During the run-up to the U.S. midterm elections last month, retirement investors held their breath and made no sudden moves.

That's the picture painted by Arizent's latest Retirement Advisor Confidence Index (RACI), which shows that clients' confidence and investment activity stayed roughly the same from September to October.

The RACI composite score, a combination of several figures measuring economic optimism, dipped only slightly, from 48 in September to 47.7 in October. (Composite scores above 50 indicate rising confidence, while scores below 50 indicate a decline.)

Advisors blamed a number of factors for this stagnant confidence, including inflation and market volatility. But many also pointed to the midterm elections, saying that clients felt unsure of the economy's future as long as control of Congress remained undecided.

"The economy is still struggling and people are still uncertain about elections and their futures," one advisor told RACI's survey.

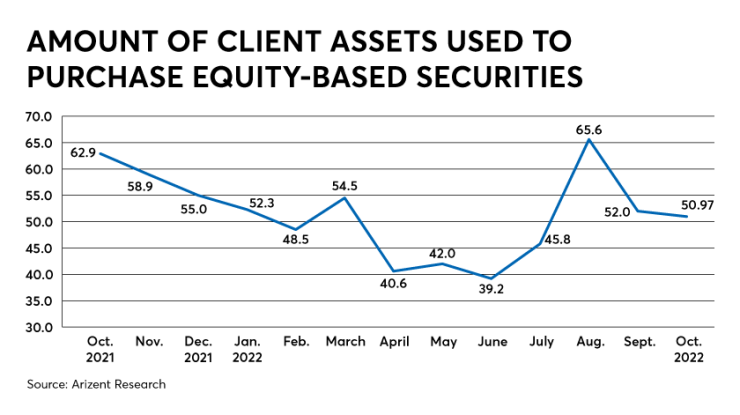

Clients' investments in stocks decreased modestly as well. From September to October, the amount of assets used to purchase equities dropped from 52 to 50.97.

Total contributions to retirement plans followed roughly the same pattern, sliding from 59.1 in September to 55.48 in October.

"Clients are still not quite ready to allocate new money into these markets," one advisor said. "[They] would rather sit on the sidelines, even if it means missing out on big gains."

Risk tolerance, on the other hand, rose slightly, from 38.2 in September to 42.6 in October. However, this may have been a correction to the unusually steep drop from August to September, when confidence plunged from 51.8 to 38.2.

Though there was some good news about the economy in October, advisors said it made little impact on their clients. On October 27, the Commerce Department revealed that U.S. gross domestic product rose by 0.6% in the year's third quarter. This marked a return to growth after two consecutive quarters of contraction, which had sparked widespread fears of a recession.

But to retirement investors, it made little difference. Forty percent of advisors said their clients were unaffected by the GDP news. And among those who were affected, their reactions were split — 25% said clients' fears of a recession decreased, while 29% said clients' fears actually increased.

"Clients are very sensitive to the market environment as they fear a recession in the coming months," one advisor said.

On Tuesday, tens of millions of Americans headed to the polls to choose 35 senators, 435 U.S. representatives and dozens of governors and other state officials. Hinging on those contests is control of Congress, which will either facilitate President Biden's economic policies or bring them to a screeching halt.

With so much at stake for the economy, advisors said, many clients chose to spend October waiting and watching.

"The volatility … is making clients hesitant until the election is completed, I believe," one advisor said.

"Election concerns," another wrote simply. "High level of fear."