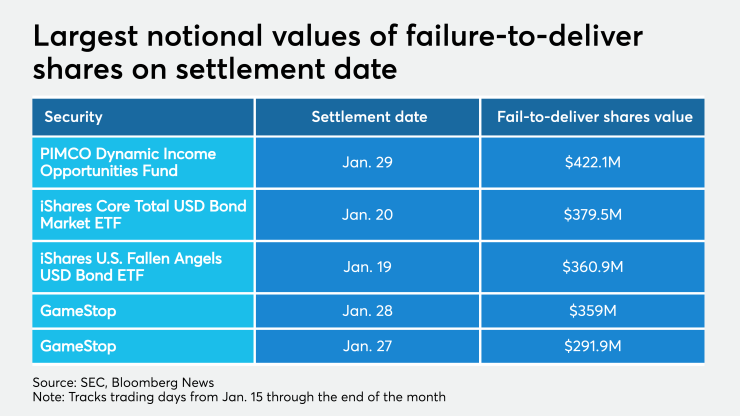

On Jan. 28, the day after GameStop mania hit its crescendo on the back of a short squeeze for the record books, about $359 million worth of shares were caught in limbo.

More than 1 million shares were deemed failed-to-deliver that day due either to buyers lacking cash to complete purchases or sellers not having the shares to settle trades, according to U.S. SEC data.

The SEC report, which covers trading from Jan. 15 through the end of the month, is just one more indication of the dislocation in the market for the video game retailer’s shares.

GameStop stock, for months among the most heavily shorted on the NYSE, surged more than 1,700% from Jan. 1 through Jan. 27 as a legion of Reddit users piled on, forcing bearish traders to scramble for shares and brokers to take the highly unusual step of curbing trading.

While the SEC’s list highlights the extent of the short squeeze, on Reddit’s WallStreetBets forum, where the GameStop trade was galvanized, it’s evidence of something else: the unproven theory that hedge funds were engaged in naked short-selling of the shares.

Short sales — when an investor borrows shares, sells them and then tries to buy them back at a lower price to profit from the difference — are an everyday market occurrence. Naked short selling, the illegal practice of selling shares that aren’t known to exist, is just one possible cause of a failure-to-deliver, with more quotidian reasons being human error and administrative delays.

I didn’t own GameStop but did profit from BlackBerry, also caught up in the current mania, writes Allan Roth.

“Fails-to-deliver can occur for a number of reasons on both long and short sales,” reads a disclaimer on the SEC website. “Therefore, fails-to-deliver are not necessarily the result of short selling, and are not evidence of abusive short selling or ‘naked’ short selling.”

Failures to deliver can result in fines, losses as well as reputational harm, and in rare circumstances there’s also a risk they could lead to a reduction of market liquidity.

One thing is clear: the Grapevine, Texas-based company is an anomaly in the data. Ranked by the dollar value of traded shares that couldn’t be delivered — a sum that was influenced by the ballooning price of GameStop’s shares — it was the only company to appear multiple times in the top 10 during the period. And it was only one of two companies, the other being Li Auto, to feature atop a list dominated by ETFs.

The data, which is released twice a month, tracks securities that had at least 10,000 shares that failed-to-deliver on a daily basis. The total number of shares for each day is a “cumulative number of all fails outstanding until that day, plus new fails that occur that day, less fails that settle that day,” according to the SEC’s website.

About 2.1 million GameStop shares failed-to-deliver on Jan. 26 before falling to 138,179 on Jan. 29, the day after Robinhood and other brokerages began restricting trading in so-called meme stocks.