Clients are boosting their cash positions by taking gains off the table as they hedge against the possibility of a selloff, according to the latest Retirement Advisor Confidence Index — Financial Planning’s barometer of business conditions for wealth managers.

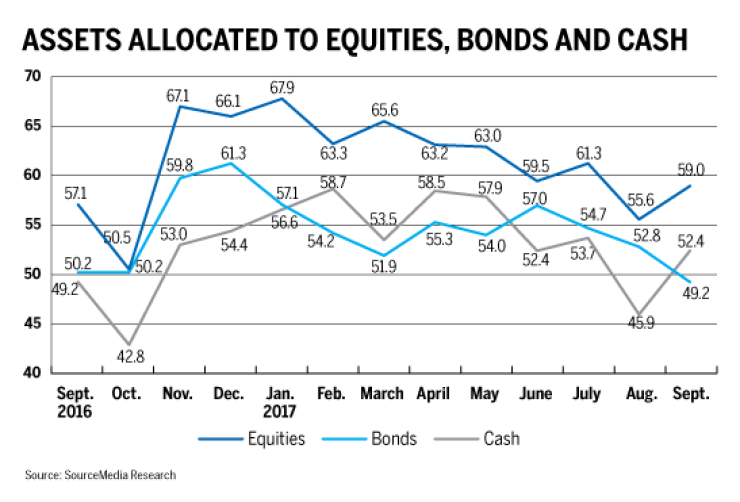

The component measuring flows into cash jumped 6.5 points to 52.4, one of the biggest moves in the monthly index, which also tracks asset allocation; investment product selection and sales; client risk tolerance and tax liabilities; new retirement plan enrollees and planning fees.

Advisors say many clients are spooked by high multiples, with some liquidating securities over market concerns. “I had a handful of clients that we felt had achieved our return objectives for the year and wanted to take some profits,” one planner says.

Nevertheless, solid long-term investment performance and decent economic fundamentals are still influencing client allocations.

“Clients are becoming more and more comfortable with the stock market. They see it as a place to save for retirement more so than they did three to five years ago,” one advisor says. “And each month the market makes new highs, [and] they become more expectant in their returns from our firm.”

The RACI component tracking the amount of client assets used to buy equities increased 3.4 points to 59, and the composite index increased 2.3 points to 53.7. Readings above 50 indicate improving conditions, while readings below 50 indicate deterioration.

The most recent numbers show advisors have been reporting that the wealth management environment has been broadly improving for nearly a year.

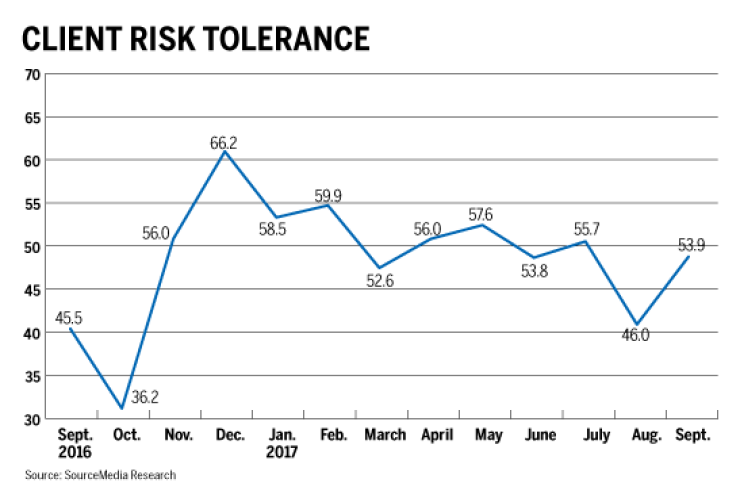

RISK TOLERANCE REBOUNDS

Despite defensive shifts into cash, advisors say overall client risk tolerance has rebounded. RACI’s risk component swung back into expansion territory with a 7.9-point increase to 53.9.

