Confidence among retirement investors jumped in August, continuing its rebound from a historic low in June.

According to the latest data from Arizent's Retirement Advisor Confidence Index (RACI), the investors' composite score — an aggregate of different figures measuring economic confidence — rose to 53.1 in August, up from 46.8 in July.

Composite scores above 50 indicate increasing confidence, while scores below that reflect a decline. That means that last month, retirement confidence actually switched directions — from sinking to rising. It also marks a dramatic recovery from June, when the score plummeted to 43.7 — nearly the lowest ever recorded.

"Clients are starting to move cash and bond accounts into securities," one advisor told RACI's survey. "Most believe we have seen the worst of the downturn and are positioning for the recovery, slowly getting back in."

Other indicators showed improvement as well. Investors' risk tolerance continued to climb, leaping to 51.8 in August. That's up from 38.6 in July, which was already a steep increase from June's score of 25.6 — the lowest point in RACI's 11-year history.

In the survey, no single factor stood out as the main driver of this change, but advisors pointed to a few encouraging signs for the economy. Some mentioned gas prices, which

"Clients were interested in moving cash back into the markets," one advisor said.

However, even those respondents who found reasons for hope tempered it with persistent concerns about inflation, market fluctuations and monetary tightening.

"July was positive, which brought optimism," one said, "but August was packed with volatility."

"The economy still has issues with inflation and uncertainty with the Fed raising interest rates," another said — but then added, "gas prices have decreased."

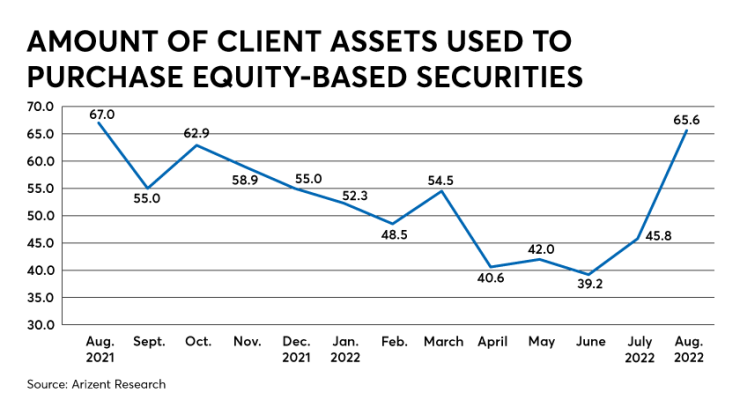

Even amid these anxieties, investors showed strong signs of growing confidence — or at least decreasing pessimism. Purchases of equity-based securities rose almost 20 points, from a score of 45.8 in July to 65.6 in August.

Overall contributions to retirement plans rose as well, from 53.2 to 60.3. And the total number of retirement products sold to clients saw a significant jump, from 48.8 to 60.8.

Nevertheless, advisors made it clear their clients aren't feeling sanguine about the economy.

"While we bought more stocks for clients in August, many clients were still concerned about the overall market volatility," one advisor said.

"Clients are very nervous," said another. "The economy, inflation, worries of recession/depression are everywhere. Clients are very cautious to do any new investing."

As for those investors creeping back into the stock market, at least one advisor expressed frustration over their timing.

"Clients always want to invest less when the markets are down, and more after the markets have already gone up," the advisor said.