Fee-only RIAs may not have tens of thousands of financial advisors at their firms, but they're drawing many away from the giants of wealth management who do have that many.

A continuing flow of independent advisors who leave wirehouses and other brokerages for big registered investment advisory firms are opting for the other channel of the industry in order to find "a degree of autonomy" and "offload a lot of the administrative tasks you don't want to take on as an entrepreneur," according to Andrew Besheer, the director of the wealth management practice at

Advisors who have built up a significant base of clients over their brokerage tenures are "self-starters" who are "highly motivated" in their jobs, Besheer said in an interview. "A lot of them are very, very passionate about what they do. While many of them find comfort within the structure of a large organization and its boundaries and rails, there are others who really want to take it to the next level of independence and entrepreneurship."

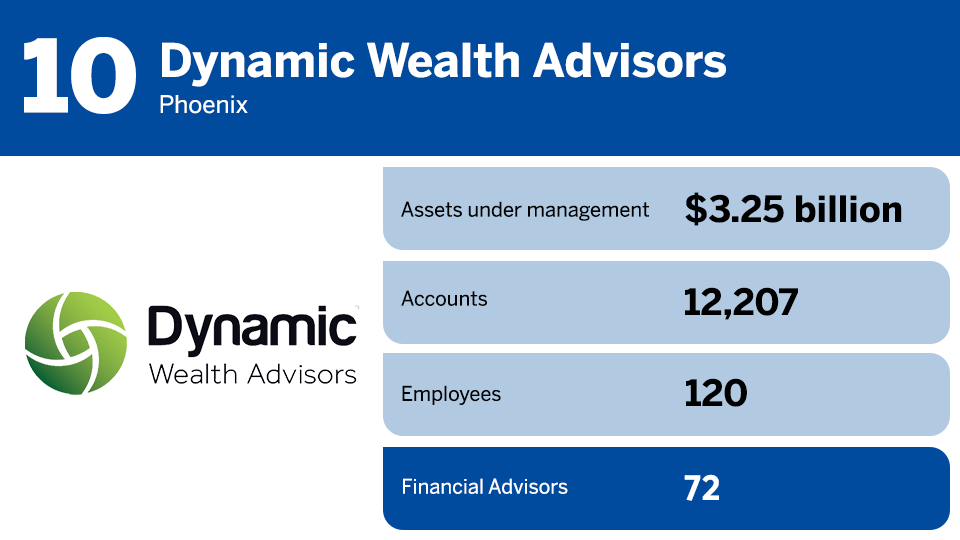

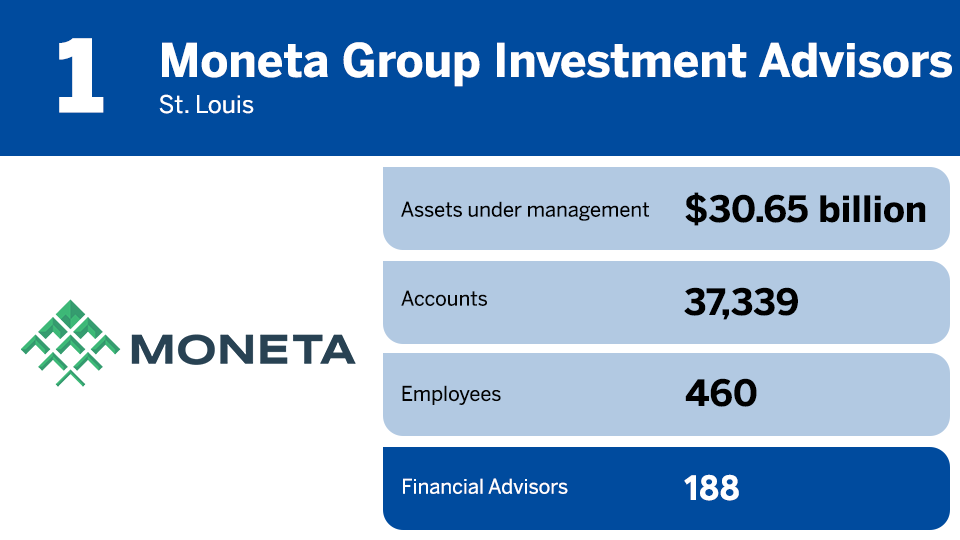

Scroll down the slideshow to see which fee-only RIAs that provide planning services to clients have the most financial advisors. For last year's rankings,

And see other RIA Leaders 2023 coverage:

Schwab and Fidelity referrals give certain RIAs business, deal others out These are the 20 largest fee-only RIAs, ranked by AUM 11 more views on RIA referrals from Schwab, Fidelity, rivals and experts No Fidelity RIA referrals for Goldman PFM after Creative Planning deal

Notes: FP used the

FP's data partner for the RIA Leaders feature,

- Firms must have zero registered representatives of a broker-dealer.

- At least 50% of the firm's clients must be individuals or high net worth individuals.

- Firms must not list commissions as a compensation arrangement.

- Firms must have more than zero financial planning clients.

- Firms must not list commission-taking businesses in "other business activities."

- Firms cannot be affiliated under common ownership with commission-taking businesses.