Want unlimited access to top ideas and insights?

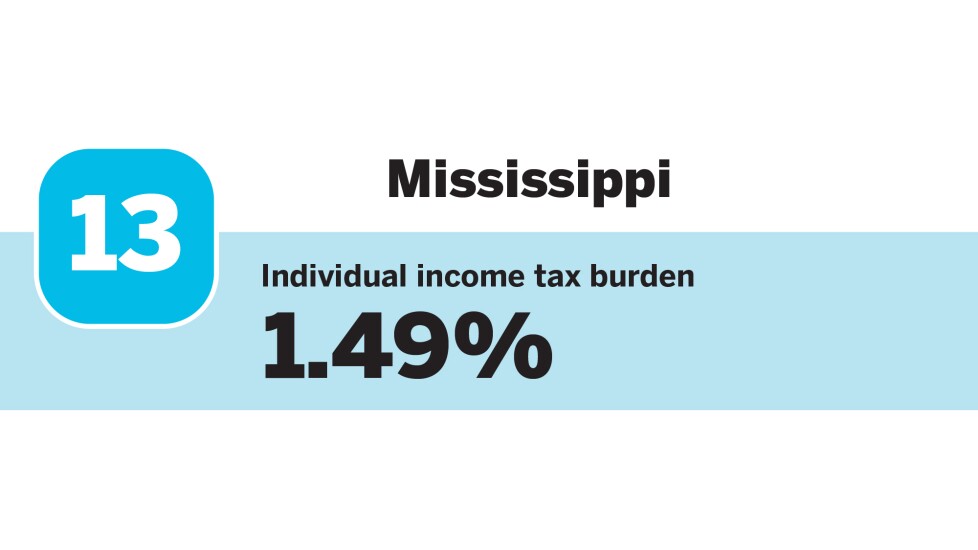

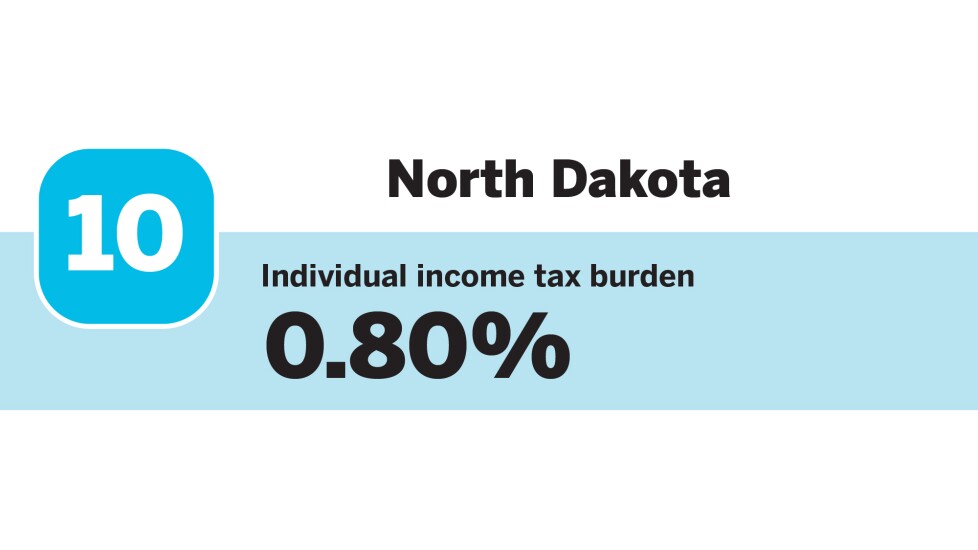

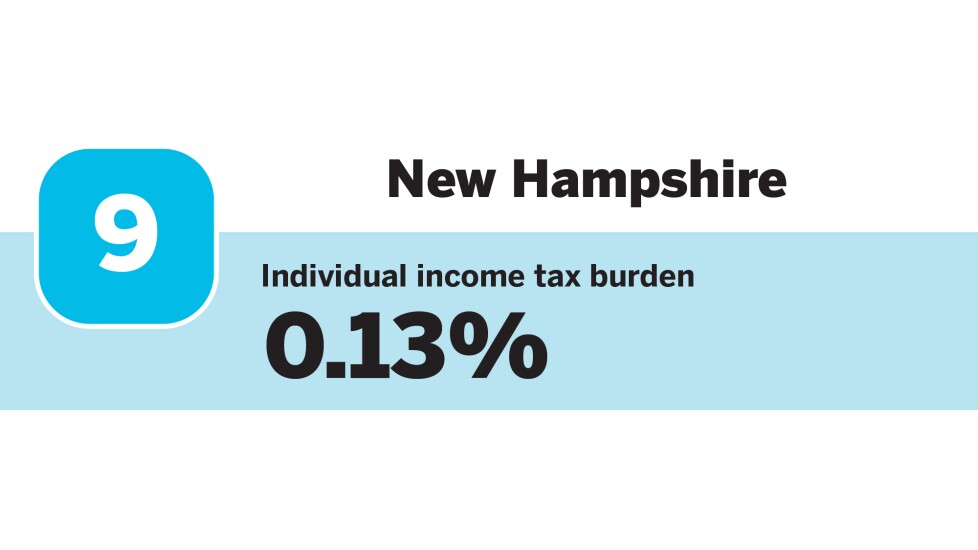

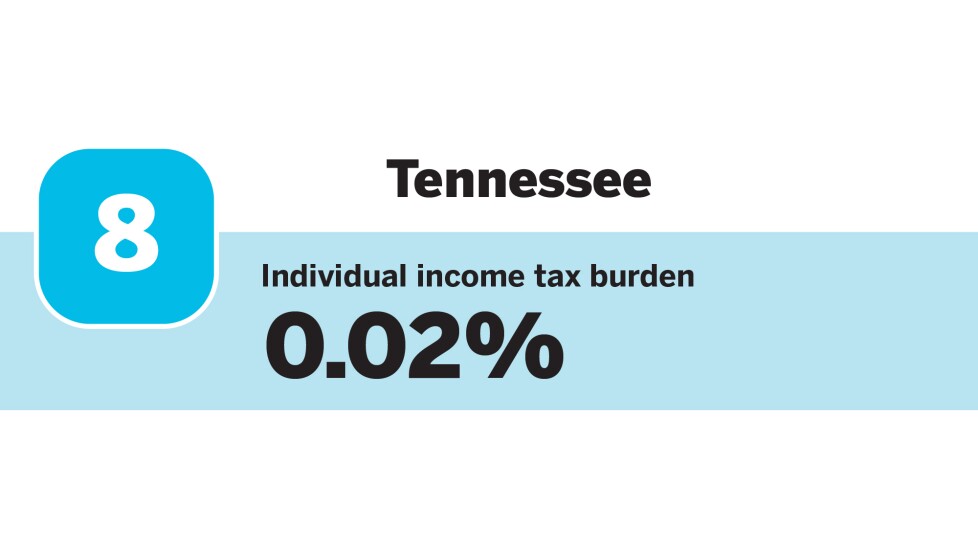

Federal income tax brackets are clearly defined for taxpayers. However, when it comes to your individual income tax burden — the percentage of personal income you have to pay in state and local taxes — the state you live in can give you a clear advantage.

