Despite the plethora of resources available to clients, advisors say they are still worried about their clients’ grasp of a number of key financial areas, including financial literacy, savings, retirement and insurance.

Almost one-third of clients are not financially literate, meaning they do not have sufficient knowledge and skills to make informed decisions about their monetary lives, according to advisors surveyed by Financial Planning’s most-recent Financial Wellness Report.

“Financial literacy is a major issue,” one advisor said. “If a client doesn’t understand the basics of finance and investment strategies, it makes giving advice to them meaningless.”

This difficulty has far-reaching ramifications. For one, financial stress — often caused by poor planning and misunderstanding — can lead to higher health care costs, according to SourceMedia research. The impact can also trickle down to the next generation: Three-quarters of clients had either minimal or adequate savings for their children’s college expenses, according to about 300 advisors surveyed by Financial Planning in September and October.

‘SOMETIMES WORSE’

Sensitivity is critical when it comes to working with clients who are less confident about financial concepts. “The best thing I’ve learned is not to make them feel inferior or afraid of money and investments,” one advisor said.

Showing clients “a visual representation” of financial concepts was helpful, one advisor noted, while another suggested clients with less financial knowledge bring in a family member to help them grasp new concepts.

At least one advisor who works with less-experienced clients found it affected their investment recommendations. “If a clients’ literacy level is lower, I will encourage them to save more,” a respondent explained. “And I might recommend [investment] strategies that are more- or less-risky depending on their literacy level.”

While wealth managers generally agreed it’s easier to work with financially literate clients, others pointed out that sophisticated clients can be troublesome, too. “Sometimes it’s worse if they’re financially literate,” one advisor said. “They’re good people, but sometimes they think they know everything.”

Another wealth manager put it this way: “If clients [think they are] are financial experts, they take my advice less seriously.”

TOP CONCERN

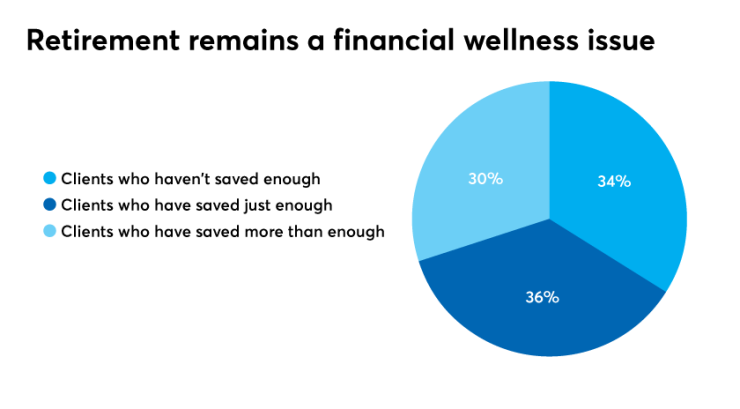

Lack of adequate retirement savings remains a top concern for planners. While respondents said 30% of their clients had more than enough saved for retirement, 34% reported clients had not saved enough and 36% indicated their clients had saved “just enough.”

“It seems to be getting harder for people to hit the goals I feel are necessary for a worry-free retirement,” one advisor said.

Another advisor’s clients are struggling because they didn’t save or invest enough while working. “They were under the impression that their jobs had a retirement plan set up for them,” the planner said.

The lack of adequate emergency savings and health insurance coverage also remain concerns. Thirty-four percent of advisors surveyed said their clients didn’t have enough money for an emergency; and 36% reported that their clients had “just enough” money for unexpected expenses.

One quarter of clients do not have any health insurance, according to advisors surveyed, and 34% had only minimal health insurance. “The increasing cost of health care in this country is an emerging need that more clients need to understand for their financial wellness,” one wealth manager said.

The concern is well-founded. For example, the median annual cost of a home health aide is almost $50,000, according to a

On a more cheerful note, clients show familiarity with tax strategies, helping relieve advisors’ worries about financial wellness. Around two-thirds of clients were either very knowledgeable or extremely knowledgeable about key tax strategies, including capital gains, estate tax exemptions, charitable contributions deductions, retirement plan contributions and DAFs.

Compensation is an integral part of clients’ financial wellness. When salaries or comp packages rise, planners told FP they overwhelmingly advise clients to increase their allocation to investments and retirement savings.

A majority of planners also said they advised clients to not change the amount of their spending on health care, debt payments, non-discretionary items such as mortgage payments, as well as discretionary items like vacations and entertainment.

Overall, advisors told Financial Planning they found clients listened well and “with a positive mindset to follow our recommendations and advice.” They added that it helps to tailor messages to clients’ level of understanding.

“I decide how much and what kinds of information to give my clients based on their financial literacy,” one advisor said. “I also try to provide additional resources to help increase their overall financial knowledge.”

The Financial Wellness Report, published in partnership with ADP, is created by the editors of Financial Planning and is based on a survey of about 300 advisors in September and October of 2019. Clients were segmented by age and investable assets: less affluent (less than $250,000), mass affluent ($250,000 to $999,999), HNW ($1 million to $9.9 million) and UHNW ($10 million and more).