The onset of a multi-front trade war is at the top of the list of investor concerns and is helping to damage sentiment, advisors say. Clients are asking more questions about how tariffs might impact their investment holdings, and they are nervous about growing uncertainty as rhetoric escalates into concrete trade measures that disrupt business activity.

“Tariffs are starting to get clients’ attention,” one advisor says. There are “more conversations as to how it might affect their accounts.”

Continuing stock price volatility is also weighing on investors, as additional geopolitical worries contribute to the unease generated by trade standoffs, advisors say.

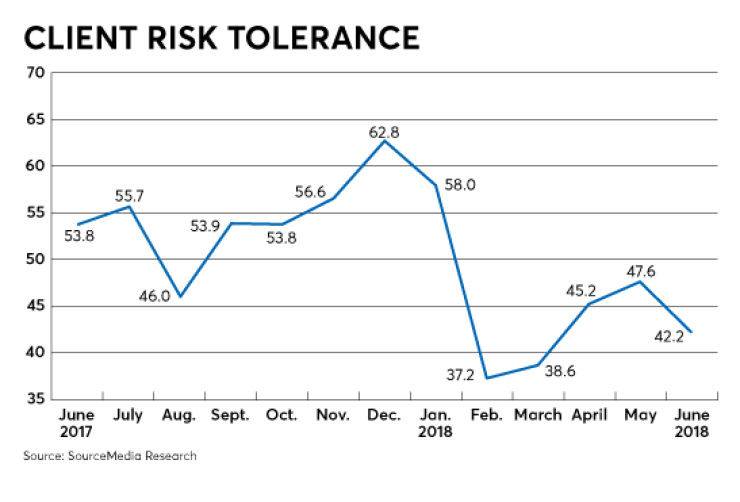

“Clients are becoming more concerned over the volatility in the markets and are not as comfortable taking on risk,” one advisor says.

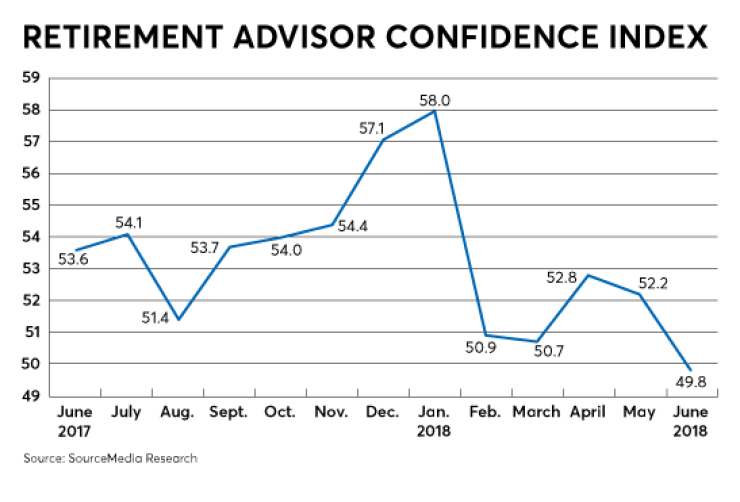

Indeed, clients’ appetite for risk has continued to shrink, according to the latest Retirement Advisor Confidence Index – Financial Planning’s monthly barometer of business conditions for wealth managers. The component tracking risk tolerance slid 5.4 points to 42.2, registering its fifth consecutive month in negative territory. Readings below 50 indicate a decline, while readings above 50 indicate an increase.

The poor reading on risk tolerance helped push the composite into contraction territory, with a decline of 2.4 points to 49.8. That’s the first time since late 2016 that the index has suggested overall business conditions for wealth managers are worsening. In addition to risk tolerance, the composite tracks investment product selection and sales, client tax liability, asset allocation, new retirement plan enrollees and planning fees.

The risk pullback was also apparent in investment flows reported by advisors. The index component tracking the amount of client assets used to buy bonds dipped into negative territory with a decline of 4.3 points to 49.5. The component tracking assets used to buy equities dropped 6.9 points to 52.7.

“Clients are concerned about equity and fixed-income valuation, and geopolitical risk,” one advisor says.

