In recent months, there's been an upsurge of serious interest from traditional brokers in becoming RIAs – reversing a recent trend.

The RIA world can thank the Department of Labor for the new business.

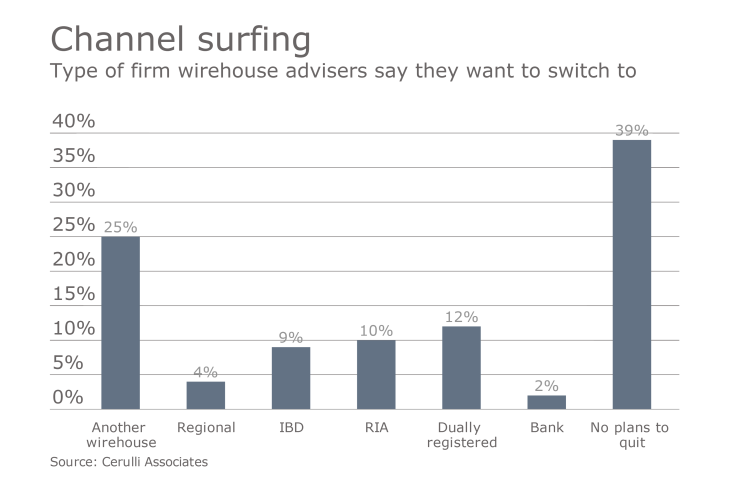

Wirehouse advisers for example have moved mostly to other wirehouses in recent years. In 2015 Cerulli Associates estimated that 24% of wirehouse brokers went independent in 2015, down from almost 30% in 2010. In 2014, 59% of wirehouse advisers who moved opted to join another wirehouse, up from 45% in 2010. In my experience, more advisers at IBDs are also now exploring the RIA model.

It's too early for this year's data to show the numbers, but anecdotally it's clear the fiduciary rule is giving new energy to the RIA model.

The largest teams to go indie this year managed more than $5 billion in client assets.

Assets at RIA firms have grown an average of 11% a year over the past five years, compared with 8.6% across all wealth management channels according to Cerulli Research. I think that those numbers are about to accelerate due in part to the new fiduciary standard.

The RIA model offers advisers the maximum protection from the DoL's regulatory onslaught against commission-based business, which has shocked and alarmed many advisers. RIAs are full-fledged fiduciaries and charge their clients fees. The Department of Labor's role with RIA's is mostly limited to scrutinizing IRA rollovers. The DoL has much greater involvement with wirehouse and independent advisers who do transactional business in retirement accounts.

INCENTIVES

There are other reasons that also explain the appeal of the RIA channel for both wirehouse and independent advisers.

Advisers can drop their Series 7 license entirely and escape the oversight of FINRA, which some brokers find to be too heavy-handed. The SEC operates a more process-based system, under which the commission examines advisers' actions to ensure that they conform with a fiduciary standard of conduct.

Here's another reason: RIAs typically operate on a 100% payout rather than the 90% pay out that is typical at IBDs. One way that broker-dealers make money is by marking up ticket charges. The ticket charges for RIAs are typically less than $10 per trade – far less than the $20 per trade formulation at many IBDs. Advisers who envision selling their practice to a successor often favor the RIA model. That's because fee-based practices generally sell for higher multiples than those that are even partially commission-based.

Of course, those incentives have always been there, but the Labor Department's fiduciary rule is acting as a new catalyst, renewing wirehouse advisers' interest in the RIA model.

And so, we're left with a rather surprising state of affairs. The Department of Labor is generating business for RIA custodians everywhere. Who knew?