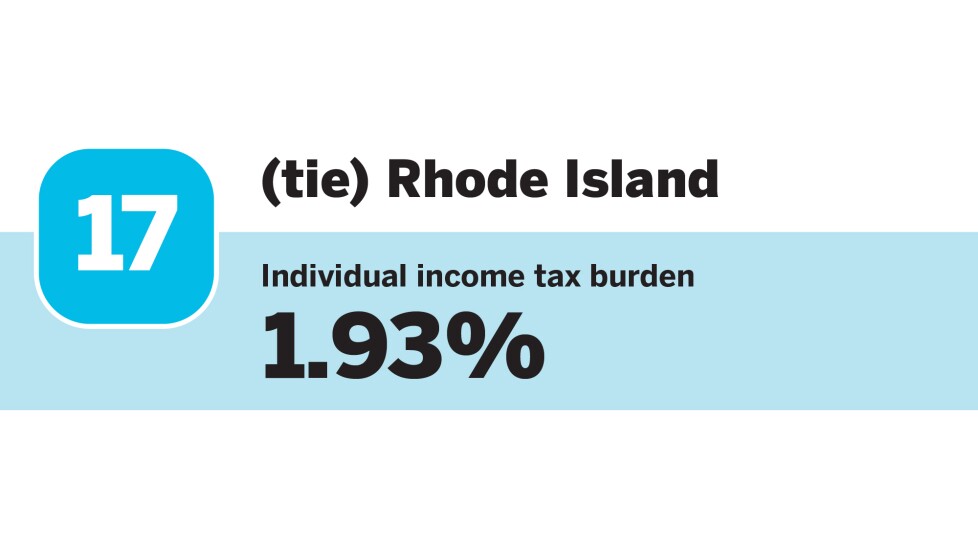

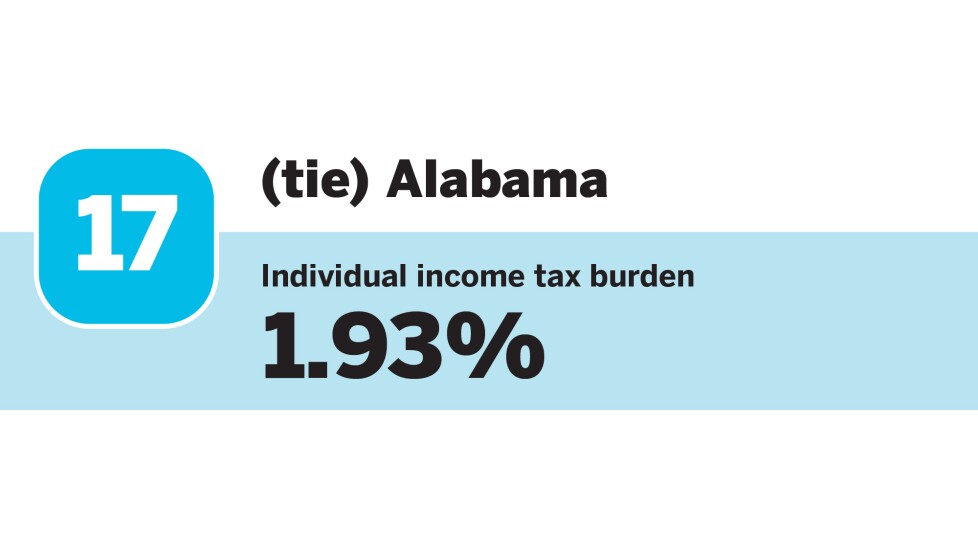

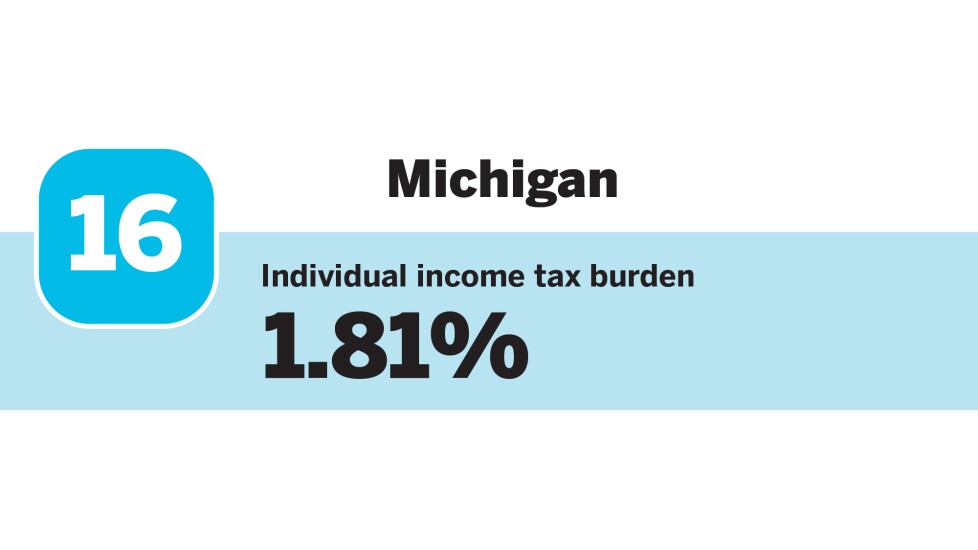

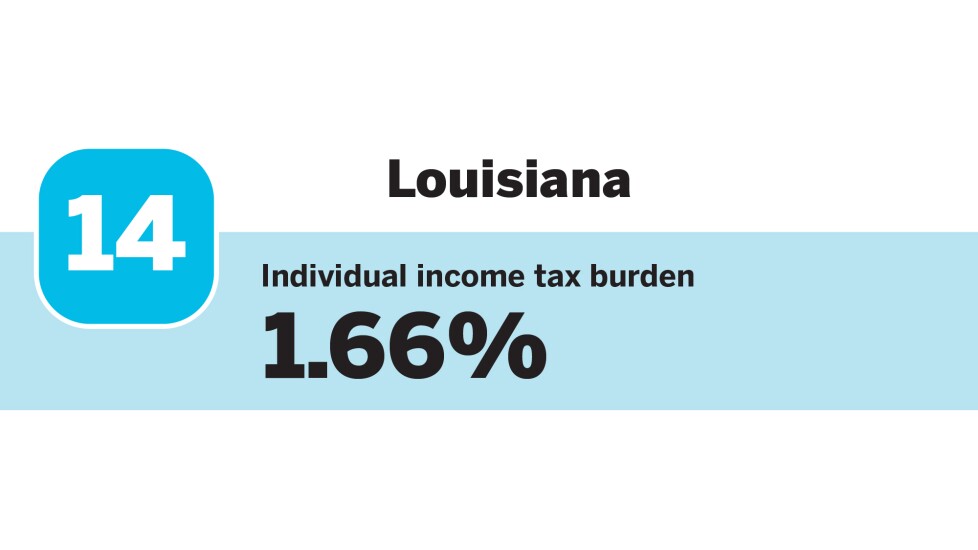

In the ranking below, the seven states that impose the least on residents actually have an individual income tax burden of 0.00%. Scroll through to find out the individual income tax burden in the best 20 states.

Source: