Student loan forgiveness after 20 to 25 years in a repayment plan often causes people to think, "I'll just wipe my hands clean" of the debt, according to financial planner Adrienne Davis.

"But that's not the case," said Davis of Philadelphia-based

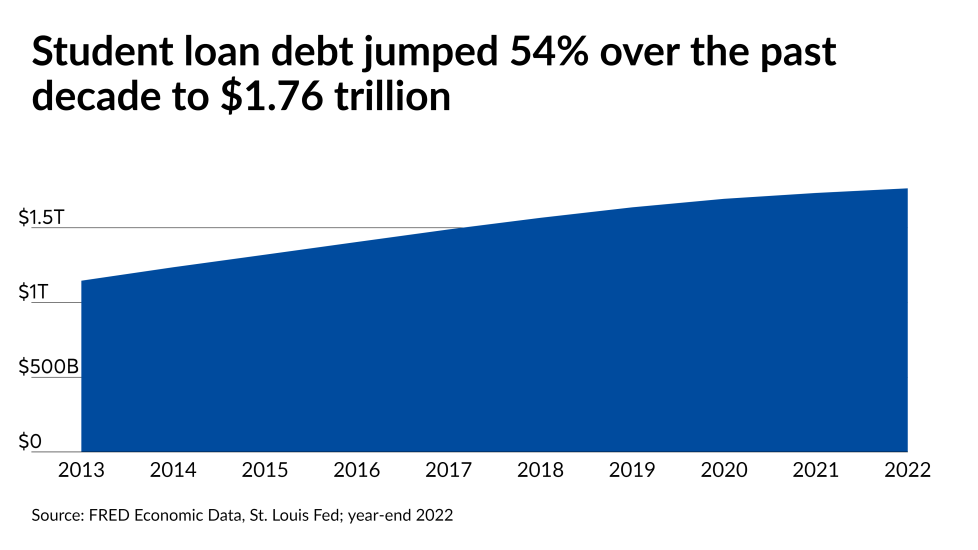

The tax complexities of those plans and other strategic intricacies surrounding student loan debt include questions about eligibility for deductions on interest payments, 529 plans and employee benefits. With over

Legislative "sunsets" in particular could carry significant tax implications in a couple of years.

"Paying something off is one thing, but you have to really understand the cash flow," said Catalina Franco-Cicero, a certified financial planner with Plantation, Florida-based

College admissions, higher education expenses, tuition and student loans are "interlinked with taxes like never before," according to Rupa Pereira, an IRS-credentialed enrolled agent who is the

She added the new direct transfer of taxpayers' information from the IRS when filling out the Free Application for Federal Student Aid in the 2024-25 school year to the

For federal student loans, a borrower's adjusted growth income and filing status determines the size of their payments and how to ensure their household is in the "best position to maximize cashflow while minimizing debt burden," Pereira said in an email. "Cashflow planning becomes a critical factor for households navigating student loans — something that a tax preparer or loan servicer may not be able to assist with."

Clients should understand that the type of loan they received often decides their eligibility for various tax deductions and credits, as well as refinancing and repayment programs, according to Emily Stead, founder of the ByMethod Financial Collective, a Phoenix-based

"The most efficient way to make sure you are making the best possible financial decisions is to gather all of the information on your current loan(s) from your current loan servicer, and then speak with a licensed tax professional for information on your current tax standing and for advice on potential deductions and credits," Stead said. "From there you can speak with a financial planner to help you understand what options would be most suitable for you and your goals and put in place an actionable plan based on your financial picture as a whole."

For seven tax subjects that planners like Stead suggest clients consider when paying off student loans, scroll down the slideshow. To see a listing of three potential strategies in response to the recent Supreme Court decision blocking the Biden Administration's student loan forgiveness program,