The COVID-19 pandemic has infected the service’s annual list of top tax scams.

“They’re now realizing: Let’s actually get the contingency plan in place,” said Dominic Volek, head of sales at Henley & Partners, the world’s biggest citizenship and residency advisory firm.

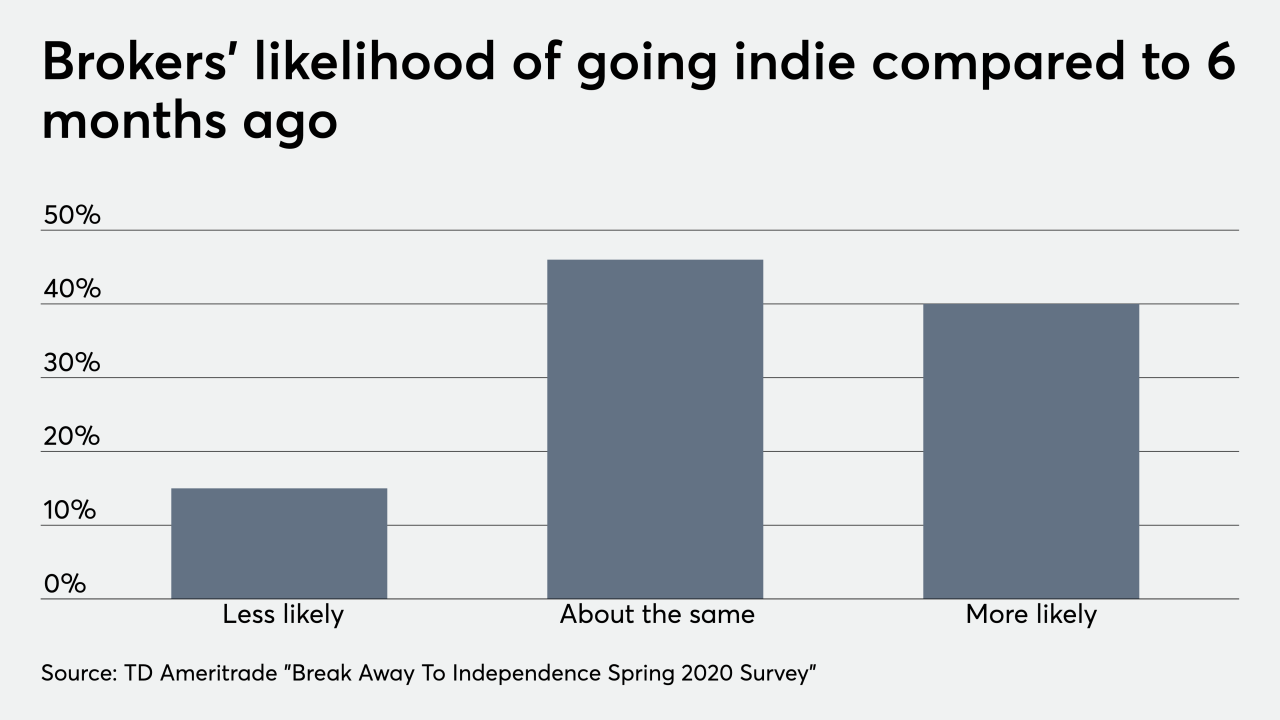

After 30 years in the wirehouse world, we found an unlooked-for opportunity for our practice amid devastation.

Candidates will be allowed “two tissues” while testing at home and are advised to have bed linen handy.

“What this tool does uniquely is it takes the depersonalized delivery of benefits and really helps the individual determine how best to get the most out of their benefits,” says Voya’s Andrew Frend.

At home or under a socially distanced beach umbrella, these diverse titles will help while away this singular season.

Wealth management profits fell, but a steep rise in transactional business offset some of the decline.

The 4,000-person regulator in March was one of the first federal agencies to tell employees to stay home due to the public health emergency.

-

Despite growing to about $1.1 trillion in AUM, senior executives made a series of bets to keep pace in a changing industry that have yet to pay off.

July 29 -

Trading under the ticker EFIV, the fund will exclude companies involved with tobacco-related products and weapons.

July 29 -

The majority of advisors don’t understand how much of a positive difference they can make for their clients, says advisor Deborah Fox.

July 28 -

An iShares ETF investing in companies it says has “positive environmental, social and governance characteristics” has more than tripled gains of the S&P 500.

July 28 -

Perceptions on relationships, health, and lifestyle have also changed.

July 28 -

Many clients have seen the value of their investment accounts drop, making this a good time for planners to prove their value

July 27 Prudential Financial

Prudential Financial -

At the height of pandemic-related job losses, 18.9% of Americans with disabilities were unemployed, data show.

July 27 -

A typical investment for Nuveen's $5.8 billion impact investing unit these days ranges from $20 million to $60 million, says its co-head.

July 27 -

“It’s going to flip everything on its head,” says one XY Planning Network advisor.

July 24 -

There has been increased demand for havens amid a resurgence in coronavirus cases, flaring political tensions and a weaker dollar.

July 23 -

“No one could have envisioned what this virus was going to do to the commercial real estate space,” an expert says.

July 22 -

Unexpected tailwinds from the global pandemic have made recruitment more efficient and have highlighted advisor-client bonds.

July 22 -

The Tax Cuts and Jobs Act created opportunity zones as an economic development tool to stimulate investments in distressed communities.

July 22 Farella Braun + Martel

Farella Braun + Martel -

Their options are dwindling as the number of insurers offering nursing or home-health care coverage shrank to about a dozen in 2018 from over 100 in 2004, data show.

July 22 -