The

Dozens of retirement advisors polled by Financial Planning report rising client anxiety resulting in altered investment decisions and other disruptions in retirement planning stemming from the response to the worldwide outbreak.

"The coronavirus has changed everything, at least temporarily," one retirement advisor says.

"As the economy started taking a hit, people stopped or slowed down their investing," another advisor says.

By the numbers: the composite index in the most recent month checked in at 42.5, the lowest mark in the history of the RACI survey, which began in May 2012. That score was down 3.6 points from the

RACI scores above 50 denote an increase in confidence, and scores below that number mark a decline.

Jobs are being cut and pay lowered — [it’s a] tough time to enroll new participants

Nearly every metric showed a deep slump in investor confidence.

The RACI component that tracks equity investments posted a record low of 35.3 in the most recent period, down 9.7 points from the previous month and 23.3 points from the year-earlier period.

"These changes are due to dramatic disturbances in the market and because of coronavirus, and clients are very nervous," one advisor says.

The component of RACI that tracks enrollments in employer-sponsored plans, which nearly always posts a score above 50, sagged to an all-time low at 42.2. That marked a 10-point month-over-month decline and the first score below 50 since November 2018.

"Jobs are being cut and pay lowered — [it’s a] tough time to enroll new participants," one advisor says.

Many advisors report facing clients who are skittish about the general volatility and are fighting the attendant impulse to pull money from the markets, either out of panic or worries about having cash to meet their immediate expenses.

"The market is volatile until this pandemic is over," one advisor says. "People have many worries and investing has slowed dramatically."

Another advisor adds that clients' responses to the pandemic and the economic turmoil shows "just how crazy the world is right now. It has sent clients into panic and are doing things they normally wouldn't do."

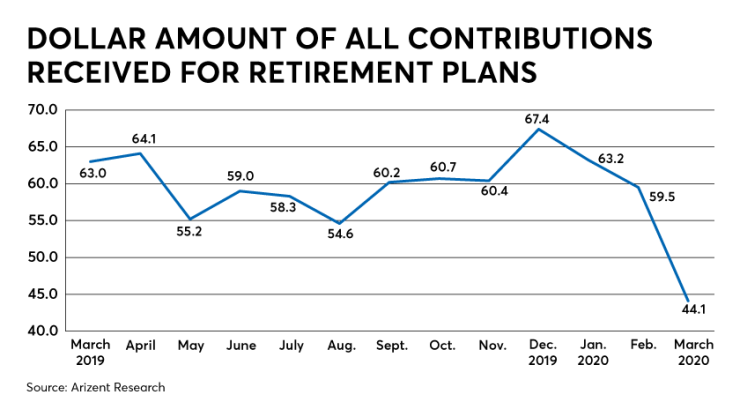

Those worries have translated into another record low in the RACI survey. The component of the index that measures overall contributions to retirement plans checked in at 44.1 — the first time that metric has posted a score below 50. The current mark represented a drop of 15.4 points from the previous month, and was off 18.9 points from last year.

In response, advisors find themselves counseling clients to hold onto their positions if they are able, and some are counseling that the fallout from the pandemic is creating buying opportunities.

"Many clients wanted to pull out of the market and we had to convince them to wait this out, the market will eventually recover," one advisor says. "Now is not the time to panic sell. It is a great time to buy, though."