The channel of wealth management that has seen some of the largest financial advisor recruiting moves in recent years needs to hire many more of them in the future.

That’s the main takeaway of a study

Megabanks such as Wells Fargo, JPMorgan Chase and Citi remain the largest players, but the programs using external brokerages often referred to in the industry as third-party marketers, or TPMs, have proved to be a hot recruiting opportunity for wealth managers. No firm is tapping into it on the level of LPL, which has secured recruiting deals to add

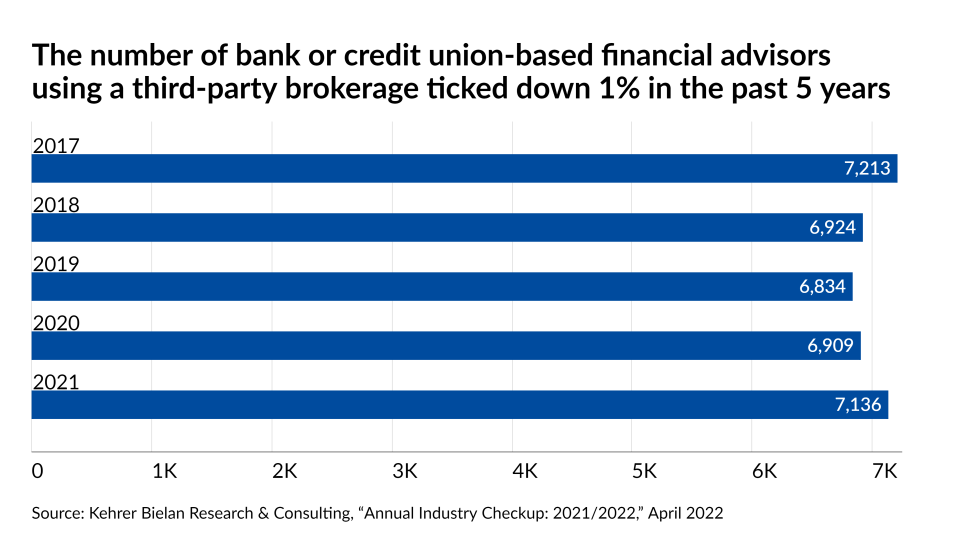

“Historically, the bank-owned channel, that's really been the larger channel,” Tim Kehrer, Kehrer Bielan’s director of research, said in an interview. “There used to be a lot more of these bank-owned broker-dealers than there are today. … It represents a real shift in the way that investment advice and services are delivered in banks and credit unions.”

Wealth programs in the channel reach their optimal level of business when the bank or credit union has one advisor per roughly $125 million in deposits, according to the firm’s research. The current coverage in the channel stands at about one advisor per $350 million, which suggests that the typical program needs to double its ranks of registered representatives, Kehrer said.

“The best-performing banks and credit unions have more than twice as many advisors relative to their size than everyone else,” the consulting firm’s co-founder, Ken Kehrer, said.

Such conditions make for a “really fascinating situation” in the channel, with banks and credit unions in many cases not equipped to assist clients with questions about investing a portion of their savings or other basic queries, according to FinLit Tech’s Mac Gardner,

“The industry is aging out. On the investment management side, the industry has made it so hard to get in and be successful because it's been so sales-driven that there's no huge pipeline of young financial advisors ready to jump in and fill this gap,” Gardner said. “The big boys can afford to self-clear. With economies of scale, you're going to want to find a resource that allows you to offer you these services, but to do it in a cost-effective way.”

To see the most interesting stats for advisors and other wealth management professionals from the consulting firm’s study of the channel, scroll down our slideshow. For a look at mergers and recruiting moves from the past week across wealth management,

Note: All figures come from Kehrer Bielan Research & Consulting’s report, “