-

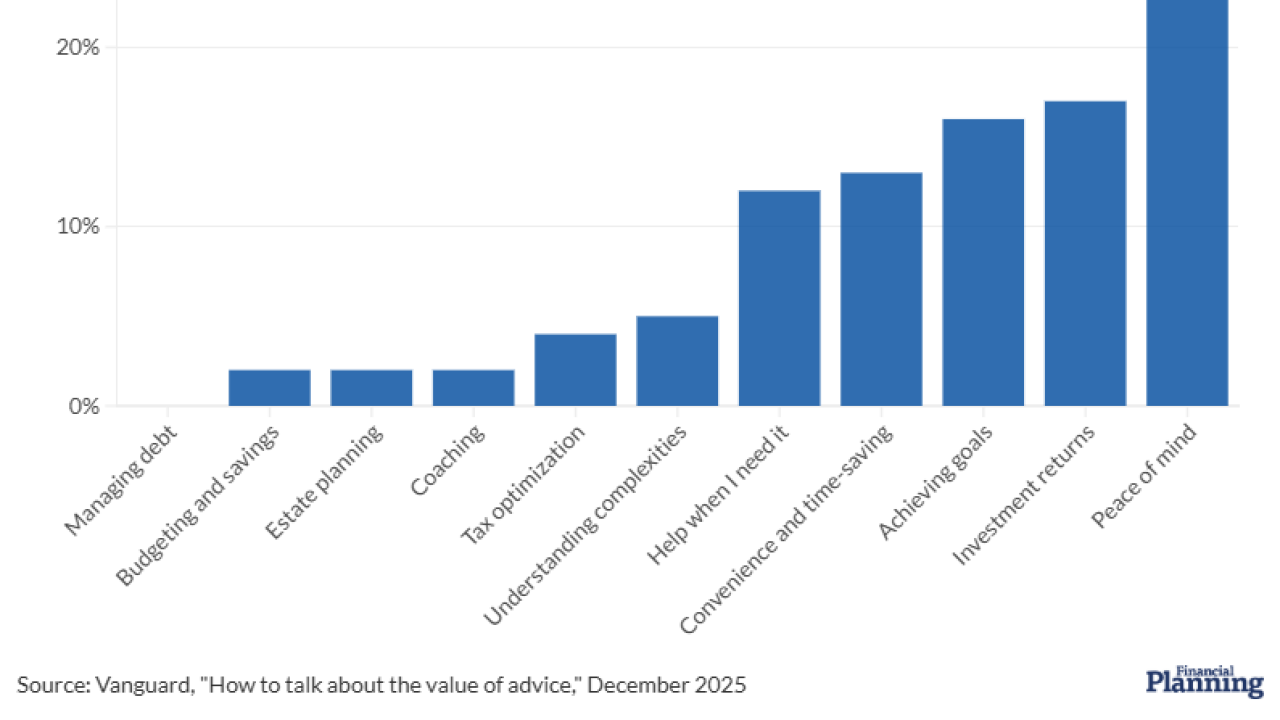

Vanguard's latest poll and analysis offers a multifaceted explanation into how financial advisors should talk about their value to clients and prospective customers.

January 8 -

The platform can offer a wide audience, but with serious content moderation and other concerns, is remaining active worth it?

January 8 -

A tiered service model should make clients feel valued while helping the firm scale.

January 8 SoftPak Financial Systems

SoftPak Financial Systems -

Fewer U.S. adults have non-retirement investment accounts than three years earlier, and many retail investors struggle with understanding fees and fraud risk.

January 7 -

Keith Todd Ashley, an advisor indicted for the murder of a client, has turned to the Fifth Circuit of Appeals to fight his 60-year prison sentence in a related fraud case.

