MIAMI BEACH, Fla. — The fate of the fiduciary rule may be shrouded in uncertainty, but RIAs who aren’t taking steps to implement the new regulations are making a big mistake, says TD Ameritrade executive Skip Schweiss.

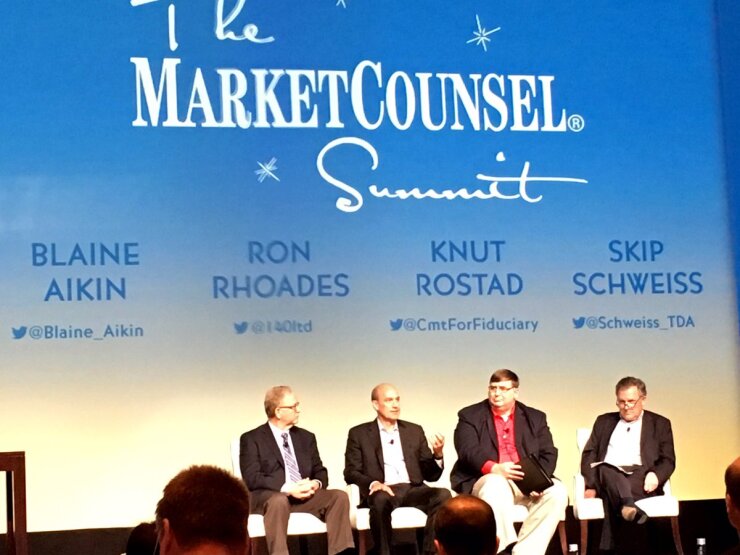

Speaking on a panel at the annual MarketCounsel Summit, Schweiss, managing director of adviser advocacy for the custodian, pulled no punches: Advisers who “call a time out” in the wake of Donald Trump’s election are running “a real risk to [their] business.”

It’s not “a huge leap to comply with this rule if you’re an RIA,” Schweiss said. What’s more, he noted, the fiduciary rule is on the verge of becoming a de facto industry standard with or without government oversight.

“It’s the right thing for the client,” says TD’s Skip Schweiss.

Some of the industry’s biggest firms have already spent “millions of dollars to get into compliance,” he noted and are spending heavily on advertising and public relations to tout that fact. “It’s the right thing for the client,” Schweiss said. “I don’t see how they can pull that back.”

RIAs would be wise to also quickly implement the rule and let people know about it “to get an advantage in the market,” Schweiss said.

HAMBURGER: FIDUCIARY RULE IS DOA

But advisers got a different opinion from Brian Hamburger, president and CEO of MarketCounsel.

“No prizes are handed out for being the first to comply with the DoL rule,” Hamburger said when he opened the conference. He reiterated his belief that the fiduciary rule is dead on arrival. “I continue to believe the rule won’t make its way to implementation.”

Schweiss and other panel members noted the fiduciary rule is indeed already an official government rule, although not set to go into effect until April 10. The rule can only be turned back, panelists said, by undergoing the same process of notification and public comment that goes into formalizing a regulation.

WHAT DOES TRUMP WANT?

Former SEC Commissioner Luis Aguilar said in an interview that the key question was what does President-elect Trump want to do when he takes office?

Barring the constitutional authority to overturn the rule by executive order, Trump could either ignore the rule or send a signal via the person he names to head the Department of Labor, Aguilar said. The Labor Department has the option of simply not enforcing the rule, he added.

Aguilar said he’s betting that the rule “goes away,” but Schweiss thought a more likely scenario was a delay in implementation, but not an outright repeal.

MARKET WILL DECIDE

His fellow panelists Blaine Aikin, executive chairman of fi360 and Knut Rostad, president of the Institute for the Fiduciary Standard, argued that market forces would pressure advisers to adopt a fiduciary standard regardless of what the Labor Department does.

Rostad pointed to the current ad campaign Merrill Lynch is running about its status as a fiduciary. “The ad speaks volumes about the marketplace challenge that we have,” Rostad said.

Not only is there marketplace demand for a fiduciary approach, Aikin said, it’s also “a very good business model.”

PR BATTLE

Meanwhile, detractors and supporters of the rule are stepping up efforts to influence its fate.

Conservative US Sen. Ron Johnson from Wisconsin, the head of the Senate Homeland Security and Governmental Affairs Committee, recently told Labor Secretary Thomas Perez to stop implementing the department’s “burdensome” rule because it will likely be “undone” by the incoming Trump administration.

But in full-page ads in The New York Times and Wall Street Journal this week, Jon Stein, CEO of Betterment, the country’s largest, independent, robo adviser, urged President-elect Trump to get behind the fiduciary rule.