Merrill Lynch was hit by over $400 million in penalties from regulators this week, driven in part by the severity of the allegations, lack of transparency and alleged discouragement of whisteblowers, authorities say.

And the firm's record-breaking punishment may be serving to put other brokerage firms on notice, experts and industry observers say.

"This is pretty groundbreaking," says Tom Lewis, an attorney at Stevens & Lee, a Lawrenceville, N.J.-based law firm.

Merrill Lynch is due to pay $430 million to FINRA and the SEC, which has accused the wirehouse of misusing clients' cash for years, misrepresenting the cost of complex investments and dissuading whistleblowers from coming forward, among other misconduct.

Read more:

The SEC will also do a targeted sweep of broker-dealers to see if similar violations have occurred elsewhere, the regulator says. Andrew J. Ceresney, director of the SEC’s Division of Enforcement, said that the commission is providing a "window" for firms to self-report any violations before November.

A self-report "doesn't mean we'll open an investigation," but the regulator does want firms to be forthcoming about any issues, Ceresney said during a conference call with reporters on Thursday.

The brokerage industry's leaders will likely take note, says Michael Weinstein, a former federal prosecutor and chair of the White Collar Defense & Investigations Practice Group at Cole Schotz, a Hackensack, N.J.-based law firm.

"I think you'll see general counsels huddle up next week and decide whether they do want to come forward," says Weinstein of potential mistakes or misconduct.

He says that having conducted this investigation, the SEC essentially has a "template" of what to look for at other brokerage firms as well as an experienced team. They know what to look for in emails, documents and other records.

"I'm sure a lot of that can be translated to other firms. So it makes sense that the SEC is now saying, 'You want to tell us what happened?'"

INSIDERS NEED TO SPEAK OUT?

The SEC also reprimanded Merrill Lynch for allegedly discouraging whistleblowers or employees through policies, procedures, and agreements to report potential misconduct to the appropriate authorities. The forms permitted employees to disclose confidential material information pursuant to a regulatory or court order, but not to voluntarily provide such information to authorities, the commission says.

The SEC says it is unaware of any current or ex-employees being prevented from directly communicating with the commission, but the language found in the forms and policies "operated to impede such communications by prohibiting employees from voluntarily providing information to the Commission without prior approval from [Merrill Lynch]."

As part of its settlement with the SEC, Merrill will be required to revise policies and procedures, implement a mandatory annual whistleblower-training program for all employees and annually provide them "with a summary of their rights and protections under the SEC’s Whistleblower Program," the regulator says.

Weinstein says that government authorities rely on whistleblowers to unveil corruption and misconduct.

"Literally, it is a huge area for the government to offer incentives to people to stand up and say my company is doing something wrong," he says. "They want the financial firms to know that you can't do anything that impinges on any whistleblower."

A Merrill Lynch spokesman declined to comment specifically on the whistleblower allegations.

However, the firm issued a statement saying: "While no customers were harmed and no losses were incurred, our responsibility is to protect customer assets and we have dedicated significant resources to reviewing and enhancing our processes. The issues related to our procedures and controls have been corrected. We have cooperated fully with the SEC staff throughout this investigation."

Ceresney declined to comment on whether whistleblowers contributed to its investigations. However, the Wall Street Journal reported earlier this week that two ex-Merrill Lynch brokers contributed as whistleblowers to an SEC investigation related to allegations regarding the firm's sale of structured notes.

A NEW RECORD

Ceresney said that "unprecedented violations" led to the severest of the sanctions against Merrill, and that these were a record for violating the commission's consumer protection rule.

These penalties far surpassed the ones levied against J.P. Morgan last December, when two of the firm's wealth management subsidiaries admitted that they failed to disclose conflicts of interest to clients and agreed to pay $267 million as a result, according to the SEC.

-

JPMorgan Chase will pay more than $300 million to settle U.S. allegations that it didnt properly inform clients about reported conflicts of interest in how it managed customers money over a half decade.

