If February was a nadir for retirement confidence — and

"Clients are feeling a little better about the market in March," one retirement advisor said.

Better, perhaps, but hardly exuberant.

Overall, the composite RACI score ticked up to 50.3 last month, up more than three points from February, but off 4.7 points from March 2021.

RACI scores above 50 indicate an increase in client confidence about retirement, while scores below that mark signify a decline.

So March saw the index creep back into positive territory, but advisors indicated that clients continue to feel anxious about their plans for retirement owing to an array of concerns about the markets and global instability.

"Geopolitical events, inflation and the Fed have consumers on edge at the moment," said one advisor.

In many ways, the story of March was one of a modest bounce back in retirement confidence. Advisors polled in February reported some of the lowest levels of retirement confidence among their clients in months. That survey came amid the onset of the war in Ukraine, which, while far from resolved, appears not to be weighing as heavily on client confidence, or perhaps the shock of the conflict and the ripple effects have already been priced into the stock market.

In March, the RACI component that tracks retirement investments in equities rebounded six points to post a score of 54.5, the highest mark since December 2021, which capped a full year of equity scores above the 50 threshold.

"Some clients were nervous based on volatile stock markets and inflation but continued to invest," one advisor said.

Several advisors offered similar versions of that sentiment — that at least some clients seemed to be shrugging off some of the macro concerns that weighed more heavily earlier in the year. For some clients, the choice comes down to whether the greater worry is in the volatility of the markets or missing out on the opportunity that those downturns can create.

"Clients are fearful of the war in Ukraine, inflation and Fed raising rates. The greatest fear, however, is missing out of a stock rally," one advisor said.

Overall, though, any optimism was cautious, and clients remain wary of the market fluctuations they've been seeing and what may lie ahead.

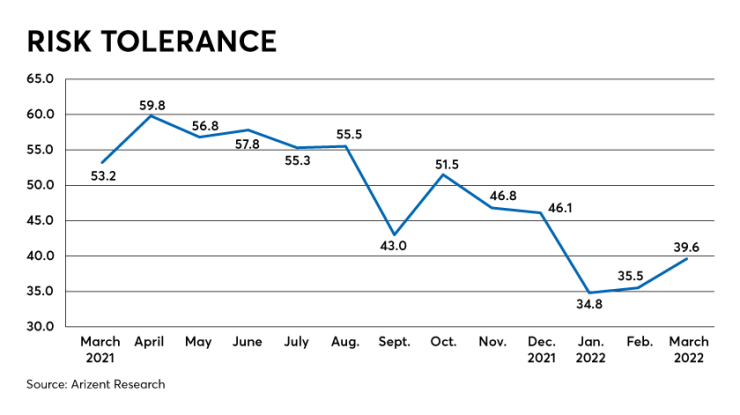

The RACI component that tracks clients' risk tolerance was up from February, but checked in at an anemic 39.6, off 13.6 points from the same period last year. Excluding the first two months of 2022, March's risk tolerance score was the lowest in the category since October 2020.

Still, a handful of measures of retirement saving through a workplace plan had strong showings in March, including the tally of new participants enrolling in an employer-sponsored plan, which posted the biggest monthly gain across RACI, jumping seven points in March to check in at 54.5.

"In spite of everything, including volatility in the market," one advisor said, "my clients and their employees seem more optimistic and ready to take advantage of some of the dips in the market, and the seeming momentum of the economy."