As a new decade begins, Jan. 1 will bring a variety of challenges for financial advisors: daily turmoil and macroeconomic changes; compliance burdens, and an acceleration of trends years in the making. The firms that are prepared will have a prosperous new year. But companies caught leaving advisors in the headwinds may vanish altogether.

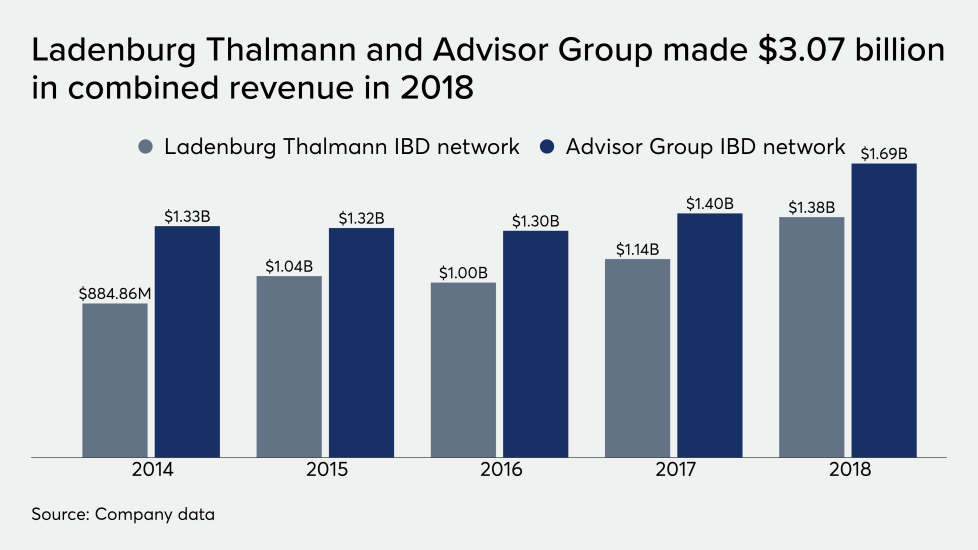

In many ways, a trip back in time to 2010 in wealth management feels like ancient history. Some broker-dealers have changed hands two — or even three — times over that span, while fee compression and the rise of passive ETFs have wrought major changes to the fund landscape.

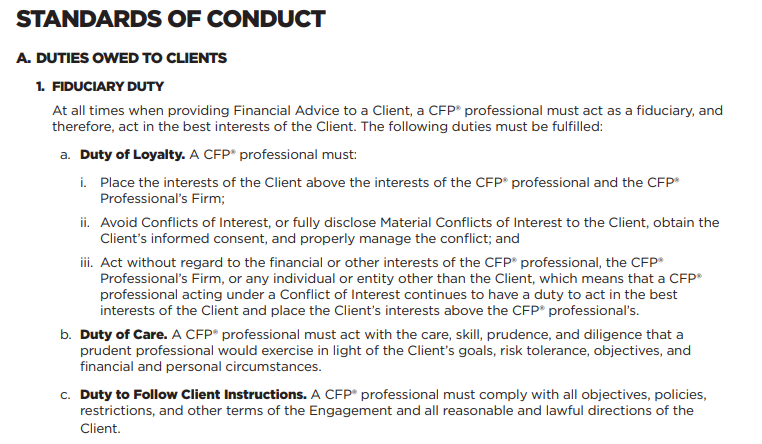

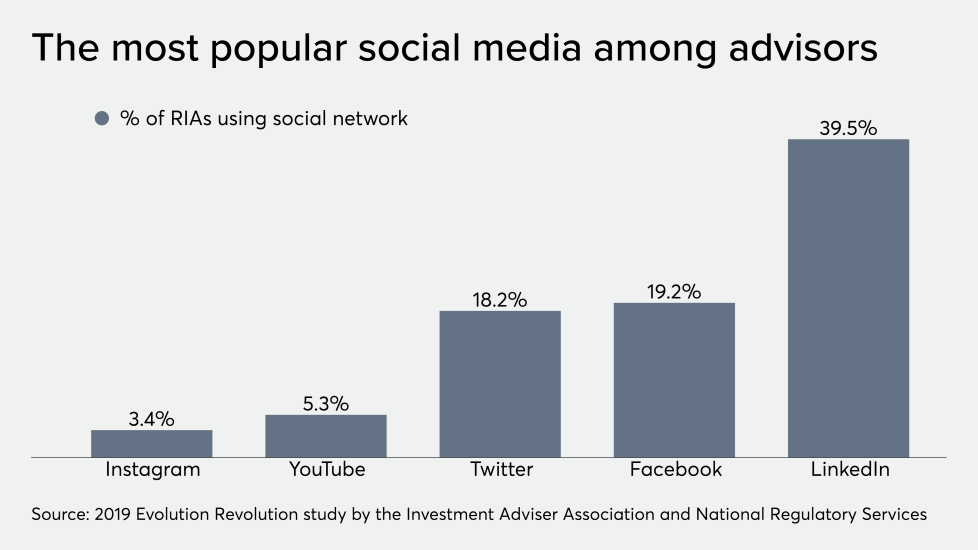

Financial advisors and their clients now have an array of new options when it comes to affiliations, business models and digital investment tools. With new regulation nudging it toward records, the RIA movement has put advisors at the center of every trend.

To see what trends looked ready to reshape the industry at this time last year, see “