Some advisors say clients are also expressing broader qualms about fundamentals as the economic expansion enters its 10th year, and as the yield curve flattens – possibly signaling increased chances for a recession.

Nevertheless, advisors say strong hiring has helped support retirement plan enrollments and contributions. “New participants in employer plans is higher due to lower unemployment and businesses hiring more workers,” one advisor says.

The RACI component tracking contributions to retirement plans increased 4.6 points to 55.1, and the component tracking the number of retirement products sold increased 3.4 points to 53.4. Those moves helped keep the component for fees for retirement services in positive territory, at 52.7.

The latest RACI, which is based on advisors’ assessment of conditions in June relative to May, is accompanied by the quarterly Retirement Readiness Index. RRI tracks advisors’ evaluations of their clients’ income replacement ability, likely dependence on Social Security and exposure to big economic shifts.

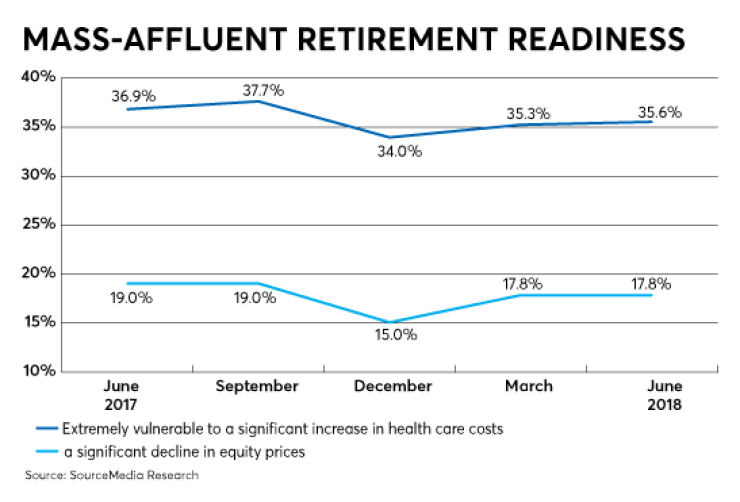

The number of advisors who say mass-affluent clients (net worth of $250,000 to $1 million) would be extremely vulnerable to a significant decline in equity prices was flat, at 17.8%.

Advisors say mass-affluent clients continue to be exposed to rising health care costs, with the number reporting that such clients would be extremely vulnerable to a significant increase edging up to 35.6%.

Many advisors emphasize potential problems posed by the cost of long-term care, particularly for clients who reach unexpectedly old ages.

“Health-related issues such as long-term care can be devastating to one’s retirement planning,” one advisor says. “Many clients don’t like to acknowledge that it could happen to them.”

Many advisors also say factors such as caring for aging parents and adult children can destabilize retirement security, and they are sometimes overlooked.

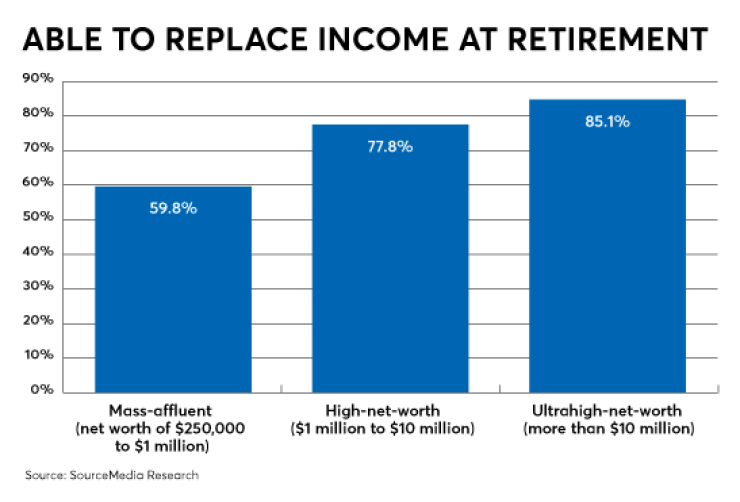

In another assessment of clients’ retirement preparations, advisors say they believe that about 60% of mass-affluent clients will be able to replace their income for 30 years by the time they retire, compared with 78% of high-net-worth clients ($1 million to $10 million) and 85% of ultrahigh-net-worth clients (more than $10 million).