Vanguard’s record rake was an extreme example of the general trend last year of a rush for more passive investments. Indeed, the top three fund families, rounded out by BlackRock and State Street, also focus on ETFs.

BlackRock, a distant second, drew $99 billion in 2016. Often listed as the largest asset manager in the world, BlackRock is listed here as having just $1.4 trillion in assets given our parameters.

To be sure, other well-known names in this space aren’t listed here at all since this is ranked on one-year flow data and not total AUM. For instance, T. Rowe Price had an outflow of $4.5 billion in 2016, according to Morningstar’s data. PIMCO had an outflow of $15 billion; Fidelity had an outflow of $23 billion; and Franklin Templeton had the biggest annual outflow of $42 billion.

Scroll through to see the biggest inflows of 2016.

20. Harding Loevner

3-Yr, estimated net flows (millions): $6,371

5-Yr,estimated net flows (millions): $9,773

Total net assets (millions): $14,529

19. Flexshares Trust

3-Yr, estimated net flows (millions): $5,219

5-Yr,estimated net flows (millions): $11,391

Total net assets (millions): $11,721

18. ProShares

3-Yr, estimated net flows (millions): $6,620

5-Yr,estimated net flows (millions): $12,899

Total net assets (millions): $26,244

17. Parnassus

3-Yr, estimated net flows (millions): $6,757

5-Yr,estimated net flows (millions): $8,332

Total net assets (millions): $20,437

16. Lord Abbett

3-Yr, estimated net flows (millions): -$2,227

5-Yr,estimated net flows (millions): $15,911

Total net assets (millions): $108,334

15. Prudential Investments

3-Yr, estimated net flows (millions): $10,356

5-Yr,estimated net flows (millions): $20,731

Total net assets (millions): $83,546

14. Guggenheim Investments

3-Yr, estimated net flows (millions): $18,669

5-Yr,estimated net flows (millions): $24,436

Total net assets (millions): $46,431

13. PowerShares

3-Yr, estimated net flows (millions): $1,830

5-Yr,estimated net flows (millions): $23,690

Total net assets (millions): $103,998

12. Metropolitan West Funds

3-Yr, estimated net flows (millions): $51,490

5-Yr,estimated net flows (millions): $59,634

Total net assets (millions): $86,694

11. Van Eck

3-Yr, estimated net flows (millions): $11,436

5-Yr,estimated net flows (millions): $17,550

Total net assets (millions): $34,156

10. DoubleLine

3-Yr, estimated net flows (millions): $31,973

5-Yr,estimated net flows (millions): $48,087

Total net assets (millions): $71,897

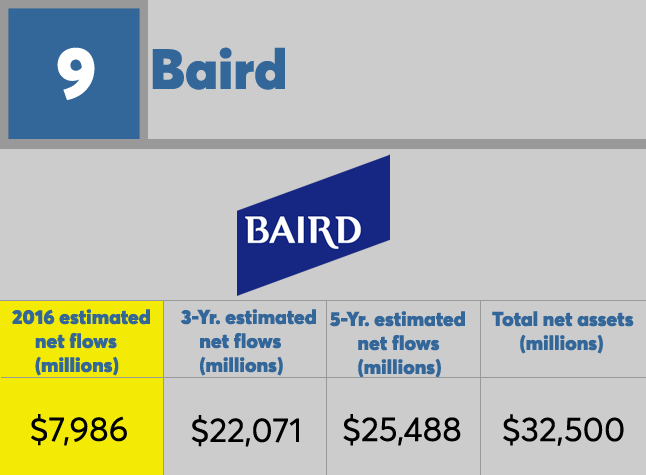

9. Baird

3-Yr, estimated net flows (millions): $22,071

5-Yr,estimated net flows (millions): $25,488

Total net assets (millions): $32,500

8. TIAA-CREF Asset Management

3-Yr, estimated net flows (millions): $22,505

5-Yr,estimated net flows (millions): $37,202

Total net assets (millions): $103,862

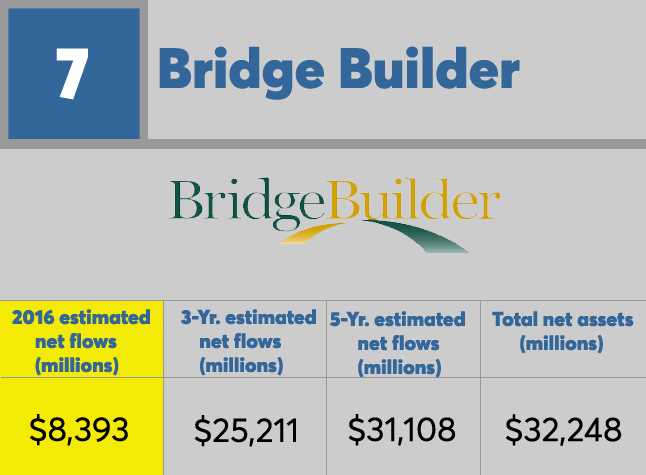

7. Bridge Builder

3-Yr, estimated net flows (millions): $25,211

5-Yr,estimated net flows (millions): $31,108

Total net assets (millions): $32,248

6. AQR Funds

3-Yr, estimated net flows (millions): $18,369

5-Yr,estimated net flows (millions): $25,832

Total net assets (millions): $32,534

5. Schwab ETFs

3-Yr, estimated net flows (millions): $39,079

5-Yr,estimated net flows (millions): $48,090

Total net assets (millions): $59,750

4. Dimensional Fund Advisors

3-Yr, estimated net flows (millions): $73,850

5-Yr,estimated net flows (millions): $111,774

Total net assets (millions): $316,073

3. SPDR State Street Global Advisors

3-Yr, estimated net flows (millions): $65,231

5-Yr,estimated net flows (millions): $117,289

Total net assets (millions): $501,890

2. BlackRock/iShares

3-Yr, estimated net flows (millions): $307,299

5-Yr,estimated net flows (millions): $424,568

Total net assets (millions): $1,203,390

1. Vanguard

3-Yr, estimated net flows (millions): $726,473

5-Yr,estimated net flows (millions): $997,101

Total net assets (millions): $3,404,657