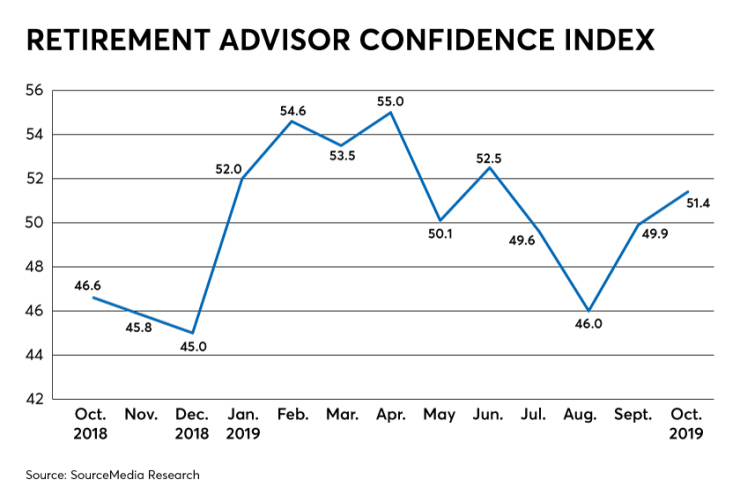

Investors have become slightly more confident in their plans for retirement despite lingering concerns about the global economy. Clients are looking more favorably at equities and target-date funds, according to the latest Retirement Advisor Confidence Index -- Financial Planning's monthly barometer of business conditions for wealth managers.

One retirement advisor described clients as "cautiously optimistic" about their retirement picture.

Another stressed the importance of talking clients through the short-term fallout of headline-grabbing events like elections or tariff wars and keeping them focused on a sound, long-term plan.

"Although people are fearful of the trade wars, we have prepared our clients for the long term so they do not worry so much about the short-term volatility," the advisor said.

The component of the index measuring confidence in equity-based securities jumped 4.4 points to 57.6 in the most recent month, up 12.8 points from the year-ago period.

RACI scores above 50 denote an increase in investor confidence, while scores below that mark signify a decline.

Investor confidence in equities has been zigzagging throughout the middle part of the year up one month and down the next, mirroring overall confidence in the retirement picture as measured by the RACI composite. Still, the most recent equities score of 57.6 was the highest mark since April.

"As the volatility dropped this month, clients' portfolios shifted some from cash to equities," one advisor says.

Overall, the RACI composite for the most recent month posted a modest increase to 51.4, up 1.5 points from the previous month and up 4.8 points from the same period last year. But the most recent measure was the first time overall confidence had been above the 50-point mark since June.

One advisor describes "a bit of optimism coming back to the markets causing greater inflows into equity investments."

And it wasn't just equities that saw a boost. Investors also showed a renewed confidence in target-date funds. The component of RACI measuring confidence in the asset class posted an even score of 50 in the most recent period, rebounding 3.2 points from the previous month and up 8.2 points from the same period last year.

Notably, the current month was only the second time all year that target-date funds posted a score of 50 (April's score was 50 as well), and the last time that class had seen a score higher than 50 was January 2018.

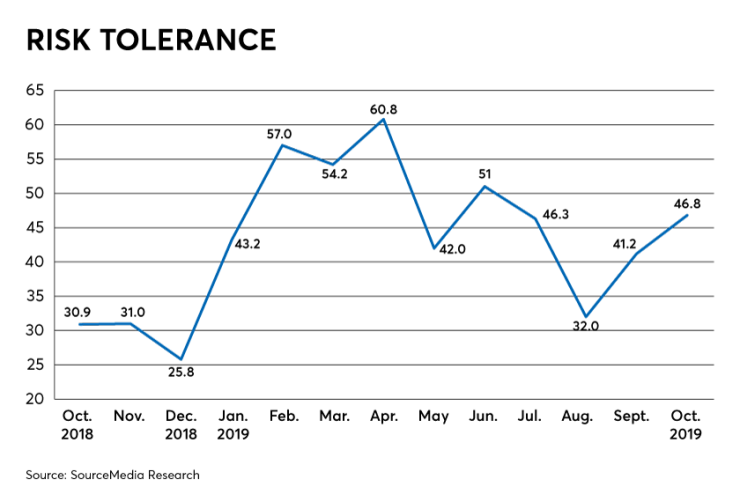

Overall, investors demonstrated a mild increase in their appetite for risk. The component of RACI that measures risk tolerance checked in at 46.8, up 5.6 points from the previous month for the second consecutive month-to-month increase.

Still, advisors cite a number of factors that have weighed on investors' risk tolerance, including a potentially messy Brexit, trade wars and domestic political turmoil. Risk tolerance hasn't posted a RACI score above 50 since June.

Some advisors take a sanguine approach to those uncertainties, and actually see an upside.

"Some clients are jittery," one advisor says. "In the grand scheme of things, that's probably a good thing. I worry when everything looks rosy and clients want to be more aggressive."