Clients' confidence in their retirement outlook is surging: Key metrics such as risk tolerance and overall retirement contributions are posting double-digit increases, according to the latest Retirement Advisor Confidence Index — Financial Planning's monthly barometer of business conditions for wealth managers.

"With the continued momentum in the markets, clients were wanting to take on more risk," a financial planner says, referring to 2020’s strong start.

Of all the RACI components, risk tolerance was the biggest year-over-year mover, soaring 30.7 points over the same period in 2018. In the most recent survey, advisors reported a risk tolerance score of 56.5, up 2.9 points from the previous month, and the highest mark since April.

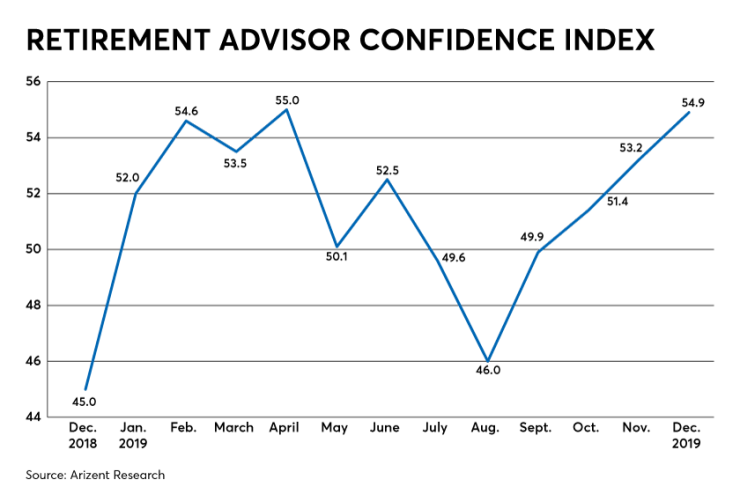

RACI scores above 50 indicate an increase in investor confidence, while scores below that mark denote a decline.

Some advisors worry that clients are getting too comfortable with riskier investments, and are counseling a more cautious approach in planning for retirement.

"With the market at all-time highs, we have to help our clients modify their mindset because they want to be more risky," one advisor says.

Another advisor reports that "clients are becoming too relaxed with the market performance."

Overall, contributions to retirement plans surged to 67.4, the highest score since December 2017. That’s a more than 13-point jump from the same period a year ago, and a month-to-month increase of seven points.

Advisors acknowledge that the calendar was a factor in driving up contributions, along with the sustained bull market.

"Everyone [was] trying to stuff money into their accounts (retirement and non-retirement) before the end of the year to meet their personal savings goals," one advisor says, adding that the record high stock market had encouraged clients to want to invest more, as well.

The composite RACI score for the most recent month was 54.9, just a tenth of a point off the high for the year posted in April. That meant that the most recent RACI composite score, up nearly 10 points from the same period last year, was the second highest reported since January 2018.

Among asset classes, equities posted the strongest yearly gains. That component of the RACI survey saw a score of 62.9 in the most recent period, off less than a point from the previous month. But it was more than 22 points ahead of last year.

One advisor reports "allocating more to equities due to rate conditions and generally positive longer-term outlook."

Still, amid the strong investor confidence and increased appetite for risk, some advisors are wondering when the wave will crest. One financial planner suggests that clients might be too exuberant about the potential for continued stock increases.

"As bonds have matured, more clients are looking at higher dividend-paying stocks in solid businesses to replace fixed income," the advisor says. "At times like this you know you have to be close to the peak because stocks are being viewed as having less long-term risk than a 2% bond, which we know is not the case."