Clients are on edge as markets reassess the growth outlook for the economy and a range of risk scenarios.

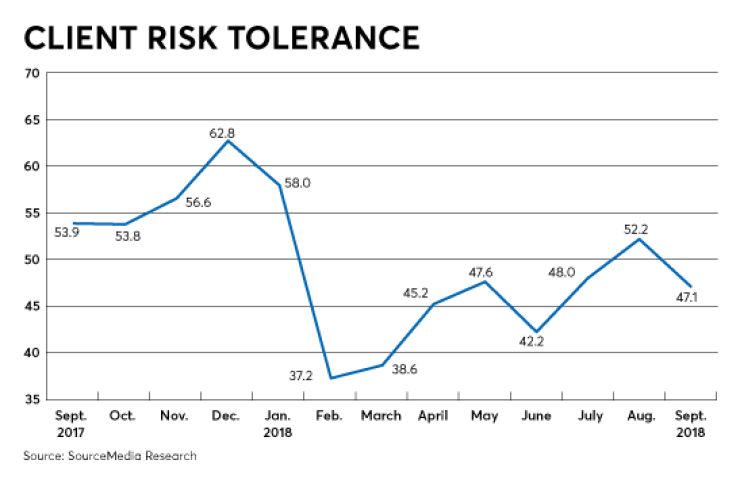

Client risk sentiment deteriorated for the seventh time in eight months, according to the latest Retirement Advisor Confidence Index — Financial Planning’s monthly barometer of business conditions for wealth managers. The component tracking client risk tolerance dropped 5.1 points to 47.1. Readings below 50 indicate a decline and readings above 50 indicate an increase. The latest index is based on advisors’ assessment of conditions in September relative to August.

Advisors say clients are deeply conflicted about securities valuations and fearful the economic expansion could run out of steam. At one end of the spectrum, an advisor says that “clients in general are becoming more fearful of a depression [and] thus have a lower perceived risk tolerance.”

Advisors report retired clients and clients with large near-term cash needs are behaving particularly cautiously, moving into cash and bonds to insulate themselves from stock fluctuations. Meanwhile, “new clients setting up accounts are nervous to get into the market right now,” one advisor says, and are using strategies like dollar cost averaging.

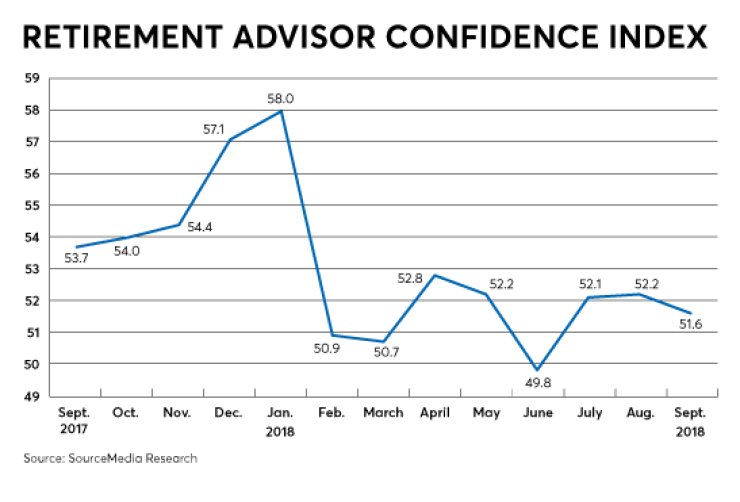

Despite the retreat in risk tolerance, the composite RACI stayed in positive territory at 51.6. In addition to risk tolerance, the composite tracks asset allocation, investment product selection and sales, planning fees, new retirement plan enrollees and client tax liability.

The composite was buoyed by strong performance in the component tracking the number of retirement products sold, which jumped 4 points to 57.1. The component tracking the dollar amount of contributions to retirement plans also gained 2.7 points to 57.7. With sales and contributions up, the component for fees for retirement services also remained in growth territory at 52.3.

Planners note they are working to keep clients from making rash mistakes and instead focus on developing long-term financial plans and showing discipline in sticking to them. “Advisors coach clients to remain consistent and focus on long-term goals rather than market fluctuations,” an advisor says.

Advisors also attribute healthy retirement account contributions to a strong employment environment.

Indeed, despite the client unease evident in the risk tolerance component, flows into equities have been robust with the component tracking allocations to stocks remaining well into expansion territory for the third consecutive month at 58.8.

Allocations to bonds also stayed in expansion territory for the third consecutive month at 51.9, with advisors saying rising yields are drawing client attention. “For first time in many years clients are taking notice of bonds,” an advisor says. “Some have even stated if the five-year gets into the 4% range, they would considering purchasing.”

This RACI is accompanied by the quarterly Retirement Readiness Index. RRI tracks advisors’ evaluations of their clients’ income replacement ability, likely dependence on Social Security and exposure to big economic shifts.

The number of advisors reporting their mass affluent clients (net worth of $250,000 to $1 million) would be extremely vulnerable to a significant increase in housing costs fell to 7.2%.

Health care costs continue to raise concern in planners. While advisors’ assessment of clients’ exposure to the potential for a significant increase in health care costs also improved, almost a third say their clients would be extremely vulnerable.

“Health care is the number one concern that I talk about with my clients,” one advisor says. Many advisors cite the cost of long-term care, the need to provision for it, and the risk of outliving one’s savings.

Advisors are also concerned about intergenerational drains on financial plans. One advisor specializing on millennial clients says it is important to consider the likelihood that baby boomer parents will have to depend on children for medical and living expenses.

Another advisor says, “We see retired and near-retired clients preparing for fluctuations in the cost of health care and market fluctuations, but most are caught off-guard when adult children require significant financial assistance.”

In another assessment of clients’ retirement preparations, advisors say they believe that about 58% of mass affluent clients will be able to replace their income for 30 years by the time they retire, compared with 72% of high-net-worth clients ($1 million to $10 million) and 80% of ultrahigh-net-worth clients (more than $10 million).