Renewed volatility in stock prices has worried clients, prompting many to recalibrate portfolios and adopt a more defensive posture, advisors say.

Client risk tolerance has deteriorated sharply, according to the latest Retirement Advisor Confidence Index – Financial Planning’s monthly survey of wealth managers. The component tracking risk tolerance plummeted 20.8 points to 37.2, the biggest monthly drop since the index was launched in 2012. Readings above 50 indicate an increase, while readings below 50 indicate a decline.

“Violent” swings in equity markets have “definitely spooked clients,” one advisor says. “A small percentage went to 100% cash, many more to more conservative allocations.”

Advisors report they are frequently reviewing risk positions with clients, with a particular focus on those nearing or in retirement. “We’re having discussions about moving some funds to annuities” to preserve future income, one advisor says.

Some advisors say the volatility has reinforced expectations for a deep correction in stocks and that clients are braced for more pain. The slide in stock prices following the highs set last year “serves as a reminder that the markets can pull back,” one advisor says.

The freefall in the risk component was the biggest factor behind a 7.1-point drop in the composite RACI to 50.9 – also the largest retrenchment in the history of the index. The composite tracks asset allocation; investment product selection and sales; client risk tolerance and tax liability; new retirement plan enrollees and planning fees.

Still, at just above 50, the composite remains in expansion territory. Advisors say they remain confident in the fundamental strength of the economy and that, while they have had to coach some clients not to stray from long-term plans, many have taken higher stock volatility in stride.

“My team and I have been telling our clients that the economy is healthy and the outlook looks good going forward. We also did expect a correction – not recession – sometime this year,” one advisor says. “Our clients still remain confident in the stock market.”

Many advisors say clients are taking advantage of stock price swings to buy the dips – in some cases deploying cash that had been accumulated for just such an opportunity.

“The drop in the markets at the end of January and start of February was jarring for clients,” one advisor says. “While many had concerns, we stayed the course and increased equity exposure during the pullback.”

The RACI component measuring flows into cash fell 8.3 points to 46.8. The component tracking the amount of client assets used to buy equities also fell 10.7 points but remained in expansion territory at 54.

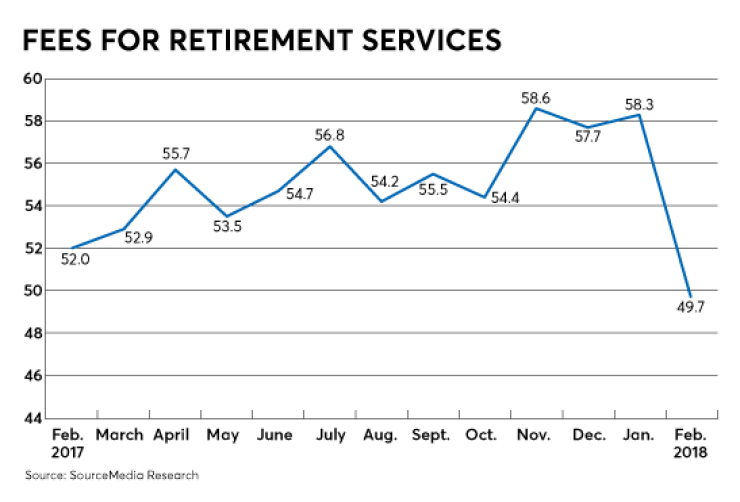

The component tracking fees charged for retirement services dropped 8.7 points to 49.7, the first reading below 50 in more than a year. Advisors say stock price declines have eroded managed assets. Some also note competitive pressures, including from robo advisor platforms, have compressed fees.