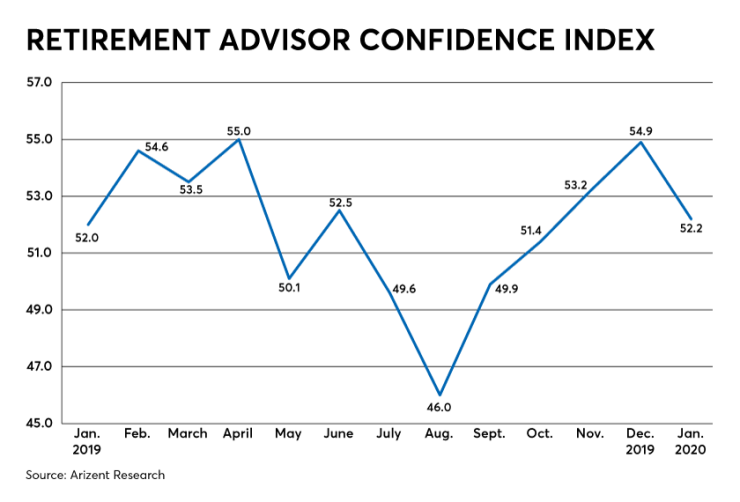

Clients are feeling a bit rattled about their retirement strategies, telling their advisors they are fretting about domestic and global uncertainty and the potential for a stock market decline, according to the latest Retirement Advisor Confidence Index, Financial Planning's monthly barometer of business conditions for wealth managers.

"We're all waiting for a shoe to drop, and have no idea when it will happen," one retirement advisor says.

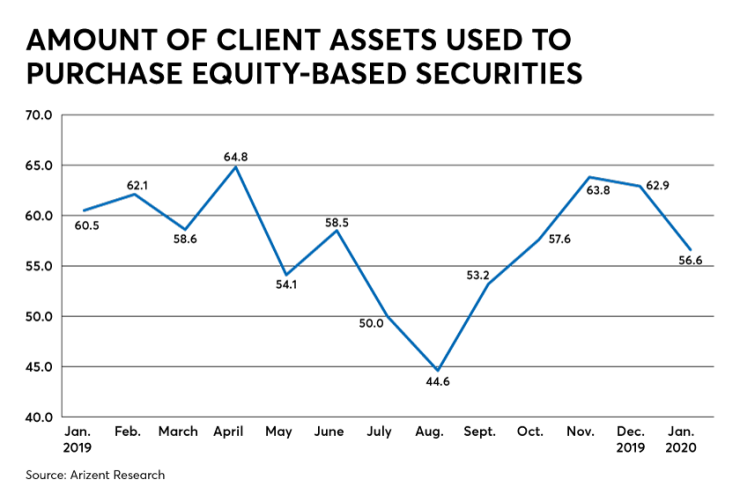

Unease about a potential contraction had clients pulling back slightly from equities in their retirement planning, according to the latest RACI survey. The component of that index that tracks equity-based securities notched a score of 56.6 in the most recent poll, down 6.3 points from the previous month and off 3.9 points from the same period a year ago.

But while this month's equities score came as the lowest mark since September, it's not as if the bottom dropped out of that category: RACI scores higher than 50 indicate an uptick in investor confidence, while scores below that mark signify a decline.

One retirement advisor describes "a general feeling that equities were a little expensive."

Another advisor sees clients' attitudes as having a sort of cautious continuity: "Clients' retirement savings did not change, although we found many of them wanted to keep new funds on the sidelines until the market settled a bit."

"Momentum in the markets from 2019 caused clients to want to lower risk appetite in 2020," another advisor says.

Additionally, many advisors indicated that clients are anxious about the fallout from Brexit and the coronavirus. Of course, it's also a political year, which can bring its own unique strain of uncertainty.

"Clients are worried about the outcome of the election and how far the stock market has climbed," one advisor says.

That sense of caution was evident in investors' risk tolerance, which dipped 9.7 points from last month to 47, the lowest mark since October. That was still 3.8 points above last year's score, when investors were still rattled from a sharp but short-lived market downturn.

Overall, clients' confidence in their retirement picture checked in at 52.2 — precisely the median for the past 13 months and just 0.3 points above the average for the same period. That middle-of-the-road figure was off 2.7 points from the previous month, and up just 0.2 from the same period a year ago.

But clients are split. As one advisor explained, "some clients are bullish and heavy in stock positions, while others are becoming more conservative in anticipation of the next recession."

In all, retirement contributions were off slightly, but still strong. The RACI component that measures total dollars put into the retirement system posted a score of 63.2, off 4.2 points from the previous month, making it the second-highest score since April.

Some advisors explain that they are taking a bifurcated approach to the market, calibrating risk and equity allocations to clients' time horizons for their retirement.

"[For] those that are approaching retirement, we are pulling down risk," the advisor says. "[For] those that are more than 10 years away, we are encouraging more aggressive portfolios."