As the new year began and inflation cooled, retirement investors began to show some cautious optimism about the economy.

In January 2023, retirement confidence jumped to its highest point in five months, according to new data from Arizent's Retirement Advisor Confidence Index (RACI). The surge came amid improving news about inflation, which

"I think they are starting to feel inflation come down," one financial advisor told RACI's survey. "And they don't seem to be as concerned about a recession."

From December to January, RACI's composite score — an aggregate of various confidence indicators — rose from 48.7 to 52.9. Scores above 50 indicate rising confidence, while those below 50 reflect a decline.

That means the trend in retirement confidence switched directions in January — something that happened often in the volatile final months of 2022. The composite score sank from 53.1 to 48 in September, then spiked from 47.7 to 50.9 in November and dropped again from 50.9 to 48.7 in December.

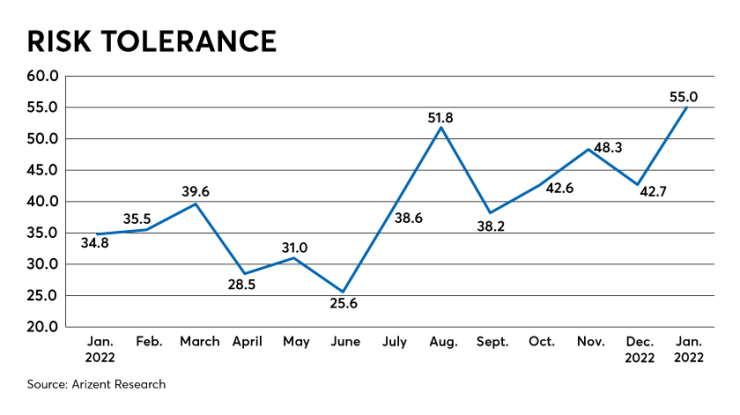

Last month, confidence shot up once again, driven largely by an increase in risk tolerance. From December to January, retirement savers' appetites for taking chances jumped from 42.7 to 55 — the highest level in a year. Several advisors noted this change in their clients, but emphasized that they're still being careful.

"They are feeling better, but they do want to inch in slowly," one wealth manager said.

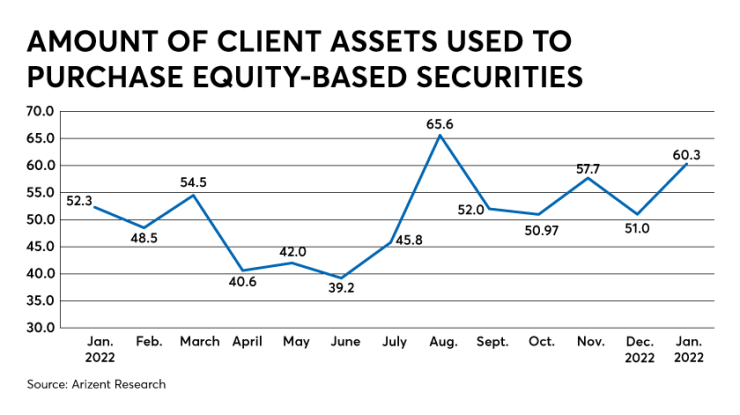

In another sign of growing optimism, investment in stocks increased as well. From December to January, the amount of client assets used to purchase equities rose from a score of 51 to 60.3.

"More folks are expecting a stock rally in 2023," another advisor said.

In general, clients put more money in their retirement accounts than they had in the previous two months. Total contributions ticked up slightly, from 57.9 in December to 59 in January.

Advisors credited a number of factors for the improving mood, especially the recent signs that inflation, which can eat away at retirement savings, appears to be easing. In December, the year-on-year change in the consumer price index dropped to 6.5% — its

"With inflation slowing, more people are investing and hopeful for the stock and bond markets," one planner said.

Others, however, said that even if inflation has decreased on paper, their clients haven't noticed it at the gas pump or the grocery store.

"They are feeling inflation more as they have gone months without vacations and [are] having to cut back as everything is more expensive," one advisor said.

As for inflation's remedy, several advisors said their clients were reassured by the Federal Reserve's recent, more moderate interest rate hikes. On Dec. 14, the Fed raised its benchmark rate by

"Smaller Fed rate adjustments are a positive sign for the economy," one wealth manager said.

Others pointed to a wide range of anxieties tempering their clients' confidence, including the war in Ukraine, the ongoing COVID-19 pandemic and a potential crisis in Congress over

"People believe that the worst is behind us," an advisor said, "but there is a long way to go before we're back to normal."