-

Even though advisors doubt it will pass, California's proposed billionaire tax is already reigniting residency and wealth planning conversations.

February 6 -

A federal judge rejects arguments that U.S. Bank has a fiduciary duty toward uninvested cash sitting in clients' brokerage accounts.

February 5 -

At a hearing Tuesday, executives at the Swiss banking giant faced tough questions from both Republicans and Democrats. The lawmakers are unhappy with the bank's recent decision to withhold certain documents from a lawyer who's overseeing research regarding Nazi accounts.

February 3 -

The SEC's decision marks a startling reversal from the full-court press it had mounted against Commonwealth Financial Network in 2019 over alleged failures to disclose conflicts of interest in its brokers' mutual fund recommendations.

February 3 -

Linda Friedman, who has made a career with Wall Street discrimination and harassment cases, is representing an ex-Citi executive in a bombshell lawsuit this week. Things didn't have to take this turn, she contends.

January 30 -

The accounts give wealthy investors more opportunities to place alternative vehicles in a tax-advantaged retirement nest egg. But mistakes can be costly.

January 28 -

Brokers were worried a new rule intended to lighten their responsibility to monitor advisors' side hustles would ironically mean greater supervision duties with RIAs.

January 22 -

A Ninth Circuit appellate panel ruled that10 advisors recruited to LPL from Ameriprise have the right to resist turning over their personal devices to a forensic examiner to be searched for evidence of misappropriated client data.

January 21 -

Even as crypto prices slide, a growing share of financial advisors are adding digital assets to client portfolios, with firm policies slowly catching up.

January 21 -

New OBBBA restrictions mean wealthy donors lose deductions on smaller, routine gifts. Here is how to use DAFs and donation grouping to preserve tax benefits.

January 19 -

The former CEO of Orion Advisor Solutions has since become involved in several artificial intelligence startups, which he hopes will be integrated into advisor technology stacks.

January 16 -

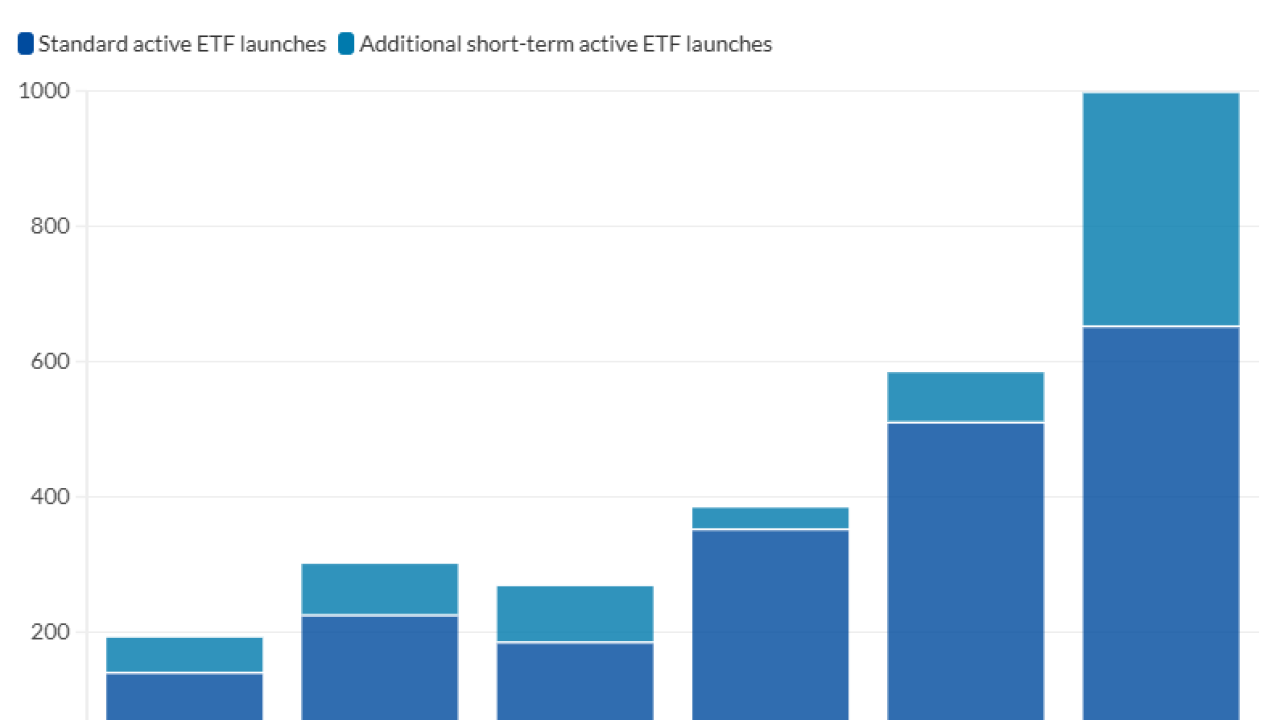

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

Kyle Busch's lawsuit against Pacific Life and his former insurance agent provides a window into potential issues around complexity, suitability and more in indexed universal life policies.

January 12 -

Systems still don't talk to each other as well as they should in 2026, so advisors are finding their own solutions.

January 12 -

Last January, one of the deadliest and costliest wildfires in modern U.S. History struck, leaving those who survived with hard-won wisdom about how to prepare clients for the next disaster.

January 9 -

The regulator considers raising the AUM threshold it uses when considering how newly proposed rules are likely to affect small RIAs.

January 8 -

Fewer U.S. adults have non-retirement investment accounts than three years earlier, and many retail investors struggle with understanding fees and fraud risk.

January 7 -

Keith Todd Ashley, an advisor indicted for the murder of a client, has turned to the Fifth Circuit of Appeals to fight his 60-year prison sentence in a related fraud case.

January 7 -

The tax shield on student loan forgiveness has expired. Here is how advisors can help clients lower their burdens.

January 6 -

Under a new proposal, clients would have to opt in to receiving account statements and other documents in paper form.

January 5