Advisory Services: How Do You Stack Up?

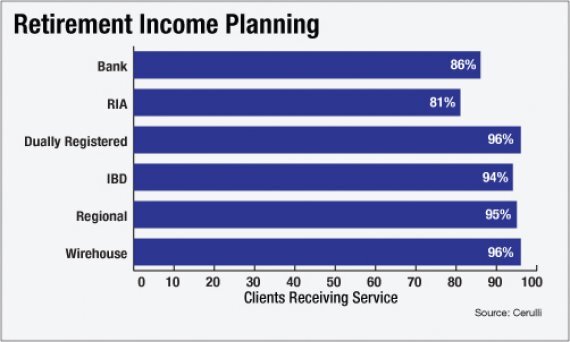

Shaping the bulk of services being received in all channels – retirement income planning, estate planning and elder care planning -- is the percentage of aging clients in the market, says Kenton Shirk, associate director for Cerulli and the author of the report. “Across all channels, if we look at the average age, nearly three quarters, 71%, of clients are age 50 and above,” Shirk adds, quoting Cerulli research on client demographics. “Among wirehouse advisors it is 78%. So it is fitting that there has been a greater focus on those services.”

Wirehouses also lead when it comes to providing high-end services for wealthy clients. For example, at wirehouses, 90% of clients received estate planning services in the third quarter of 2014. That compares to 83% of regional broker-dealer clients, 76% of bank clients, 80% of independent B-D clients and only 66% of RIA clients. With concierge and lifestyle services, 33% of wirehouse advisor clients received such services during the same period, compared to 12% among the clients of regionals, 17% among bank clients, 16% among IBD clients and 22% among RIA clients.

“Since 2010, wirehouses have focused on the largest advisors in the industry, and affluent investors,” Shirk says. “With that, they are expanding service delivery, because that is what client service warrants. It is all very much rooted in the wirehouses’ desire to grow profitability. The strategy to get there is big advisors, big clients.”

Click through to see the breakdown of planning services received by clients across all advisor channels.

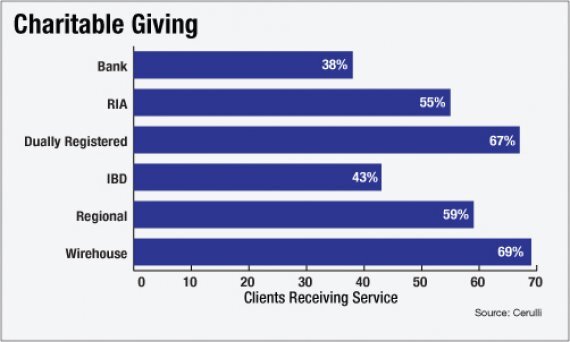

Charitable Giving

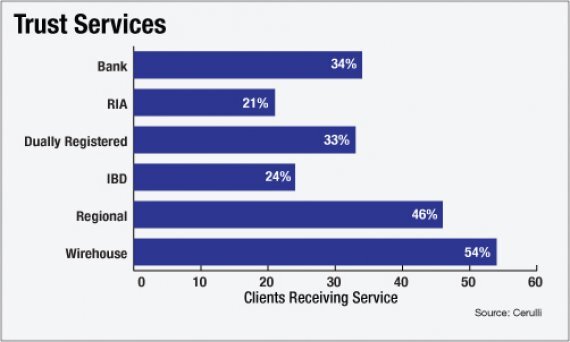

Trust Services

Concierge and Lifestyle Services

Private Banking

Elder Care Planning

Retirement Income Planning

Retirement Accumulation Planning

Estate Planning

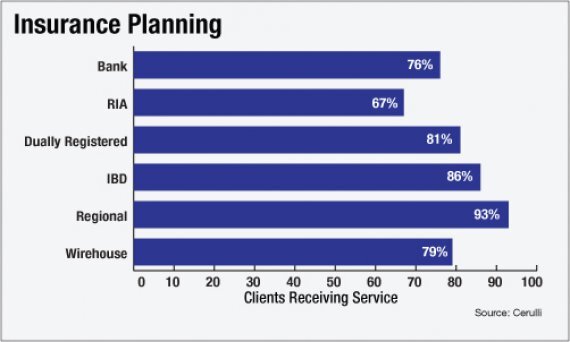

Insurance Planning

Tax Planning

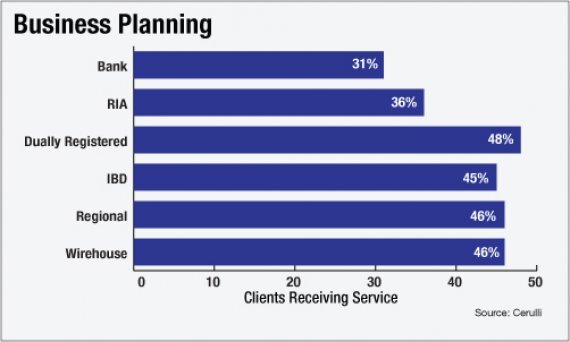

Business Planning

Investment Manager Due Diligence

Employer Benefits Retirement Planning

Cash Management / Budgeting