Escalating trade tensions, chaos in the White House and seesawing stock markets are deeply unsettling investors, advisors say.

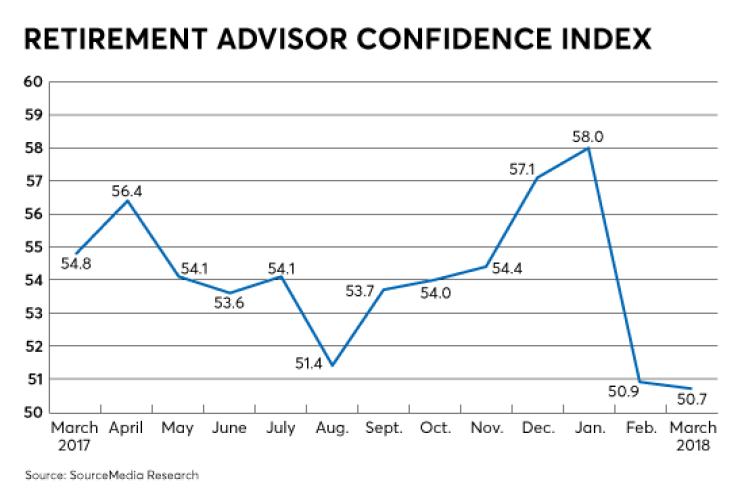

Clients’ appetite for risk has deteriorated further, according to the latest Retirement Advisor Confidence Index – Financial Planning’s monthly barometer of business conditions for wealth managers.

At 38.6, the component tracking risk tolerance registered one of its lowest readings since the index was launched in 2012, and remained deep in contraction territory, extending a retrenchment that began in February. Readings above 50 indicate an increase, while readings below 50 indicate a decline.

Many advisors say clients have grown increasingly sensitive to ongoing volatility in equity prices. They also say clients are particularly unnerved by President Trump’s tariffs and the White House’s threats to take even more aggressive actions in that realm.

“Trade has been the single most important indicator of both portfolio and client concerns,” one advisor says.

Fears about the impact of a trade war are accompanied by broader concerns about President Trump’s impulsive approach to governing, according to some advisors, one of whom describes it as a “chaos management style.”

“The president is unstable, and causing further instability,” another advisor says.

Weighed down by the risk component, the composite RACI barely kept above water at 50.7, a drop of 0.2 points. The composite tracks asset allocation, investment product selection and sales, client risk tolerance and tax liability, new retirement plan enrollees and planning fees.

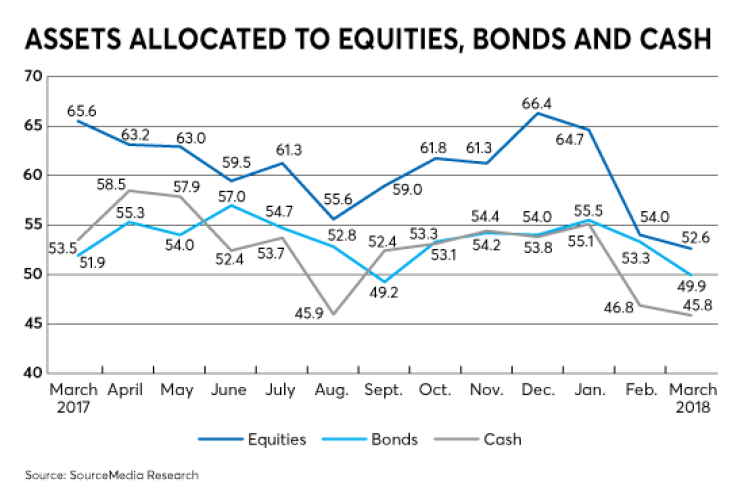

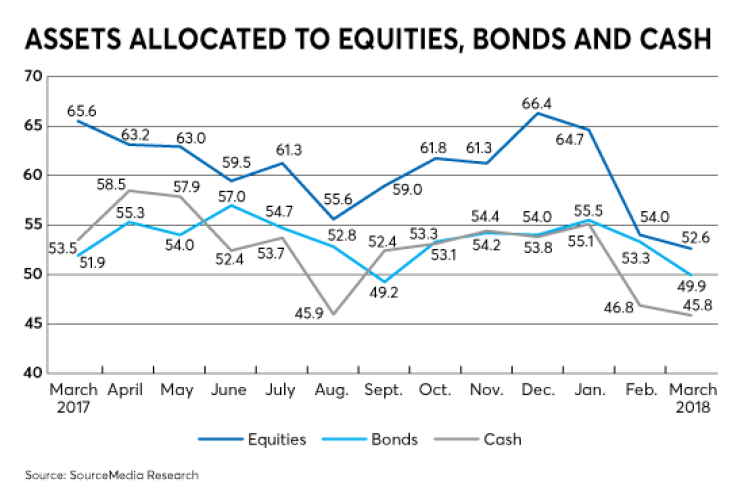

Some advisors say rattled investors are reallocating to cash and fixed-income investments. One advisor highlights the impact on retirement planning, saying clients are “rolling over 401(k) plans to annuities or traditional IRAs with bonds because of the market volatility.”

Many adjustments are taking place within stock portfolios, as clients seek to harvest losses for tax purposes and build positions in more conservative equities.

“While clients expressed concerns about the national and international political scenes, they increased exposure to equities in defensive sectors including food and healthcare,” one advisor says.

Other advisers say many clients are taking renewed stock market volatility in stride, however, by buying on the dips, eschewing macro wagers and sticking to long-term strategies. “We are not a tactical shop, so when stocks go down, we will rebalance into them,” one advisor says.

Overall, the RACI component tracking the amount of client assets used to buy equities fell 1.4 points to 52.6, and the component measuring flows into cash slipped 1 point to 45.8. The component measuring allocations to bonds dipped 3.4 points to 49.9.

Notwithstanding market and policy turmoil, advisors say flows into equities have been sustained in part by clients’ abiding focus on saving for retirement. “Elective deferrals from paychecks into 401(k) plans remained unchanged,” one advisor says.

In fact, the RACI component tracking the dollar amount of contributions to retirement plans jumped 5.2 points to 62.7 as clients boosted tax-protected accounts prior to April deadlines.

“Increased volatility in equity markets made investors less willing to buy equities and more likely to buy fixed income,” says one advisor. “However, with March being tax season, there was an increase in contributions.”

The latest RACI, which is based on advisors’ assessment of conditions in March relative to February, is accompanied by the quarterly Retirement Readiness Index. RRI tracks advisors’ evaluations of their clients’ income replacement ability, likely dependence on Social Security and exposure to big economic shifts.

The number of advisors who say mass-affluent clients would be extremely vulnerable to a significant decline in equity prices improved slightly to about 18%.

Roughly 35% of advisors say a significant increase in health care costs would be extremely damaging to mass-affluent clients’ retirement security, also a small improvement.

In another assessment of clients’ retirement preparations, advisors say they believe that about 62% of mass-affluent clients will be able to replace their income for 30 years by the time they retire, compared with 77% of high-net-worth clients and 80% of ultrahigh-net-worth clients.