January 7 -

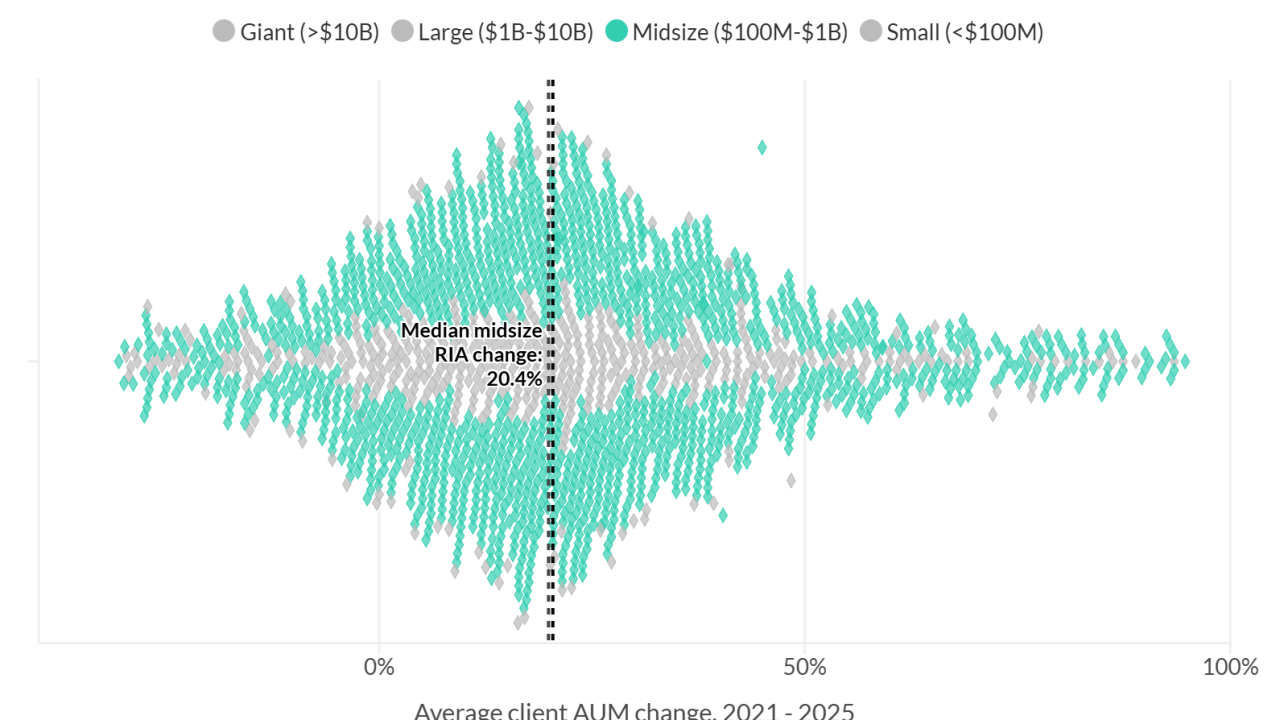

The industry's biggest firms are winning the battle for assets but losing the war for high net worth efficiency. New data reveals how some of the biggest RIAs are growing through volume, not value.

January 7 -

The tax shield on student loan forgiveness has expired. Here is how advisors can help clients lower their burdens.

