After a horrible 2022, investors have fresh reasons to buy bonds.

"It appears that investors are seeking the safe haven of high-quality bonds in response to the current market volatility and uncertainty," Brett Wander, the chief investment officer of fixed income strategies at Schwab Asset Management, said.

"It wasn't that long ago that interest rates were in the 1%-2% range," he added in an email, but now investors "are thinking about fixed income differently than they have in several years."

Both stock and bond markets plunged last year, an unusual tandem dive as bond shifts usually counter stock moves. The S&P 500 index shed more than 19% in 2022, the biggest loss since 2008. Unusually, bonds also had a horrible run, with Bloomberg's U.S. Aggregate Bond Index, a widely followed benchmark,

New year, new dynamics

"Many investors now view 2022 as an aberration as more normal stock/bond relationships seem to be taking hold this year," Wander said.

The specter of a recession, fueled by the Federal Reserve's interest rate increases and made more likely by the recent collapse of two banks, has sharpened a measure that's often seen as a warning sign of bad economic times.

What's called an inverted yield curve materializes when the yields on short-term bonds outstrip those on longer-term instruments. Typically, longer-term yields are higher than shorter-term ones — the idea is that investors should earn more for risking their money over a longer period of time. So when shorter-term bonds pay more, it's read as a sign that higher interest rates will make it more expensive for companies to borrow and grow, and speed a broad downturn.

The deeper inversion lately

Catching up

Many investors allocated less of their portfolios to bonds in recent years amid low yields — the return an investor can expect to receive from the security's interest payments — and tighter credit spreads — the narrow difference between the interest paid on low-risk bonds vs. riskier instruments. And the bull stock market provided plenty of joy.

But the last half of March saw a flood of cash go into bond exchange-traded funds as retail investors and wealth advisors sought safety.

Andrew McCormick, T. Rowe Price's head of global fixed income and chief investment officer, called the first quarter of 2023 "action-packed" for bonds. He added that "the high inflow into bond funds makes sense in this environment and may accelerate when it becomes clear the Fed is nearing the end of this tightening cycle."

Storming into bond ETFs

Taxable bond ETFs, which trade on exchanges like stocks, took in $43 billion in net new investments during the first three months of 2023, according to data from Morningstar Direct. For comparison, investors last year

Bond ETFs

Interest payments, sometimes called dividends, from bond ETFs are

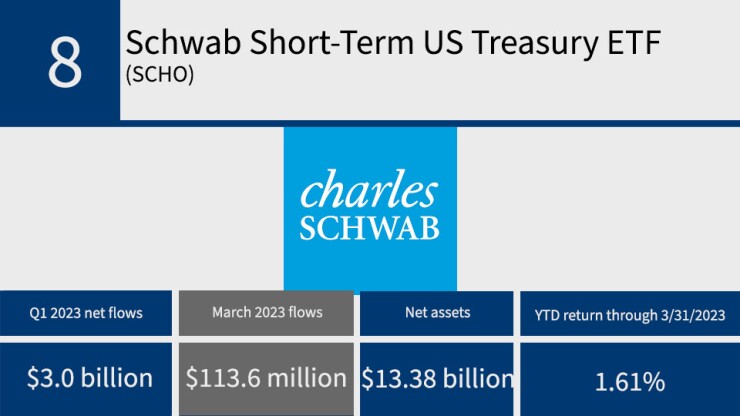

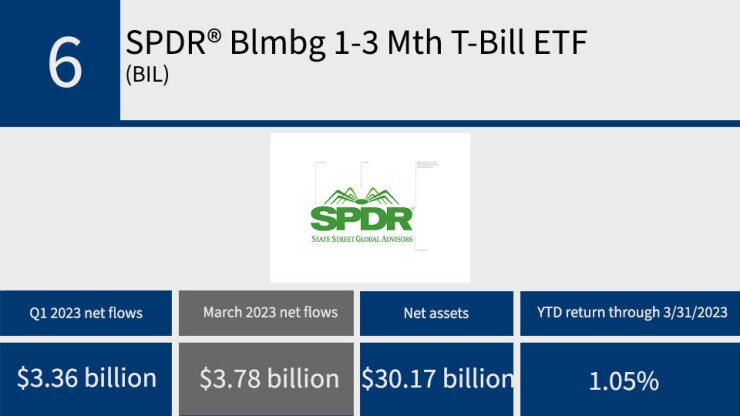

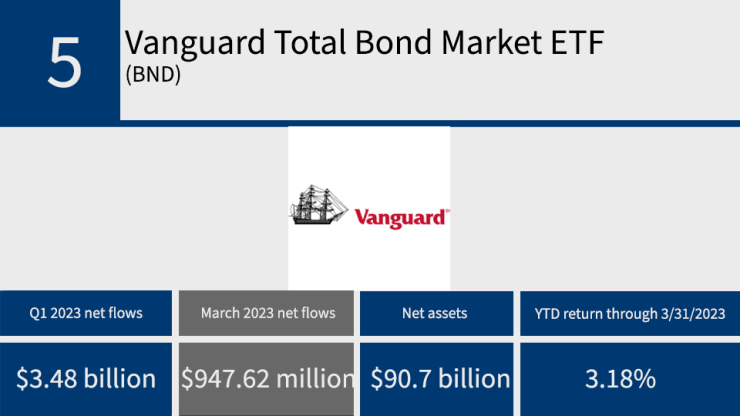

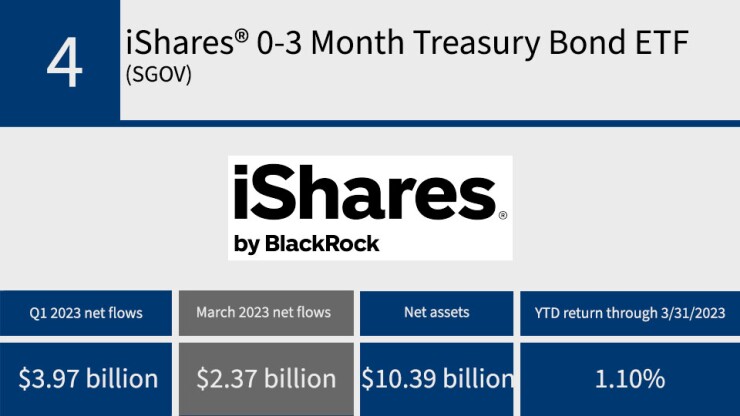

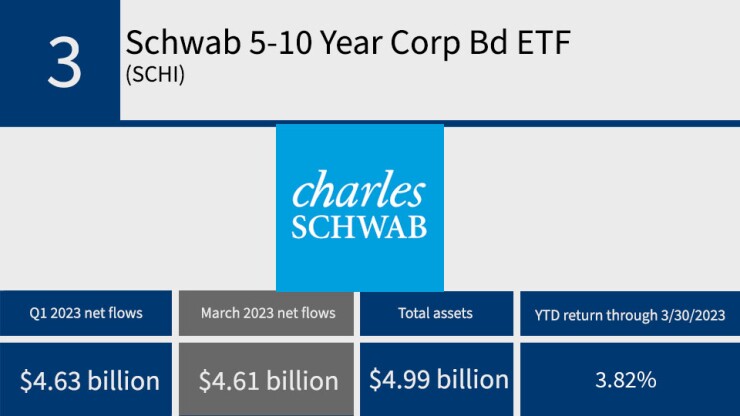

To see the U.S. bond ETFs that garnered the most new dollars, net of withdrawals, in the first three months of 2023, scroll down the slideshow. All data is from Morningstar Direct and includes year-to-date returns and fund sizes. Numbers are rounded. Slides are in ascending order.