Wall Street’s

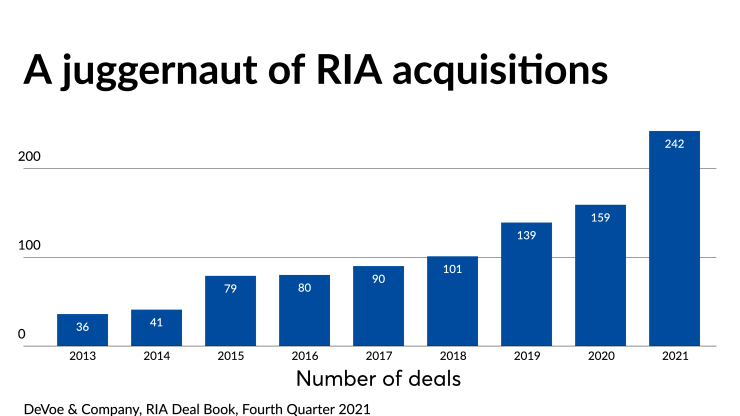

6 key trends for RIAs as mergers advance at torrid pace

Wall Street’s

The Financial Services Institute is pressing the Securities and Exchange Commission to adopt formal procedures to prevent what it deems the sometimes capricious enforcement of industry rules.

The higher standard deduction since 2017 has dramatically reduced itemization. But the new law provides incentive for teachers to consider whether that's feasible.

Political instability and other pressures are feeding some clients' portfolio fears, advisors say in this month's Financial Advisor Confidence Outlook.

Minority transactions are increasingly appealing to sellers who are wary of giving up the full control of their firms. But experts say the deals do come with strings.

Matthew Madera has become the latest former JPMorgan private client advisor to be sued after leaving for another firm. In a recent stipulated order, he agreed to stop soliciting former clients until the dispute can be resolved.

Americans tend to be overly pessimistic about their own life expectancy — a fact with major implications for retirement planning. But new research shows that certain interventions can help.