Without centralized IT protocols RIA cyber fraud scenarios are taking on new and nightmarish dimensions — but there are ways for firms to defend themselves.

Wells Fargo will temporarily stop accepting applications for home equity lines of credit, following a similar move by rival JPMorgan Chase.

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

Ongoing health risks will hinder a return to normalcy for the firm and its rivals.

Standard General accused Tusk Strategies of “blanketing the media with false and misleading proxy materials” on behalf of a “secret client.”

There are appealing methods to shift investments “upstream” to aging parents or “downstream” to grown children.

Equities have rallied more than 20% from March lows, but remain well below 2020 highs.

While the Fed regularly updates taxpayer rolls with death certificate information, the IRS was relying on 2018 data to process the checks.

-

“The world has become more digital, less global and more local,” says Amy Lo, co-head of the firm’s Asia Pacific wealth division.

May 8 -

Economic damage wrought by the coronavirus has not stopped investors from piling into the companies able to churn out profits in the stay-at-home world.

May 8 -

In just two days, technology and remote staff helped ex-Wells Fargo FAs managing $281 million open client accounts at their new employer.

May 8 -

Renewed friction between Washington and Beijing threatens to undermine a trade deal signed only months ago, further jeopardizing global economic prospects.

May 7 -

The Internal Revenue Service has posted information on how people who weren’t supposed to receive their economic impact payments for the novel coronavirus pandemic should return the money.

May 6 -

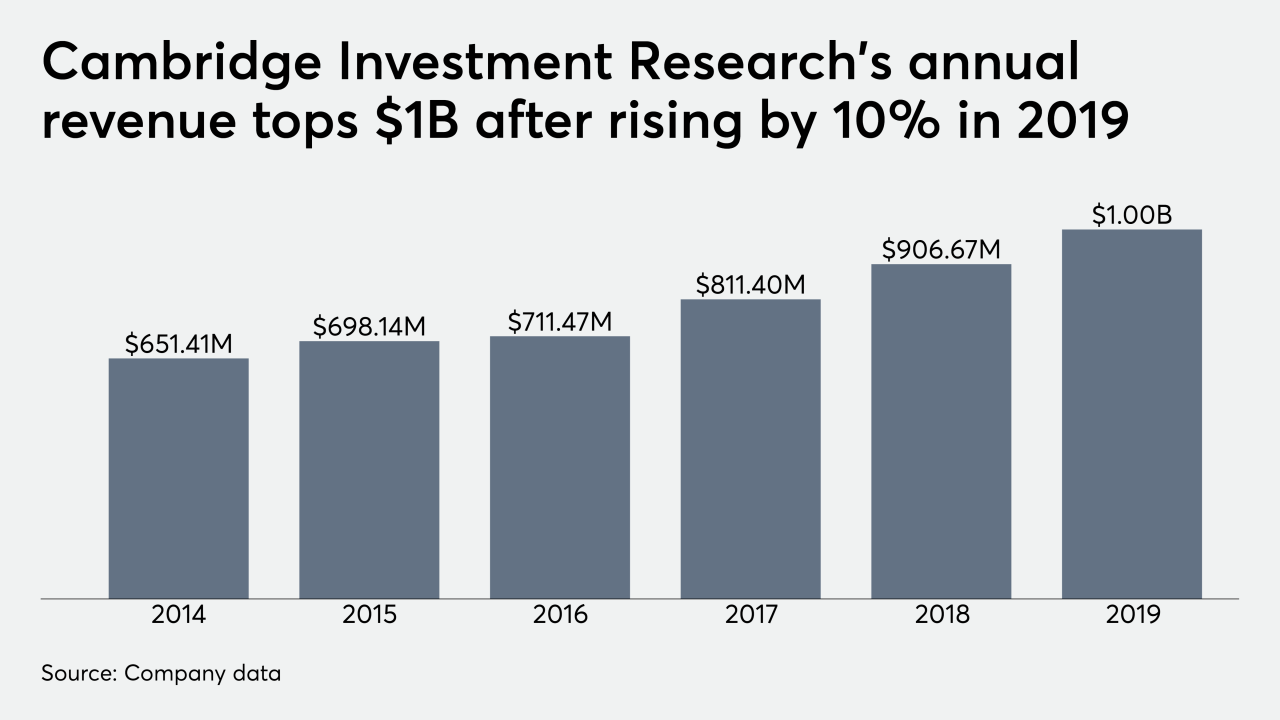

The privately held firm recruited more than 160 reps in the first quarter on the strength of its balance sheet, CEO Amy Webber says.

May 6 -

“This virtual program will fill a major a hole left by internship cancellations,” says FPA President Martin Seay.

May 6 -

Citadel Securities is humming at record pace as the coronavirus upends finance, moving dozens of employees and their families to a work-from-resort bubble.

May 6 -

From digital advice to fee transparency and fintech investment, the pandemic has touched almost every corner of wealth management.

May 5 -

-

As policymakers fear a deflation spiral reminiscent of the Great Depression, contrarians wonder if ultra-loose monetary policies can inspire growth.

May 5 -

The central bank said it “will generally not purchase shares of an ETF that are trading at a premium” of 1% above its net asset value.

May 5 -

There's a great deal of help for businesses in the CARES Act and the FFCRA.

May 5 Weaver

Weaver -

How will the relief package impact retirement accounts? CPA Ed Slott fields this and other top financial planning queries.

May 4 Ed Slott & Co.

Ed Slott & Co. -

Two testing windows remain for this year, but the board cautions they will take place “only if they can be conducted without compromising the health of exam candidates.”

May 4