It’s a strict move for a firm whose advisors are known for a retail approach to client service and acquisition.

The VanEck fund’s sell-off was so violent that it triggered the SEC’s alternative uptick rule.

Advisors may find it difficult to connect with the people who need financial help the most.

The change means legions in New York, New Jersey and Connecticut who had been scheduled to rotate among sites will instead stay away from those offices until further notice.

Lenders have been ringing up investment firms and hedge funds to garner interest in financing to companies in industries upended by the coronavirus.

The actions include cutting the federal funds rate to between 0% and 0.25% and other steps to ease economic stress from the spread of the coronavirus.

The company has asked employees on the impacted floor to work from home until March 23.

Many advisors are doing heavy lifting right now — or expect they will be — in the midst of growing coronavirus fears.

-

Bank tellers, call-center employees and support staff are part of the roughly 70% of American workers who don’t have the ability to work from home.

March 23 -

Market plunges are normal and stocks are likely to recover and earn a positive return over the long term, says an expert.

March 20 -

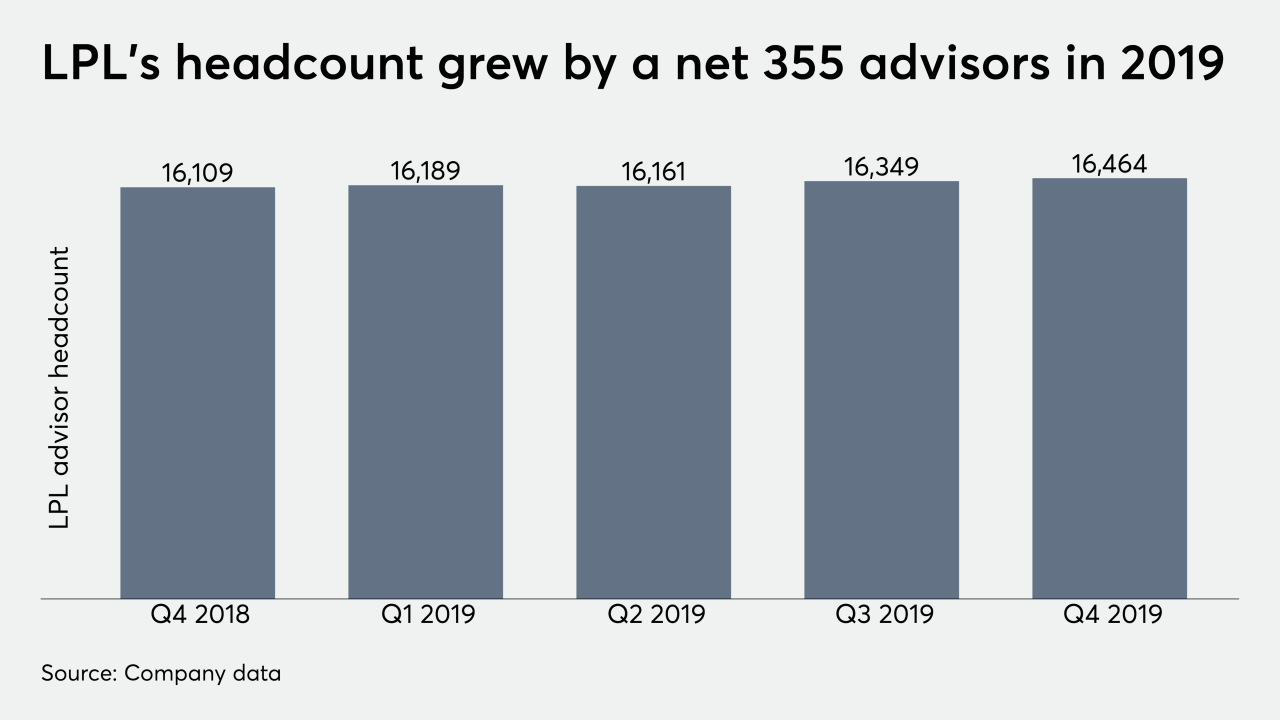

Senior leaders at the No. 1 IBD meet daily about the pandemic as large enterprises set their own continuity plans into motion with an eye toward ensuring operations.

March 20 -

It follows an earlier decision to delay the payment deadline, but not the filing deadline, in response to the coronavirus pandemic.

March 20 -

The company's bank tellers, call-center workers and support staff are part of the roughly 70% of American workers who don’t have the ability to work from home.

March 20 -

More than 245,000 people were registered for the June exam as part of the three-level program to earn a credential from the most challenging test in finance.

March 20 -

Many advisors can make the switch from a traditional office to one right down the hallway — but it comes with its own set of ground rules.

March 20 -

Moody’s lowered the giant IBD network’s credit rating with sobering words that could resonate across wealth management.

March 20 -

“I don’t think the volatility will be over until we’re finished with this virus,” one RIA says.

March 19 -

The firm is experimenting with new, virtual capabilities to permit staff to work remotely amid an unprecedented health crisis.

March 19 -

Moody’s affirmed the company’s “B3” rating but signalled the potential wide-reaching impact of the pandemic across wealth management.

March 19 -

How does an advisor ask clients to transfer accounts at a time when many people are afraid to simply leave their house?

March 19 -

Regulatory relief applies to advisors and investment funds but the commission stresses that fiduciary obligations still apply.

March 19 -

Wall Street’s nonstop aggressiveness is clashing with the demands of a deadly pandemic.

March 19 -

“Having retirement assets in both traditional and Roth accounts can help clients hedge their tax bets for retirement,” an expert says.

March 18