Proponents make them a standing core equity holding, but not all advisors are sold. One calls them "marketing schemes."

Retirees will end up locking in substantial losses if they decide to cash out their investments during a bear market to generate income.

The firm’s CEO told staff there would be no headcount reduction in 2020 even as other industries have furloughed workers in droves.

Market volatility brought on by the coronavirus pandemic may present a great time to invest, as many stocks are being sold at bargain prices.

From Roth conversions to QHFDs: The coronavirus pandemic is forcing difficult questions, and clients rightfully are looking for answers that advisors are uniquely suited to provide.

With fewer people investing in active strategies and more options to choose from, competition is extremely fierce.

Sales people are having a hard time marketing new products in isolation, one executive says.

By extending their working years, seniors can see an increase in their Social Security payouts.

-

Fintechs are offering deep discounts or even free service to hold on to advisors and attract new customers.

April 9 -

The fund will track industries such as cloud technologies, remote communications and cyber security, according to an SEC filing.

April 9 -

The firm's wealth management unit saw new demand for credit, according to CEO Sergio Ermotti.

April 9 -

For one, clients will owe taxes still on the distributions, unless they recontribute the money into the account within three years.

April 8 -

Advisors — some inspired, some resistant — envision client contact in a post-coronavirus landscape.

April 8 -

They're following other firms that are delaying, shortening or going virtual as efforts to slow the crisis leave employees working from home.

April 8 -

If the price declines enough, it can breach a barrier where the investor starts suffering one-for-one losses all the way to zero.

April 8 -

Risk managers must be especially vigilant about the bets their traders are making to profit from current market dislocations brought on by the coronavirus.

April 8 - Charity, free advisor services and more: How the industry is stepping up in the coronavirus outbreak

Organizations and firms are donating N95 masks, providing resources at no cost and taking steps to protect employees and practices nationwide from the spreading pandemic.

April 7 -

-

Whether you’re looking for titles you can learn from or an escape into page-turning thrillers, we’ve got you covered.

April 7 -

Fixed income may take a hit as yield and risk assume new dimensions, analysts forecast.

April 7 -

How FAs and firms are adapting to a radically different business environment.

April 7 -

Instead, the billionaire opted for a lucrative credit hedge that earned his firm about $2.6 billion in profits when the market plummeted.

April 7 -

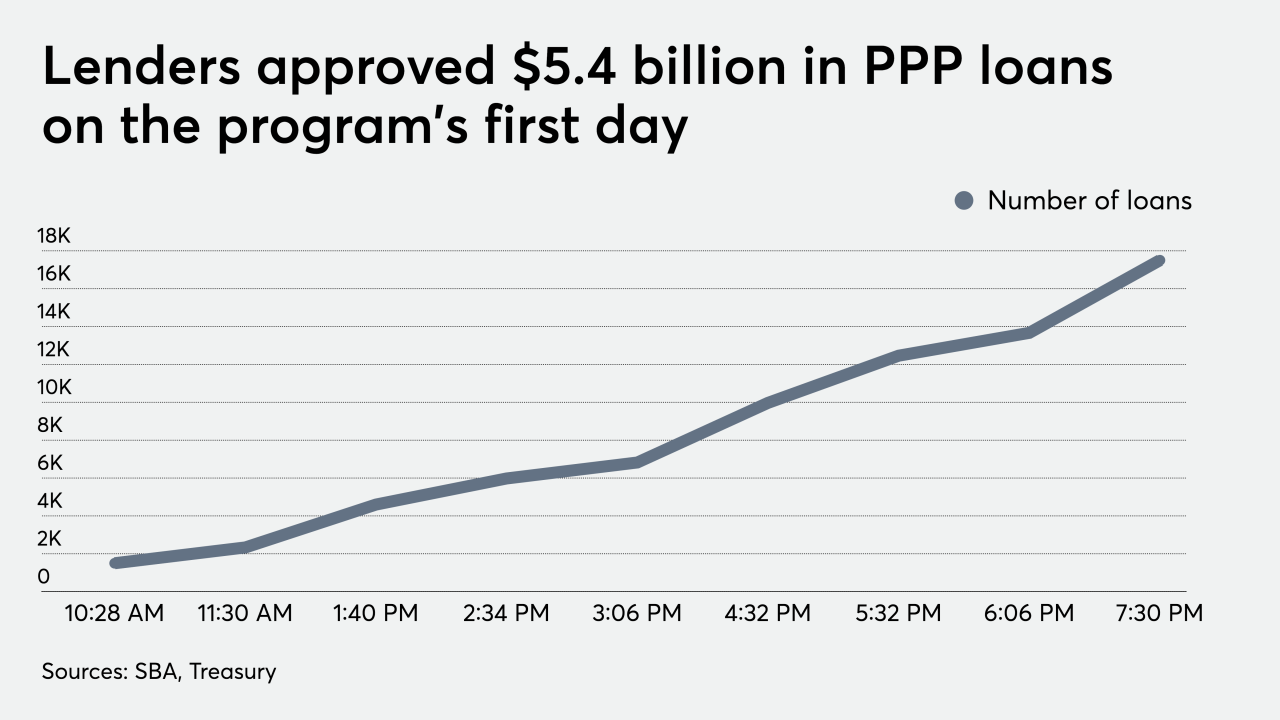

The program comes as welcome relief for many advisors and their business-owning clients — but the program has struggled since going live on Friday.

April 7