Regulators approved the first U.S. exchange-traded funds investing directly in ether, the world's second-largest cryptocurrency, according to filings and statements from asset managers.

21Shares, Bitwise Asset Management, BlackRock, Invesco, Franklin Templeton, Fidelity Investments and VanEck were among the issuers to receive U.S. Securities and Exchange Commission assent, the documents indicated Monday. The SEC didn't immediately return requests for comment.

The latest development paves the way for the imminent trading of the ETFs and highlights a softening in the U.S. regulatory climate for the digital-asset sector. Republican presidential nominee Donald Trump, currently leading in the polls, has also adopted a pro-crypto stance ahead of November's election.

READ MORE:

"Our clients are increasingly interested in gaining exposure to digital assets through exchange-traded products (ETPs) which provide convenient access, liquidity and transparency," Jay Jacobs, U.S. head of thematic and active ETFs at BlackRock, said in a statement.

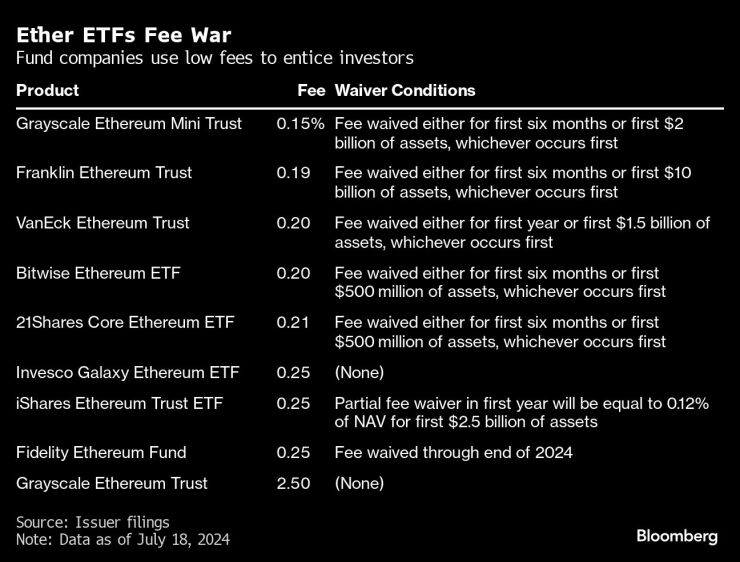

Competition over fees

The SEC in May surprisingly pivoted toward approval of spot-ether ETFs after grudgingly allowing bitcoin funds in the wake of a court reversal in 2023. Ether is the coin of the ethereum blockchain, the most important network for crypto-based financial services. Several issuers, including BlackRock and Fidelity, are partially or wholly waiving fees on ether ETFs temporarily to woo assets.

The bitcoin ETFs took Wall Street by storm and have attracted net inflows of about $17 billion since going live in January. Commentators expect far more modest subscriptions for the ether funds.

For instance, digital-asset market maker Wintermute Trading said typical analyst projections translate into anticipated annualized inflows of about $4.8 billion to $6.4 billion for the ether products in the first year.

"Our view is the actual demand may be lower, potentially ranging between $3.2 billion and $4 billion," the company wrote in a report.

Staking challenge

The bitcoin ETFs benefited from a controversial narrative that pitches the market-leading token as digital gold, a spin that ether lacks. The ether funds also won't offer so-called staking rewards for blockchain maintenance, a return that can be harnessed by owning the token directly.

READ MORE:

While bitcoin is viewed as a commodity, the SEC argues most other tokens are unregistered securities that should be subject to its oversight. Staking is a key issue because it raises questions about whether ether should be treated as a security. SEC Chair Gary Gensler has been ambiguous on ether's classification.

Bitcoin has surged 132% over the past year and hit a record high of almost $74,000 in March. Ether has gained 88% over the past 12 months. Both were little changed on Tuesday, changing hands at $67,530 and $3,475 respectively as of 11:45 a.m. in Singapore.

In late June, VanEck and 21Shares submitted filings for a product investing in solana, the fifth-biggest cryptocurrency by market value, another attempt by ETF issuers to ride demand for digital assets.