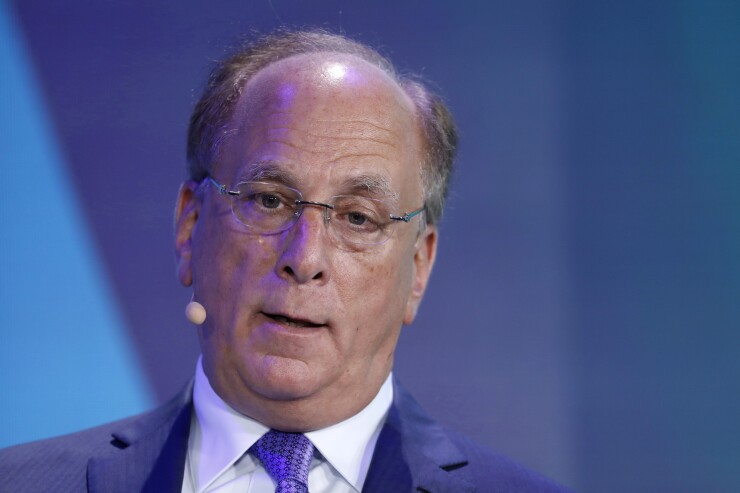

Not long before the departures began, Larry Fink warned his top lieutenants: Behave or else.

BlackRock’s CEO was speaking last year at a scheduled meeting of his global executive committee, a group of about 20 of the company’s highest-ranking officials. During a conversation about corporate ethics, Fink and others discussed how their behavior would be held to a higher standard than other employees, according to people with knowledge of the meeting.

Two of the men in that senior leadership group are now gone from the world’s largest asset manager. Mark Wiseman, once seen as a possible successor to Fink, was terminated this week for having an affair with a subordinate. Jeff Smith, who led global human resources, was dismissed in July for violating an unspecified company policy.

A BlackRock spokesman declined to comment on the 2018 meeting.

-

Mark Wiseman, global head of active equities and frontrunner to succeed CEO Larry Fink, said he failed to disclose a consensual relationship with a colleague.

December 5 -

“We need someone with a deep understanding of BlackRock, our business and, above all, our culture,” CEO Larry Fink wrote in a memo.

October 8 -

A close look at the seven letters Jay Clayton highlighted, and about two dozen others submitted to the SEC by supposedly regular people, shows they are the product of a misleading — and laughably clumsy — public relations campaign by corporate interests.

November 19

Both departures were announced in bluntly worded memos sent to approximately 16,000 employees worldwide, a sign of how serious Fink and President Rob Kapito are about punishing any misconduct among top officials as the firm seeks to position itself at the forefront of ESG issues.

With almost $7 trillion under management, mostly in index-linked products, BlackRock is one of the largest shareholders in virtually every major U.S. public company. That’s led to pressure from politicians and activists who’d like to see BlackRock wield its influence for the greater good. It’s also prodding the New York-based firm to take ever greater care of its own reputation, said Kyle Sanders, an analyst at Edward Jones.

“They’re at the forefront of conversations on ethical behavior and good management,” he said.

It isn’t just a BlackRock issue. The #MeToo era, kicked off by the allegations against movie producer Harvey Weinstein in 2017, has put the behavior of executives under a spotlight globally. Last month, McDonald’s removed its CEO over a relationship with a colleague, following a similar move by Intel in 2018.

Fink’s memo portrayed the misconduct in grave terms.

“It is deeply disappointing that two senior executives have departed the firm in the same year because of their personal conduct,” Fink and Kapito, two of the firm’s co-founders, wrote Thursday in announcing Wiseman’s exit. “This is not who BlackRock is. This is not our culture.”

The departures stunned employees. Wiseman was seen as a rising star upon joining BlackRock in 2016. He was one of few people on the global executive committee whose career featured investing experience.

Double-digit gains produced by the mutual funds and ETFs with the most AUM were not enough to best the broader market.

Wiseman, 49, was also the only one of the group seen as potential Fink successors who’d previously been a CEO, running the Canada Pension Plan Investment Board for four years. At BlackRock he led the $290 billion active equities business and chaired its alternative investment division — two areas where the firm is making a concerted effort to grow. His wife, Marcia Moffat, is BlackRock’s Canada country head.

Day-to-day operations of the alternatives business will remain under the oversight of global head Edwin Conway and Jim Barry, its chief investment officer.

The reasons for Smith’s departure were less clear. Fink and Kapito said only at the time that Smith “failed to adhere to company policy,” and BlackRock has declined to comment further. — Additional reporting by Melissa Karsh