January 6 -

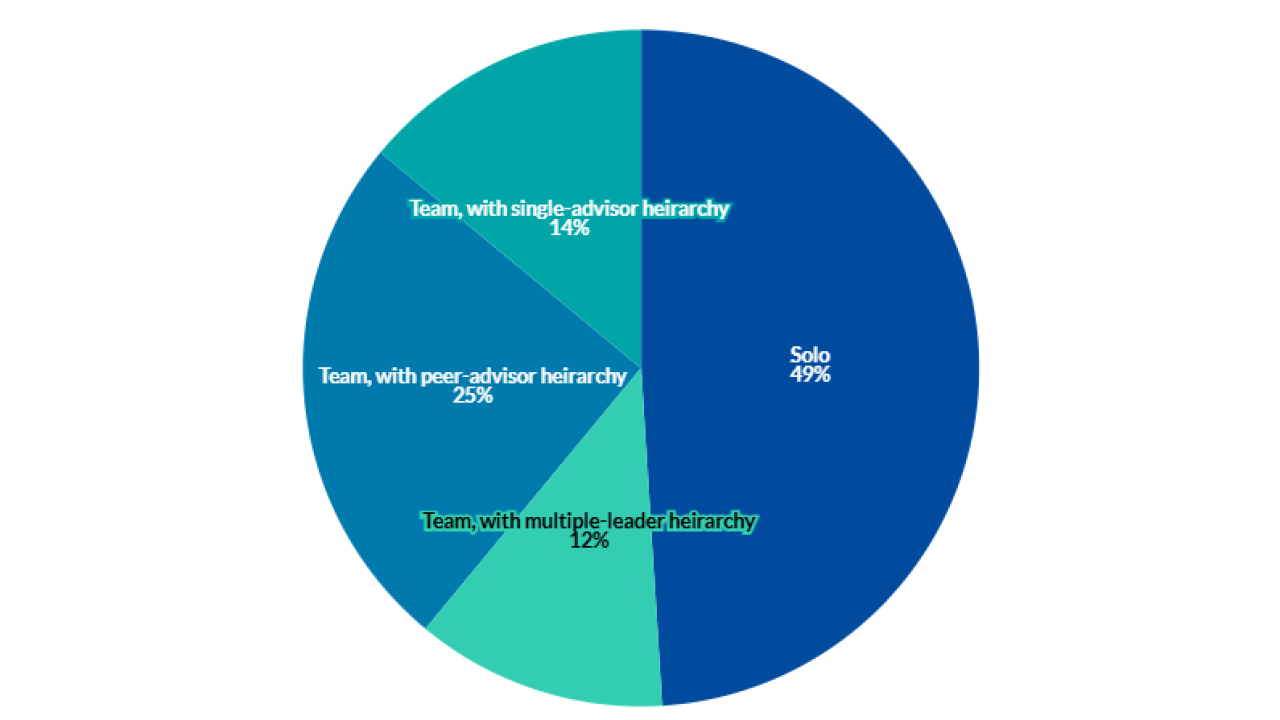

Logic (and compelling Cerulli Associates data) explain why advisor teams are gaining momentum. But teaming is not the only option for growth.

January 6 -

The "in-kind" method allows investors to diversify highly appreciated stock without handing over a chunk of the profit to the IRS.

January 6 Exchangifi

Exchangifi -

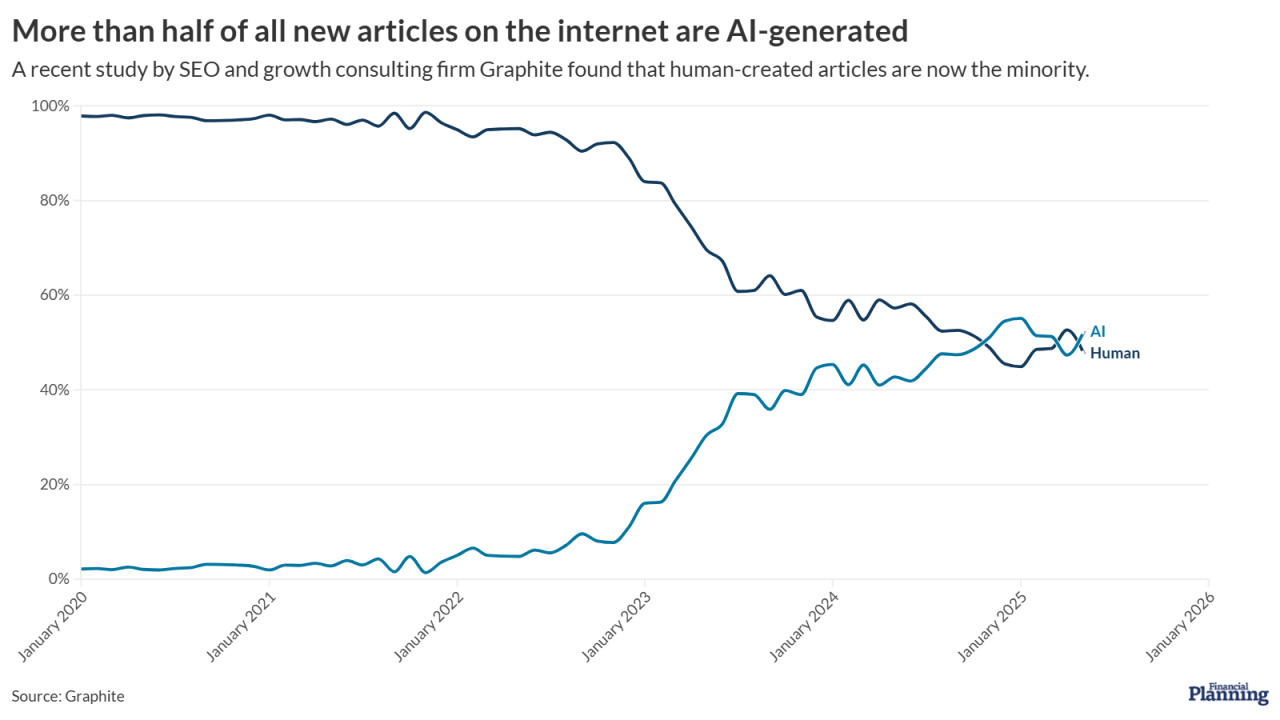

A recent study found that more than half of all new articles on the internet were AI-generated. How can advisors help their own content stand out when this deluge threatens to drown them out?

January 5