That’s close to levels that have prevailed for much of the year, and some advisors say they are trying to rein clients in.

“Clients seem to be growing more and more bullish and greedy,” one planner says. “I am maintaining the same investment mix at this point and talking them down from getting more aggressive.”

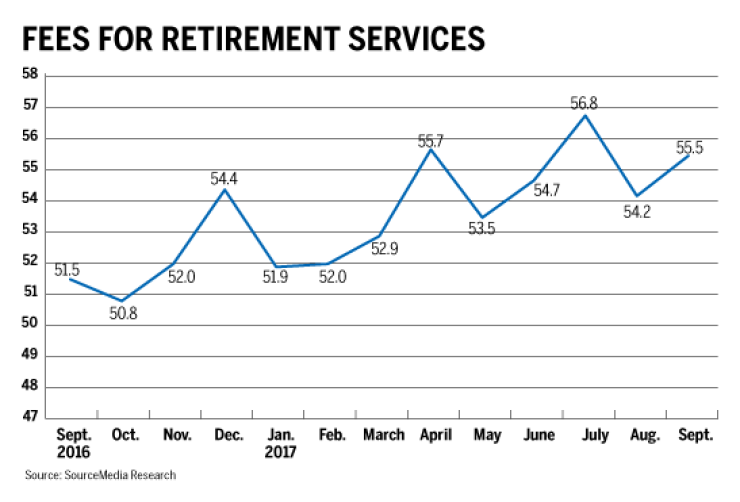

The RACI component tracking fees charged for retirement services gained 1.4 points to 55.5, maintaining a long streak in expansion that has been largely sustained by the increasing market value of managed assets.

Advisors also say clients channeled additional funds into tax-sheltered retirement accounts ahead of extended deadlines for tax returns.

The latest RACI, which is based on advisors’ assessment of conditions in September relative to August, is accompanied by the quarterly Retirement Readiness Index. Financial Planning has recently improved how the data is displayed in graphics to better reflect survey results.

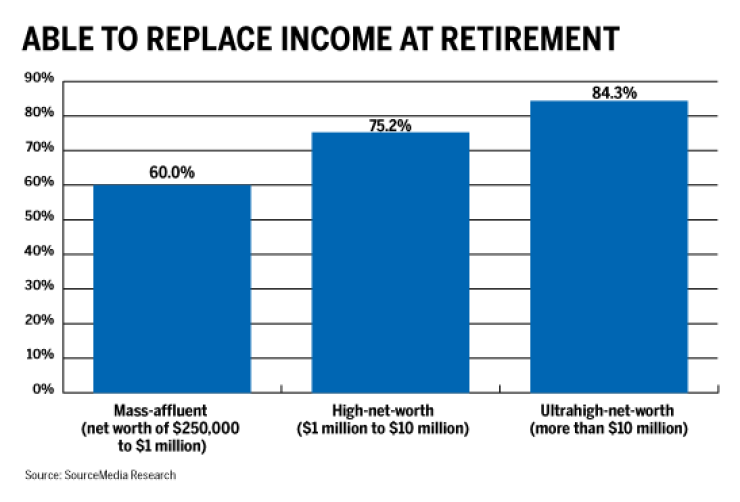

RRI tracks advisors’ evaluations of their clients’ income replacement ability, likely dependence on Social Security and vulnerability to big economic shifts.

Advisors expect relatively large proportions of their clients will be able to replace their in for 30 years by the time they retire: 60% of mass-affluent clients (net worth of $250,000 to $1 million), compared with 75% of high-net-worth clients ($1 million to $10 million) and 84% of ultrahigh-net-worth clients (more than $10 million).

Yet advisors also say the retirement security of their mass affluent clients remains under threat from a range of potential shocks. In particular, 38% of advisors say mass affluent clients are extremely vulnerable to a significant increase in health care costs, and 19% say they are extremely vulnerable to a significant decline in equity prices.