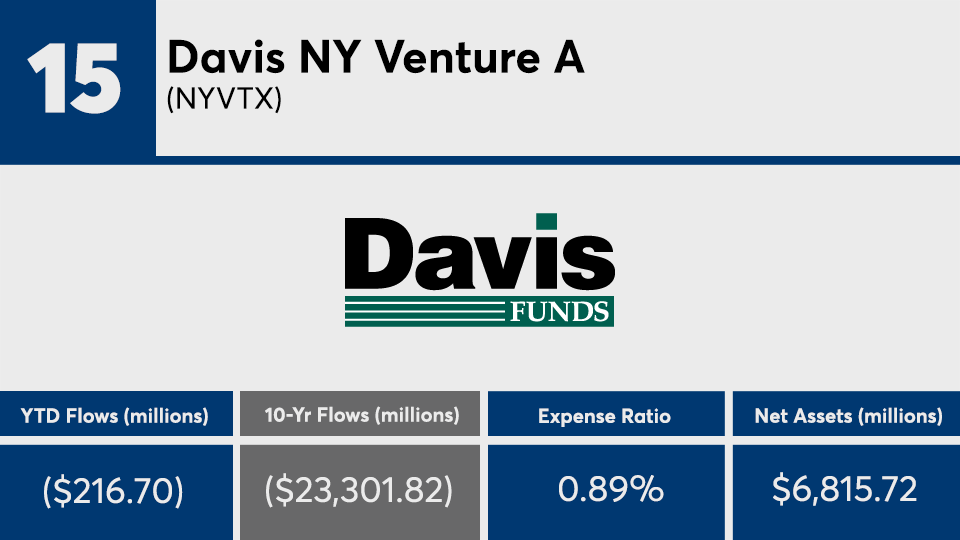

With losses continuing to mount from active funds over the past decade, the space has continued to experience massive outflows as clients look for cheaper ways to make gains.

The 20 funds with the largest net outflows of the last 10 years — and with at least $500 million in assets — have lost a combined $617 billion, Morningstar Direct data show. Although subpar, these funds have seen an average 10-year gain of 8.85%, data show. Over the short-term, however, they have seen substantial losses.

Compared with broader markets, the funds on this list undershot the S&P’s 10-year return of 11.10%, as measured by the SPDR S&P 500 ETF Trust (SPY), as well as the Dow’s 10.55% gain over the same period, as measured by the SPDR Dow Jones Industrial Average ETF (DIA), data show. In the first three months of the year, the benchmarks have posted losses of 11.30% and 15.47%, respectively. In bonds, meanwhile, the Bloomberg Barclays US Aggregate Bond Index etched a 10-year gain of 3.91% and YTD gain of 4.24%, as measured by the iShares Core US Aggregate Bond ETF (AGG), data show.

“Expense ratios here all 50 basis points or higher,” notes Marc Pfeffer, CIO at CLS Investments. “Fees matter and people are just saying, ‘Why should I pay for an active manager when most of them lose to the benchmark anyway?’ This is a big deal.”

Just as rock bottom expense ratios were expected among the

The $736.7 billion Vanguard Total Stock Market Index Fund (VTSAX) — the industry’s biggest — carries a 0.40% expense ratio and generated a 10-year gain of 10.77%, data show. VTSAX also had a YTD loss of 12.92%. With a 0.50% expense ratio, the largest on the bond side, the $259.3 billion Vanguard Total Bond Market Index Fund (VBTLX), recorded a 10-year gain of 3.94% and YTD gain of 4.47%, data show.

“Many people are just looking at the expense ratio, and that game is working right now,” Pfeffer says, adding that advisors, “should be looking at the performance of the fund and the track record of the manager. And while the expense ratio is a big component for choosing a fund, it should be a component.”

Scroll through to see the 20 mutual funds and ETFs with the largest 10-year net share class outflows through April 1. Funds with less than $500 million in AUM and investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets, expense ratios and five-year net share class flows are listed for each, as well as year-to-date, one-, three-, five- and 10-year returns. The data show each fund's primary share class. All data is from Morningstar Direct.