The fintech boom is leaving no corner of the RIA space untouched.

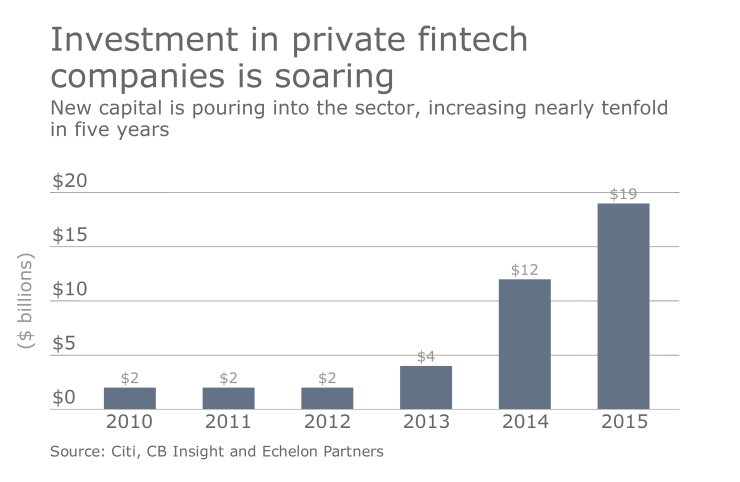

The latest indication of fintech's widespread impact is the launch of a new investment banking platform by Echelon Partners, a well-known RIA M&A firm, focusing on what it calls the "wealth technology" sector.

"The way companies decide to utilize [robo advisers] into their broader technology platform will be critical to their future success," says Echelon Chief Executive Dan Seivert. "As a result, we anticipate that traditional firms will be focused on acquiring these capabilities and we are actively building out our investment banking capabilities to support their strategies."

In addition to automated digital investment and advice services, Seivert sees new "disruptive" companies challenging established incumbents in areas such as reporting, trading, rebalancing, portfolio analysis, user interfaces and account aggregation.

The disrupters will cause incumbents to re-evaluate their competitive, product, M&A and financing strategies, Seivert says, creating demand for fintech-related investing banking services.

'VERY POSITIVE' DEVELOPMENT

The development is "very positive for the industry," says Chadwick Blythe, vice president of sales at Advicent, a financial services technology solutions provider. "It adds validity and more stability and will result in more sophisticated products. Everyone from tech vendors to advisers and end users should benefit."

Indeed, advisers are enjoying more product choices and higher tech quality than ever as a result of increased fintech activity, say industry executives.

"This is the greatest time to be an adviser," says investment banker Liz Nesvold, managing partner of New York-based Silver Lane Advisors. "There are more solutions that are more highly-vetted, easy to use and simple to onboard now available to advisers than ever before."

'VIRTUOUS CYCLE' FOR ADVISERS

Investment in technology has created a "virtuous cycle" of success for advisers, according to Seivert.

"The more RIAs succeed, the more technology investment follows, creating more innovation, tools and resources they can adopt to be more competitive in the marketplace," he explains.

"The net result for RIAs is that their technology solutions will help advisers automate processes, have better interoperability between systems, and create scale, all at a lower price."

But Echelon will have formidable investment banking competition in a hot market, going up against established players such as FT Partners, the powerhouse firm founded by Steve McLaughlin, who previously headed Goldman Sachs' global financial technology group.

DIFFERENT ECOSYSTEM

"It's not a niche anymore," says Rob Foregger, co-founder of NextCapital, an enterprise digital advice company. "It's a different ecosystem, very complex with a lot of verticals."

Nonetheless, opportunities for new players still exist because the pressure to be tech-savvy is so great, Foregger adds.

"If you're a financial services company and you're not thinking of yourself as a financial tech company, then you're probably in a declining business model," he says.

Nesvold says close to one-third of her investment banking business is related to fintech or "tech enhanced" transactions.

'LATE IN CYCLE' FOR NEW TECH OFFERINGS

The rise of robo advisers over the last four years has propelled interest in fintech and has made it made it a "much sexier" space, she says. Deal activity remains hot, although "it's late in the cycle" for new tech offerings, Nesvold adds.

"There's been rapid adoption so just being a fintech player now means nothing," she says. "You have to be a darling and be sexy and you'll do very well. But if you are a me-too player, you may end up being a technology sale."

Other prominent RIA M&A and investment banking players are sticking to their knitting for now.

HIGH DEMAND FOR RIA M&A

"Right now we can barely keep up with demand in the wealth management space, so we have no plans to expand into adjacent areas," says David DeVoe, managing partner and founder of his eponymous San Francisco-based firm. "Instead we will be expanding beyond our core focus of firms with assets between $500 million and over $2 billion, to play more strongly in the sub-$500 million space."

High demand for RIA transactions is also keeping New York-based M&A and investment banking firm park Sutton Advisors busy, says co-founder and managing director Steven Levitt.

"We're more interested in increasing our coverage across the U.S." Levitt says, "and we've added two investment bankers to our team. Most of the market is still unbanked and the demand for RIA M&A transactions is very healthy. It doesn't matter if the stock market is good or bad. Organic growth is limited for most firms unless they're in the top 1%."

WEALTH TECH OPPORTUNITES

For his part, Seivert, whose company hosts the annual "Deals and Deal Makers" M&A conference, is convinced that what he calls "wealthtech" (the name he's also using to brand his new division) will result in abundant investment banking opportunities.

Accordingly, he's added three new investment bankers to staff up the platform: Michael Wunderli, Lucas Barash-David and Adam Johnson, who have backgrounds at Lehman Bros., Fisher Investment and Goldman Sachs, respectively.

"Fintech is to technology as wealthtech is to fintech," Seivert says. As a subset of fintech, Seivert maintains, wealthtech sectors such as operations, CRM and accounting and reporting will require specific expertise that firms like his can provide to facilitate financing and strategies.

"One of the biggest questions firms will face," he says, "is whether they should exist as sole solution providers or become Microsoft Office."