December 21 -

Fired adviser Johnny Burris complained the firm forced him to sell unsuitable products to clients, long before it acknowledged to the SEC it violated the federal securities laws.

December 18 -

J.P. Morgan Securities agreed to pay $4 million to settle the charges, according to authorities.

January 6

On one of the three regulatory actions against Merrill, the firm admitted its misconduct.

"Where they think there is more egregious behavior, they are likely to require it," says Paul Radvany, a law professor at Fordham University and a former deputy chief of the Criminal Division for the U.S. Attorney's Office in the Southern District of New York.

Weinstein says such admissions are becoming increasingly less rare.

"I think from a public policy perspective that is happening more and more in the government. And that is being driven by a public perception that companies were not cooperating with the government and were putting up a wall, again and again," Weinstein says.

Lewis, meanwhile, points to the size of the fine.

"Whether you admit to it or not, when you pay $400 million that sends a message to the industry," he says.

FORTHCOMING ARBITRATION CASES?

Meanwhile, FINRA says its $5 million fine for Merrill's alleged failures to make material disclosures to clients about structured notes is the highest such fine it's given in relation to the complex investments.

The regulator alleges that Merrill misrepresented the actual costs of the notes, which in turn misled investors to think that the products had relatively low fixed costs when they in fact did not. The firm sold about $168 million worth of the notes to clients, "promoting them as a hedge against potential downturns in the equities markets," FINRA says.

"Given the importance of costs and expenses to investment performance, firms must ensure that all costs are disclosed clearly and plainly so that retail customers can fully understand and assess the investment," Brad Bennett, FINRA's chief of enforcement, said in a statement.

Without admitting or denying the charges, Merrill consented to FINRA's findings.

Spokespersons for the SEC and FINRA did not respond to immediate requests for comment on what the regulators would do with the millions that Merrill is due to fork over.

Meanwhile, Merrill may be facing client claims in arbitration. Two of the regulatory actions directed against the firm this week involved the firm's sales of structured notes.

Andrew Stoltmann, a Chicago-based attorney, is currently representing 44 clients seeking damages from Merrill for allegedly not disclosing key information about the products. He says his clients lost about $1.2 million due to the notes.

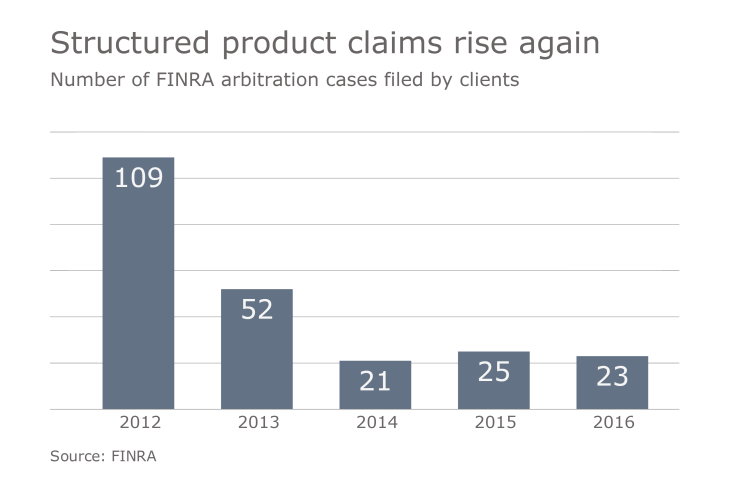

Stoltmann declined to comment further on his pending cases, but says he's been representing more and more clients in disputes regarding such products.

"The brokerage firms love to peddle these products because there is a jambalaya of fees and expenses associated with these things," he says.

A spokesman for the firm says that Merrill will defend itself vigorously in any arbitration.

"This investment was specifically designed as a hedge to protect clients against volatility in the stock market and to be one part of a larger portfolio strategy," he says, adding that the notes performed consistent with the associated risk disclosures.

He adds that "costs associated with continuing with this strategy were fully disclosed to our financial advisers and clients with extensive and regular communications."

The spokesman declined to comment on the SEC's sanctions.