What a difference a year makes.

Key measures of clients' confidence in their retirement plans saw double-digit spikes since last year as illustrated by the February installment of the Retirement Advisor Confidence Index, Financial Planning's monthly barometer of business conditions for wealth managers.

Encouraged by steady progress on the COVID-19 vaccination front, seen as critical to a full reopening of the economy, clients are growing more risk-tolerant and funneling more retirement savings into stocks and bonds.

"[With the rollout of the vaccines], clients have been very optimistic and are willing to invest more, in addition to taking more risk with their investments," one retirement advisor says.

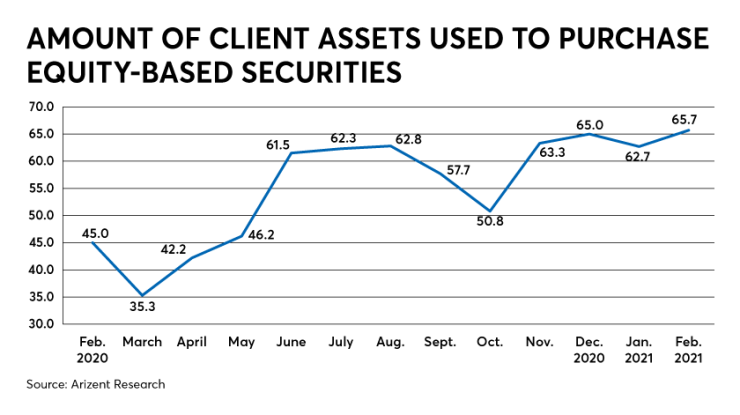

The component of RACI that tracks retirement investment in equities posted its highest score since December 2017, checking in at 65.7, up three points from the previous month and 20.7 points from February 2020.

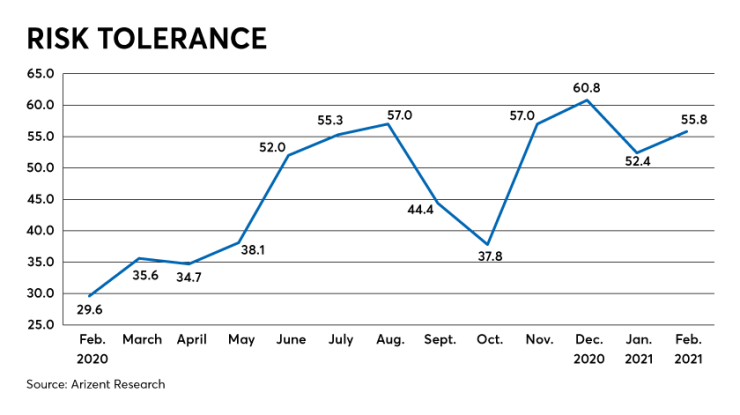

RACI scores higher than 50 denote an increase in investor confidence. Scores below that mark indicate a drop in confidence.

The story was similar — if less dramatic — with bonds and debt-based securities, which notched a score of 60.5, up 6.9 points from January and 13.9 points from the year-earlier period.

"Clients have renewed interest in markets and investments, as well as a slighter higher risk tolerance," one retirement advisor says. "This is likely due to the stability of the stock market as well as the expansion of vaccine availability."

Overall, RACI posted a composite score of 55 in February, down two-tenths of a point from January but up 8.9 points from February 2020.

One measure of clients' retirement confidence saw a sharp spike this February compared to the same period in 2020, when concerns about the pandemic were just sinking in. The RACI component that tracks clients' risk tolerance checked in at 55.8, a modest 3.4-point increase from January, but up an eye-popping 26.2 points from the year-earlier period.

"Clients are willing to accept more risk and participate in equities versus fixed income, realizing bond yields are increasing," one retirement advisor says.

And yet, the political climate and how it affects the financial landscape remain very much on clients' minds. Multiple advisors cite uncertainty around tax rates as a concern for their clients and say their opinions are mixed about the impact of the COVID relief bill.

Even if clients are broadly encouraged by progress on vaccines, some remain concerned by economic challenges at home and abroad that could upset markets. One advisor cites worries about "the number of vacant commercial properties and non-payment of rents."

"Availability of vaccines is making clients more optimistic, but global economic conditions remain very challenging," another advisor says.

Several advisors also express concern about inflation, fears stoked by rising debt levels and bond yields, though some indicate that those worries haven't materially changed the advice they deliver to clients. "Inflation on radar, but not acted upon yet," one advisor says.

Others are more proactive. "We are greatly concerned about potential inflation and have adjusted some portfolios to reflect that concern," one advisor says.